Regulations Eased for Real Estate Soft Landing,

Sharp Increase in Mortgage Loans for Apartments Over 1.5 Billion Won

Household Loans Rise Despite Higher Interest Rates

Authorities Pressure Banks to "Reduce Household Debt"

Commercial Banks Raise Loan Interest Rates from the 11th

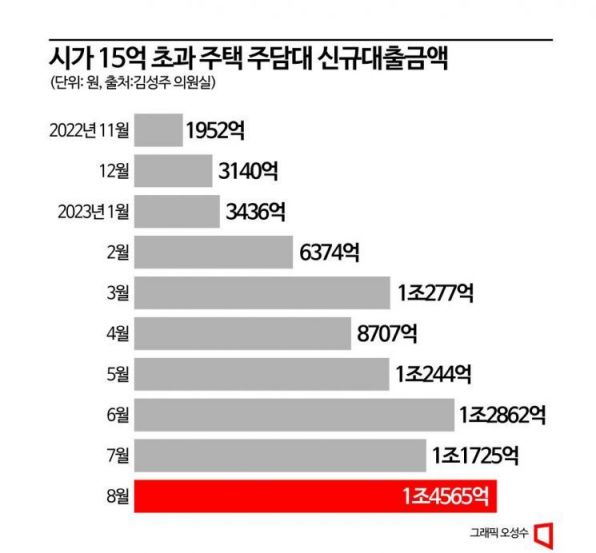

The amount of new mortgage loans for apartments and other housing priced over 1.5 billion KRW has surged more than sevenfold compared to before the real estate regulations were eased. The easing of regulations aimed at a soft landing in the real estate market has worsened the household debt problem.

On the 12th, Representative Kim Sung-joo of the National Assembly's Political Affairs Committee analyzed data from the Financial Supervisory Service and found that the amount of new mortgage loans exceeding 1.5 billion KRW at commercial banks increased 7.5 times in nine months, from 195.2 billion KRW in November last year to 1.4565 trillion KRW in August this year. In terms of the number of cases, it rose 4.1 times during the same period (839 cases → 3,405 cases).

Mortgage Loans for Apartments Over 1.5 Billion KRW Revive After Regulation Easing

Regarding the reason for the surge in new mortgage loans for apartments priced over 1.5 billion KRW, Representative Kim said, "Since December last year, mortgage loans for apartments priced over 1.5 billion KRW have been sequentially allowed even in speculative and speculative overheated districts." He added, "Previously, mortgage loans were not possible for apartments priced over 1.5 billion KRW in all of Seoul, designated as a speculative overheated district, as well as in Gwacheon-si, Seongnam-si (excluding Jungwon-gu), Hanam-si, and Gwangmyeong-si in Gyeonggi-do, but easing the regulations caused household loans to surge."

Generally, when loan interest rates rise, the burden of loan repayment increases, which tends to slow the growth of household debt. However, since the second half of last year when regulations were eased, an abnormal phenomenon has appeared where more people are taking out loans despite high interest rates, which Representative Kim points out is due to the easing of real estate regulations.

He said, "Despite this, financial authorities only attribute the increase in household loans to the loose lending behavior of banks and the introduction of 50-year mortgage loans or the recovery of the housing market by financial companies, but they do not mention the various real estate regulation easings implemented by the current government."

Under Pressure from Authorities... Banks Raise Loan Interest Rates

As the household debt issue surfaced, commercial banks have started raising loan interest rates from this week. This is interpreted as an attempt to reduce household loan demand by increasing the additional interest rate or reducing preferential rates. Kookmin Bank raised mortgage and jeonse (lease deposit) loan interest rates starting from the 11th. On the 12th, the variable mortgage loan interest rate was 0.2 percentage points higher than the previous day, ranging from 4.44% to 5.84%. The fixed rate increased by 0.1 percentage points to 4.34%?5.74%. Jeonse loan rates also rose by 0.2 percentage points, with variable rates at 4.11%?5.51% and fixed rates at 4.45%?5.85%.

Woori Bank will raise mortgage loan interest rates by 0.1 to 0.2 percentage points and jeonse loan rates by 0.3 percentage points starting from the 13th. Shinhan Bank and NH Nonghyup Bank are also preparing to raise loan interest rates. A commercial bank official said, "Since the financial authorities signaled to suppress household loan demand, banks have responded by raising interest rates and imposing age restrictions on ultra-long-term loan products." The financial authorities and the heads of the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) hold weekly meetings every Friday to monitor household loan trends and discuss demand suppression measures.

The outstanding balance of household loans at the five major commercial banks has increased for five consecutive months since May. As of the end of September, the outstanding household loan balance was 682.3294 trillion KRW, an increase of 1.5174 trillion KRW from the end of August (680.812 trillion KRW). In particular, mortgage loans increased by 2.8591 trillion KRW (from 514.9997 trillion KRW to 517.8588 trillion KRW), marking the largest increase since October 2021 (3.7989 trillion KRW).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)