Not only LG but also the market

LG Electronics receives praise for 'qualitative growth'

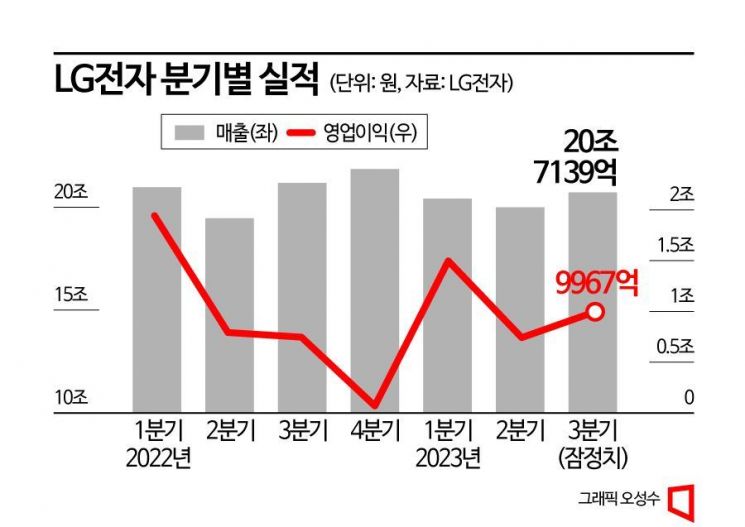

LG Electronics summarized its third-quarter performance as a result of overcoming the recession and accelerating qualitative growth in its business. While the existing home appliance business, which serves as a cash cow, remained resilient, the company emphasized the significance of the strong performance in the high value-added automotive components business. CEO Jo Joo-wan's vision to enhance profitability by activating future growth businesses was reflected in the results.

Since October last year, LG Electronics has been working on improving its overall business structure centered on the emergency management task force (TF) called the 'War Room Task.' The company maximized efficiency across the entire value chain?including purchasing, manufacturing, logistics, and sales?by accelerating digital transformation (DX). The strategy aims to reduce profitability fluctuations through stable supply chain management regardless of business content or market conditions.

Cho Ju-wan, CEO of LG Electronics, presenting the company's vision and business strategy at the LG Electronics press conference held on July 12 at LG Science Park in Magok-dong, Gangseo-gu, Seoul.

Cho Ju-wan, CEO of LG Electronics, presenting the company's vision and business strategy at the LG Electronics press conference held on July 12 at LG Science Park in Magok-dong, Gangseo-gu, Seoul. [Photo by Yonhap News]

By business segment, LG Electronics explained that the home appliance division’s strategy to target the high-demand 'volume zone' based on the competitiveness of premium products such as OLED TVs and the Objet Collection was effective. The volume zone refers to the business area with the highest consumer demand. Expanding the proportion of B2B products such as system air conditioners and heating, ventilation, and air conditioning (HVAC) also had a positive impact.

The automotive components business is expected to exceed 100 trillion KRW in year-end order backlog and 10 trillion KRW in annual sales, LG Electronics projected. The company is accelerating the establishment of regional production bases, including the recent announcement of plans to build the fourth LG Magna e-Powertrain production facility in Miskolc, Hungary. LG Electronics stated, "We expect the automotive components business to smoothly establish itself as a core business leading the overall company growth soon."

The TV business maintained profitability despite reduced consumer demand amid a global economic downturn. The business solutions division saw decreased sales and profitability due to reduced IT demand. However, the company continues to innovate customer experience through premium IT lineups such as customized commercial displays and foldable laptops.

LG Electronics’ strong third-quarter performance aligns with CEO Jo’s '2030 Vision' announced in July. Jo declared plans to increase annual sales from around 80 trillion KRW last year to 100 trillion KRW by 2030 by transforming the business model. He aims to develop LG Electronics into a 'smart life solutions' company. The plan involves not only excelling in home appliance hardware but also strengthening software across home appliances and electric vehicle components. LG Electronics said, "Achieving solid sales and high operating profit in the third quarter despite the recession is evidence that the work to advance the future business portfolio is progressing smoothly."

The market also interpreted LG Electronics’ third-quarter results not as a temporary achievement but as a signal of mid- to long-term business restructuring. On the morning of the same day, F&Guide, a financial information provider, posted third-quarter earnings analysis reports from 12 securities firms. Many reports viewed the third-quarter results from the perspective of corporate value growth rather than product performance, with titles such as 'Proof of Special Premium or Higher' (Meritz Securities) and 'A Cut Above the Rest' (Kiwoom Securities).

Kim Ji-san, a researcher at Kiwoom Securities, said, "The profitability of automotive parts in the third quarter was sufficient to dispel concerns about one-time costs, and especially the improvement speed of e-Powertrain is fast." He added, "With the new Mexico plant starting full operation from the fourth quarter and the Hungary plant under construction, we expect improved responsiveness to electric vehicle parts customers in North America and Europe and enhanced competitiveness in order acquisition."

However, some opinions suggested that since the results of LG Electronics’ business restructuring are already sufficiently reflected in the stock price, additional upside might be limited if growth slows down. LG Electronics’ closing price on the 10th was 103,900 KRW, similar to the early-year level of 104,200 KRW. Consumer disposable income and purchasing power are declining, slowing the transition to increased IT product demand (demand, sales). The potential for further cost reductions related to display panels and semiconductors used in LG products is weakening (costs), and the growth momentum of the automotive components industry may be weaker than expected (growth drivers).

Lee Jong-wook, a team leader at Samsung Securities, said, "I believe the current stock price of LG Electronics already reflects a significant portion of the negative demand factors." He added, "We will adjust the target EV/EBITDA (enterprise value to earnings before interest, taxes, depreciation, and amortization) for the improved automotive components profitability from 8 times to 6 times and slightly lower the target stock price from 145,000 KRW to 135,000 KRW."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)