Doosan Robotics Listed on the 5th

HD Hyundai, Hanwha and Others Establish Robot Specialized Companies

Samsung and Hyundai Motor Also Invest in Robots as 'Future Growth Engines'

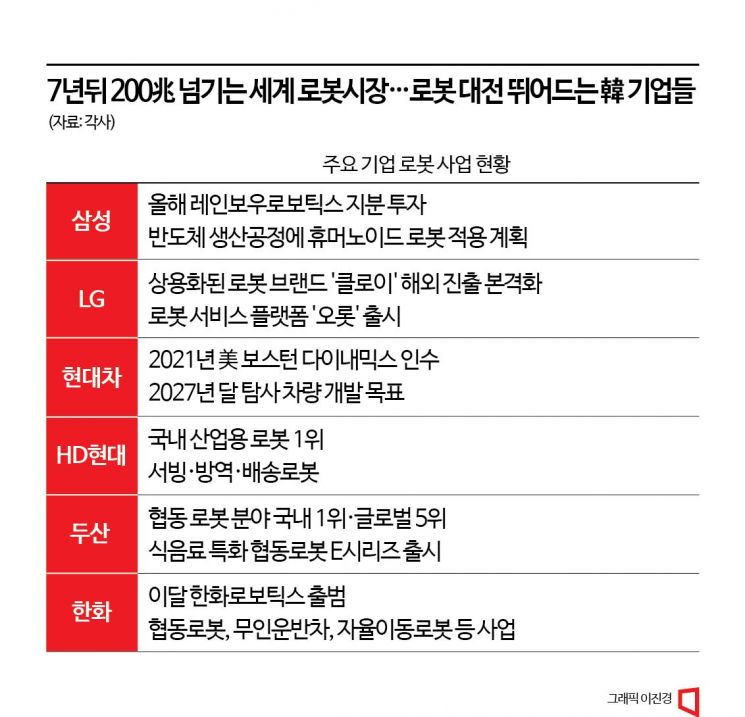

Korean leading companies are rushing to identify robots as future growth engines and are diving into investment and research and development. On the 4th, Hanwha announced the establishment of 'Hanwha Robotics Co., Ltd.' It has issued a challenge to HD Hyundai Robotics and Doosan Robotics, which are dominating the Korean robot market. Samsung Electronics and Hyundai Motor Company also view robots as new growth drivers and have started investing. Due to population decline and rising labor costs, the sustainability of Korea's manufacturing and service industries is being sought in robots.

Doosan Robotics' E Series, a collaborative robot dedicated to F&B (Food and Beverage), launched in April this year. Photo by Doosan Robotics

Doosan Robotics' E Series, a collaborative robot dedicated to F&B (Food and Beverage), launched in April this year. Photo by Doosan Robotics

200 Trillion KRW Robot Market, Companies Racing to 'Dominate Robots' through IPOs and Spin-offs

The robot industry is expected to grow rapidly in line with global social structural changes such as labor shortages and rising labor costs. Boston Consulting Group forecasted that the global robot market, which is $40 billion (about 54 trillion KRW) this year, will grow to $160 billion (about 217 trillion KRW) by 2030.

Robots are divided into industrial and service robots depending on their demand. Industrial robots operate under computer control, independent of human hands. They enable mass production of a few types and are used in large-scale equipment industries such as automobiles. Among them, collaborative robots apply Internet of Things (IoT), sensors, autonomous driving technologies, etc., allowing them to work alongside humans in the same space without safety fences. Their utilization is increasing as they can be applied to the manufacturing environments of small and medium-sized enterprises with small-lot, multi-product production systems, where robot utilization was previously low. Service robots are used not in manufacturing but for household, medical, and commercial purposes. Recently, service robots commonly seen around us include those that make or serve chicken and coffee.

HD Hyundai Robotics holds the number one market share in industrial robots, while Doosan Robotics leads the collaborative robot market, dividing the domestic robot market between them. HD Hyundai Robotics traces its roots back to the robot team established by Hyundai Heavy Industries in 1984. The company holds the top market share in industrial robots used for automobile assembly and display transportation. Hyundai Robotics is pioneering not only existing industrial robots but also the service robot market, including serving and disinfection robots.

Doosan Robotics, which will be listed on the 5th, plans to expand into medical and food collaborative robot businesses. Since more than 60% of its total sales come from overseas, continuous expansion into foreign markets is expected. Doosan Robotics established a sales subsidiary in Texas, USA, last year and plans to increase overseas channels this year.

Hanwha Group established Hanwha Robotics by spinning off its collaborative robot and unmanned transport vehicle businesses. Kim Dong-seon, Executive Director and third son of Hanwha Group Chairman Kim Seung-yeon, is at the helm. The company plans to expand its lineup by developing service applications that can directly interact with customers, in addition to existing industrial collaborative robots. It also plans to release products incorporating autonomous driving technology, such as building management robots.

Samsung and Hyundai Motor Also Invest Following Robot Market Growth

Some companies invest as needed without establishing separate companies. According to data from the corporate analysis research institute Leaders Index, domestic companies directly invested 126.2 billion KRW in 32 robot and drone companies from 2021 to the first half of this year. Samsung Electronics acquired a 14.99% stake in 'Rainbow Robotics' twice in January and March this year. The company owns a platform ranging from collaborative robots to multi-legged walking robots capable of various services. Samsung also signed a call option contract to potentially acquire additional shares in the future. Samsung plans to deploy humanoid robots in semiconductor production processes. Earlier, Samsung Electronics Chairman Lee Jae-yong stated, "We will invest 240 trillion KRW over three years in new business areas such as robots to nurture future growth engines."

Kim Dong-seon, Strategy Officer at Hanwha Robotics, visited the Hanwha Future Technology Research Center in Pangyo last month to inspect the performance of collaborative robots. Photo by Hanwha Robotics

Kim Dong-seon, Strategy Officer at Hanwha Robotics, visited the Hanwha Future Technology Research Center in Pangyo last month to inspect the performance of collaborative robots. Photo by Hanwha Robotics

Hyundai Motor Group acquired an 80% stake in Boston Dynamics, owned by SoftBank, in 2021. Through Boston Dynamics, which possesses world-class bipedal and quadrupedal walking robot technology, Hyundai plans to apply robot technology not only in manufacturing but also in autonomous driving and UAM (Urban Air Mobility) and other fields. LG Electronics started with the acquisition of domestic industrial robot manufacturer Robostar and invested in wearable robot startup SG Robotics, domestic industrial robot manufacturer Robotis, and US robot developer Boston Dynamics. It is expanding its domain through the robot brand 'CLOi.'

Corporate entry into the robot industry is intertwined with trends of population decline and rising labor costs. Inflation caused by increased liquidity after COVID-19 and labor shortages have triggered investment in the robot industry. The labor environment is changing, fostering the growth of the robot industry. While labor costs continue to rise, rental costs for robots are decreasing as production volume increases. As domestic companies simultaneously enter the robot market, fierce competition seems inevitable. This is because many of the target markets and product groups overlap. Continuous investment, securing key component supply chains, and differentiated software acquisition are expected to be decisive factors for success or failure.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)