Yoo Sang-dae, Deputy Governor of the Bank of Korea, announced on the 4th the plan to promote the 'Central Bank Digital Currency (CBDC) Usability Test' together with the Financial Services Commission and the Financial Supervisory Service, evaluating that "the project to prepare the future digital financial infrastructure has taken its first step."

Yoo Sang-dae, Deputy Governor of the Bank of Korea, is speaking at the joint press briefing on the plan to promote the CBDC usability test held on the afternoon of the 4th at the Bank of Korea Integrated Annex in Jung-gu, Seoul. Photo by Joint Press Corps

Yoo Sang-dae, Deputy Governor of the Bank of Korea, is speaking at the joint press briefing on the plan to promote the CBDC usability test held on the afternoon of the 4th at the Bank of Korea Integrated Annex in Jung-gu, Seoul. Photo by Joint Press Corps

At the press briefing on 'Joint Experiment Promotion for Building Future Monetary Infrastructure' held at the 2nd floor conference hall of the Bank of Korea annex in Seoul, Deputy Governor Yoo said in his greeting, "The Bank of Korea will work closely with the Ministry of Economy and Finance, the Financial Services Commission, and the Financial Supervisory Service to ensure that the test proceeds as originally planned."

The 'CBDC Usability Test,' scheduled to run from this month until the end of next year, will focus on 'wholesale CBDC.'

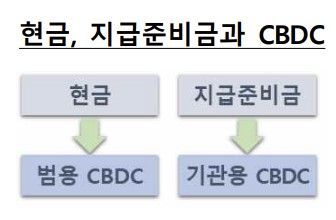

CBDC, a new form of currency issued digitally by the central bank, is divided into 'retail CBDC,' which can be used directly by general economic agents such as households and businesses, and 'wholesale CBDC,' which can only be used by financial institutions for purposes such as fund transfers and final settlements between financial institutions.

This is the first time the Bank of Korea has announced plans to build infrastructure related to wholesale CBDC.

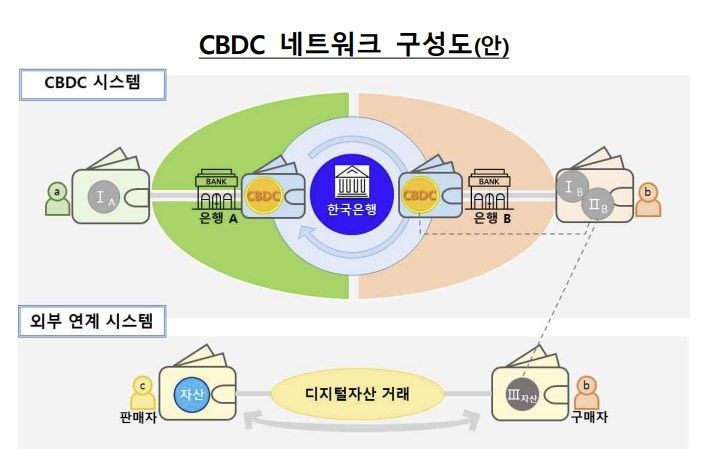

In this test, the Bank of Korea will issue wholesale CBDC that can be used for interbank fund transfer transactions, and participating banks will issue and use (deposit) tokens linked to this payment method. The core objective is to test the future monetary infrastructure.

Tokenization is the process of converting assets into programmable digital tokens on a platform. As tokenized payment methods are gradually introduced, interbank payments will be made in real-time, eliminating settlement risks and preventing errors even in complex payment and settlement situations.

Research and development of wholesale CBDC platforms supporting the issuance and circulation of deposit tokens are already underway at institutions such as the Federal Reserve Bank of New York and the Central Bank of Brazil.

Deputy Governor Yoo explained, "You might think that words like change and innovation are far from central banks, but central banks have always led the introduction of innovative payment and settlement infrastructures in response to changes in the economic environment." He added, "In line with the advancement of information and communication technology, the Bank of Korea introduced the large-value payment system, the BOK Financial Network, in 1994, and in 2001, it established the world's first real-time small-value payment system, the Electronic Financial Network, which operates 24/7."

He continued, "Recently, the transition to a digital economy, including asset tokenization, has accelerated, and active discussions are taking place on the usability of the programming functions characteristic of digital currencies. The Bank of Korea has envisioned the future digital financial infrastructure and, after considering the potential role of CBDC within it, decided to jointly promote this usability test."

Since this test will include not only technical experiments conducted in a virtual environment but also limited participation by the general public in some use case tests, organic cooperation among the Bank of Korea, the Financial Services Commission, the Financial Supervisory Service, and banks is necessary.

Deputy Governor Yoo stated, "Participating banks will play a leading role in implementing various innovative services by utilizing the secure test infrastructure built by the central bank." He explained, "In this regard, this test is a public-private joint project involving the Financial Services Commission, the Financial Supervisory Service, the Bank of Korea, and multiple banks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)