Clear Concentration on 4% Interest Rates at 5 Major Banks and Internet Banks

High Probability of Interest Rate Increase by Year-End

Household Loans Increase Due to Housing Price Recovery Despite Rising Interest Rates

As the average loan interest rate in the banking sector has been rising for two consecutive months, a banner displaying mortgage loan and personal credit loan interest rates is hung on the exterior wall of a commercial bank in Seoul on the 31st. Photo by Jinhyung Kang aymsdream@

As the average loan interest rate in the banking sector has been rising for two consecutive months, a banner displaying mortgage loan and personal credit loan interest rates is hung on the exterior wall of a commercial bank in Seoul on the 31st. Photo by Jinhyung Kang aymsdream@

Most financial consumers who applied for mortgage loans last August received interest rates in the 4% range. As financial authorities began addressing the issue of rising household debt, the 3% range interest rates completely disappeared from internet banks. The bank bond yields, which directly affect mortgage loan rates, started rising from April, and the COFIX (Cost of Funds Index) began increasing from June, pushing interest rates higher.

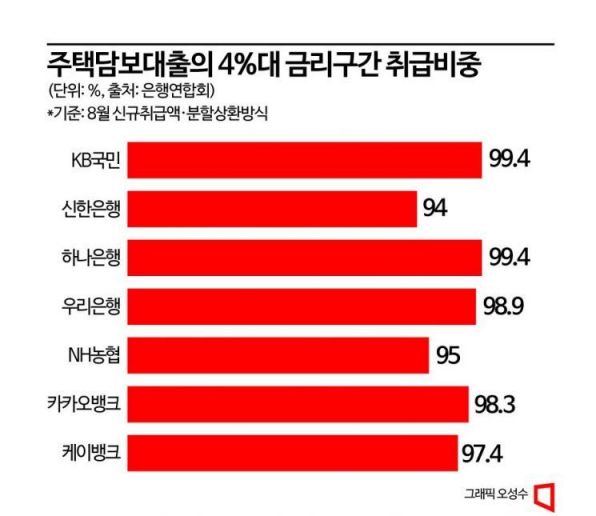

Majority Had 4% Range Interest Rates Until August

According to the Korea Federation of Banks on the 4th, the proportion of mortgage loans newly issued by banks last August showed a clear concentration in the 4% range for the five major banks as well as KakaoBank and K Bank. By bank, the figures were KB Kookmin Bank 99.4%, Shinhan Bank 94%, Hana Bank 99.4%, Woori Bank 98.9%, NH Nonghyup Bank 95%, KakaoBank 98.3%, and K Bank 97.4%. Customers who did not qualify for the 4% range received mortgage loans at 5% range interest rates.

An official from a commercial bank said, "Until early this year, internet banks mainly offered interest rates in the 3% range, and some commercial banks also handled 3% range rates, but the atmosphere has clearly changed." He added, "Interest rates are expected to rise further until the end of this year." As of the 4th, the five major banks' mortgage loan variable interest rates ranged from 4.17% to 7.12%, and fixed interest rates (fixed for 5 years before switching to variable) ranged from 4.05% to 6.41%.

Significant Room for Further Rate Increases by Year-End

There are two main reasons for the expected rise in bank loan interest rates. The first is the U.S. tightening stance. Due to the possibility of prolonged monetary tightening by the U.S. Federal Reserve, U.S. Treasury yields have risen, causing domestic bond yields to rise as well. From the banks' perspective, if the cost of raising funds increases, they must raise loan interest rates accordingly.

The second reason is the tangled funding market from last year. A commercial bank official said, "The main reason for expecting loan interest rate hikes is the rise in deposit interest rates in the fourth quarter due to the maturity of high-interest deposits." He added, "If COFIX, which serves as the benchmark for variable mortgage loan rates, rises, loan interest rates will also increase."

Although financial authorities have loosened the issuance limits on bank bonds to curb competition among banks to raise deposit interest rates, it remains uncertain how effective this will be. If the volume of bank bonds increases, banks must offer higher bond yields to sell them. An increase in bond yields is another factor driving up loan interest rates. The official explained, "Deposit interest rates directly affect COFIX next month and can stimulate money movement among people. While increased bank bond issuance is also a cause of rising interest rates, its impact may be less than that of deposit interest rate hikes."

View of apartments in Ichon-dong, eastern Seoul, seen from the 63 Building observatory. Photo by Hyunmin Kim kimhyun81@

View of apartments in Ichon-dong, eastern Seoul, seen from the 63 Building observatory. Photo by Hyunmin Kim kimhyun81@

Housing Prices Turn to Rise Even Outside the Capital Region

Despite the rising interest rates, household loans continue to increase. As of the 21st of last month, the outstanding household loans at the five major banks amounted to 682.4539 trillion won, an increase of 1.6419 trillion won from the end of August (680.812 trillion won). Household debt at the five major banks has been on the rise for five consecutive months since May.

According to the 'KB Housing Market Review' published by KB Financial Group Management Research Institute, "Housing sale prices are continuing to recover nationwide, with an increasing number of regions showing a shift to rising prices." It stated, "The price change rate of the top 50 apartments by total market value has increased for four consecutive months compared to the previous month." Furthermore, it analyzed, "In the metropolitan area, the price increase that started in Gangnam-gu, Seoul, has expanded to areas north of the Han River, and outside the metropolitan area, prices have turned upward in Sejong, followed by Gyeonggi and Daejeon. The housing price outlook index has also exceeded 100 for the first time since October 2021, expanding expectations for a housing market recovery."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.