Recovery in Demand Leads to Resumption and New Flights

No Discrimination from Major Chinese Cities to Small Japanese Towns

Demand for Japan Even Higher Than Pre-COVID-19 Levels

Favorable Trends Expected to Continue Due to Weak Yen and Yukeo Influx

As demand for air routes between China and Japan shows signs of recovery, airlines are rushing to resume and launch new flights. The allowance of group tours for Chinese tourists (Yukers) and the weak yen phenomenon are driving the popularity of routes to both countries. Through this, airlines aim to boost not only their fourth-quarter performance but also their annual results.

On the 25th, Jin Air announced the launch of a new route between Busan and Tokyo Narita Airport. They will operate a B737 aircraft on a schedule of seven flights per week. The flight departs from Gimhae Airport daily at 9:30 AM and arrives at Narita Airport at 11:30 AM. The return flight departs Narita at 10:30 AM and arrives at 1:10 PM. The company exclusively operates the Busan-Okinawa route and is preparing to operate the Sapporo and Osaka routes seven times a week during the winter season.

On the same day, Jeju Air announced the resumption of the Incheon-Macau route, and T'way Air began irregular flights on the Incheon-Toyama route in Japan. Since Jeju International Airport is Jeju Air’s hub, they are gradually increasing flights on Jeju-China routes. In July, they started Jeju-Macau flights, and in August and September, they launched Jeju-Beijing and Incheon-Hong Kong routes. Both load factors and reservation rates are strong. The Jeju-Macau and Jeju-Beijing routes recorded average load factors of 79% and 85%, respectively, for outbound flights last month. For October, which includes China’s National Day (October 1st), reservation rates are around 90% and in the 70% range, respectively.

Full-service carriers (FSCs) with many existing routes to China and Japan are actively resuming flights. Korean Air resumed operations on the Incheon-Wuhan and Weihai routes on the 24th and 27th of this month. An industry insider said, “These routes have more local demand such as visits to hometowns rather than tourism,” and added, “Demand for resuming flights (resuming operations after suspension) will increase significantly from October, and reservations will be fully booked.” Asiana Airlines is restarting flights mainly to major Chinese cities. From the 29th of next month, they will resume Incheon-Shenzhen and Gimpo-Beijing routes. For Japanese routes, Korean Air is resuming flights centered on Busan (Busan-Fukuoka and Nagoya), while Asiana Airlines is focusing on smaller cities (Incheon-Miyazaki).

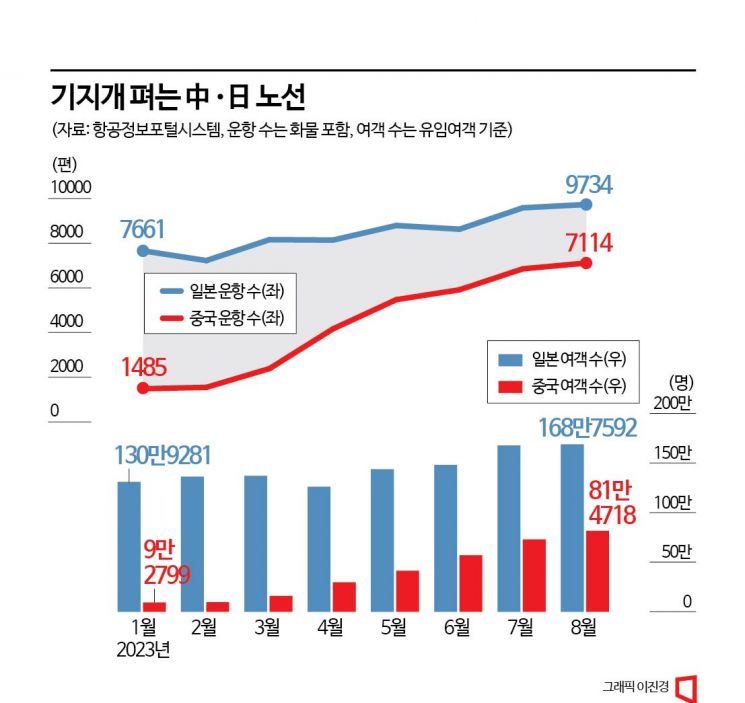

The reason airlines are rushing to operate these routes is due to increasing passenger demand. China is recovering compared to before the COVID-19 pandemic (2019), and Japan’s demand is even higher. The number of flights and passengers on routes between China and Japan have been increasing continuously since January this year. Demand for round-trip flights to China increased more than sevenfold in flights and ninefold in passengers, from 1,485 flights and 92,799 passengers in January to 7,114 flights and 814,718 passengers last month. Compared to August 2019 (10,719 flights and 1,658,954 passengers), the recovery rate is 66% for flights and 49% for passengers. For Japan, flights increased from 7,661 to 9,734, and passengers from 1,309,281 to 1,687,582 during the same period. Although the number of flights is lower than August 2019 (11,002 flights and 1,348,227 passengers), the number of passengers is actually higher.

This favorable trend is driven by Korean outbound demand due to the weak yen for Japanese routes, and by inbound demand from Chinese tourists following the allowance of group tours to Korea. On the 19th, the KRW/JPY exchange rate dropped to the 894 won level per 100 yen, influencing travel demand from Korea to Japan. Additionally, after the Chinese government fully allowed group tours to Korea on the 10th of last month, the number of Chinese visitors to Korea surged. According to Ministry of Justice data, from the announcement of group tour allowance until the 5th of this month, the number of Chinese nationals visiting Korea was 264,970, about nine times higher than the same period last year (30,113).

Park Seong-bong, a researcher at Hana Securities, said, “Last month, flights to Japan accounted for 23% of all international passengers at Incheon Airport, making it the largest share for a single country, and flights to China increased by 14% compared to July, showing a rapid recovery.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.