Stock Prices of 14 Companies Fall Compared to End of Last Year Due to Economic Recession and High Interest Rates

Only 5 Companies Show Improvement in Operating Revenue and Operating Profit This Year

Harsh Winter Continues in Second Half... Expecting Rebound Next Year with Increased Mother Fund Budget

The venture capital (VC) industry is facing difficulties due to the economic recession and high interest rates. As the first-generation VC Capstone Partners prepares for an initial public offering (IPO), attention is also focused on the current status of existing listed VCs. Currently, 18 companies, including Stick Investment, Daesung Venture Investment, M Venture Investment, and DSC Investment, are listed on the stock market. However, their performance and stock prices after listing have been disappointing. Most stock prices are below the offering price, and their earnings are also sluggish.

According to the financial investment industry on the 25th, Capstone Partners submitted a securities registration statement to the Korea Exchange aiming for a KOSDAQ market listing in November. Established in 2008, Capstone Partners is regarded as a first-generation VC. Its portfolio companies include Pado, the largest KOSDAQ IPO candidate this year, as well as Kurly, Zigbang, and Danggeun Market. As of the first half of this year, operating revenue was 3.3 billion KRW, and operating profit was 1.2 billion KRW, representing decreases of 66.37% and 84.67%, respectively, compared to the same period last year.

About 1.6 million shares will be offered in this IPO. The desired offering price range per share is 3,200 to 3,600 KRW, with a maximum planned offering amount of approximately 5.7 billion KRW. From October 16 to 20, a demand forecast will be conducted targeting institutional investors to finalize the offering price. General subscription will take place from October 26 to 27. NH Investment & Securities is the lead underwriter.

With Capstone Partners entering KOSDAQ, the total number of listed VCs will increase to 19. Currently, the listed VCs include Stick Investment, Daesung Venture Investment, Leaders Technology Investment, Lindeman Asia, M Venture Investment, Q Capital, Atinum Investment, TS Investment, DSC Investment, Aju IB Investment, SV Investment, SBI Investment, Woori Technology Investment, Now IB, Mirae Asset Venture Investment, Stonebridge Ventures, LB Investment, and Company K, totaling 18 companies.

The stock prices of VCs this year have been disappointing. Among the 18 companies, 14 have seen their stock prices fall compared to the end of last year. The VC with the largest stock price decline is LB Investment. After reaching a peak of 8,400 KRW on March 30, the stock price of LB Investment, which was listed in March this year, continuously declined and closed at 4,330 KRW on the 22nd, down 52.47% from the peak. Following that, Daesung Venture Investment and M Venture Investment fell by 36.57% and 28.17%, respectively, compared to the end of last year. SBI Investment and TS Investment also dropped more than 20%. Woori Technology Investment, Stonebridge Ventures, DSC Investment, and Leaders Technology Investment also declined by more than 10%.

Four VCs saw their stock prices rise compared to the end of last year. Stick Investment's stock price increased by 25%. This was followed by Lindeman Asia (23.91%), Mirae Asset Venture Investment (15.46%), and Atinum Investment (9.16%).

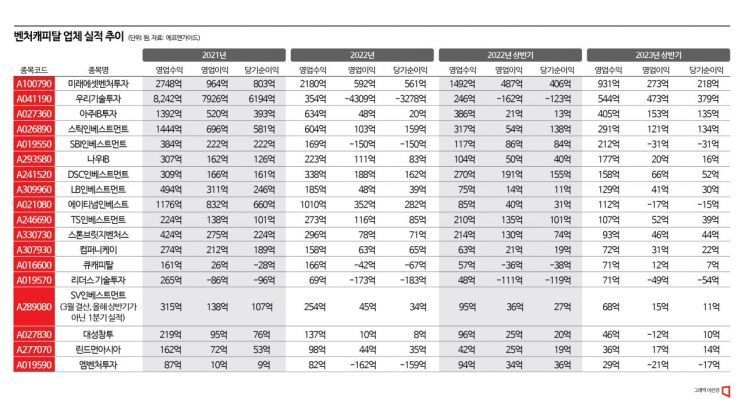

Many companies also showed poor performance in terms of earnings. A VC industry insider said, "The industry has been suffering from a cold wave due to the economic recession and high interest rates last year and this year," adding, "As the value of startups has declined, investors (LPs) have practically stopped investing." Among the 18 listed VCs, 14 saw their earnings sharply decline from 2021 to 2022. The revenue structure of VCs consists of basic management fees received from fund operations, performance fees based on fund operation results, and valuation gains from portfolio investments made by the funds.

The poor performance continues this year as well. Among the 18 companies, only five showed improvements in operating revenue and operating profit. Woori Technology Investment reported operating revenue and operating profit of 54.4 billion KRW and 43.7 billion KRW, respectively, in the first half of this year. Operating revenue increased by 121.13% compared to the same period last year, and operating profit turned positive. The biggest factor behind the revenue improvement was the increase in valuation gains on financial assets measured at fair value. This item’s operating revenue was 6.4 billion KRW in the first half of last year but jumped to 46.8 billion KRW in the first half of this year.

Aju IB Investment’s operating revenue increased from 38.6 billion KRW in the first half of last year to 40.5 billion KRW this year. Operating profit also rose from 2.1 billion KRW to 15.3 billion KRW during the same period. Among the components of operating revenue, fee income increased significantly. Fee income was 8.2 billion KRW in the first half of last year but rose to 15.3 billion KRW in the first half of this year. Notably, several investment successes were achieved in the first half, with Nanoteam, GI Innovation, Curatis, and Selbio Humantech entering the stock market.

In contrast, Mirae Asset Venture Investment performed poorly. Operating revenue dropped sharply from 149.2 billion KRW in the first half of last year to 93.1 billion KRW this year. Operating profit also shrank from 48.7 billion KRW to 27.3 billion KRW. However, it is evaluated to have performed well in the second quarter, with operating profit rising 653% from 3.2 billion KRW in the first quarter to 24.1 billion KRW in the second quarter, thanks to overseas investment portfolios such as Moloco and Chrono24.

Stonebridge Ventures also saw operating revenue plunge from 21.4 billion KRW to 9.3 billion KRW, and operating profit fall from 13 billion KRW to 4.6 billion KRW. This was due to a decrease in performance fees. Stonebridge Ventures’ performance fees in the first half of this year were 498 million KRW, sharply down from 10.4 billion KRW in the same period last year. A company official explained, "Although management fees increased due to more funds under management, many funds were liquidated last year, which reduced performance fees."

The VC industry’s earnings recovery is expected to be difficult for some time. The global economic recession, high interest rates, high exchange rates, and high inflation are expected to continue in the second half of the year following the first half, prolonging the investment winter. According to the Ministry of SMEs and Startups, venture investment amounted to 4.4447 trillion KRW in the first half of this year, down 41.9% from 7.6442 trillion KRW in 2022. A VC industry insider said, "The business conditions in the second half are not expected to be much different from the first half," adding, "Although some investments are being made, most are follow-up investments rather than new ones, so early-stage companies continue to face difficulties."

However, the situation is expected to improve next year. The government has decided to allocate 454 billion KRW for the mother fund’s contribution budget next year, an increase of 44.8% compared to this year. A VC industry insider said, "With the mother fund budget increased and the government sending positive signals, investment firms are expected to align with this, leading to an improved situation next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)