Rising Trend Ahead of September FOMC... Government Tax Revenue Reforecast Announcement Also Influences

CP at 4.02%, CD at 3.79%, Highest Since January and February

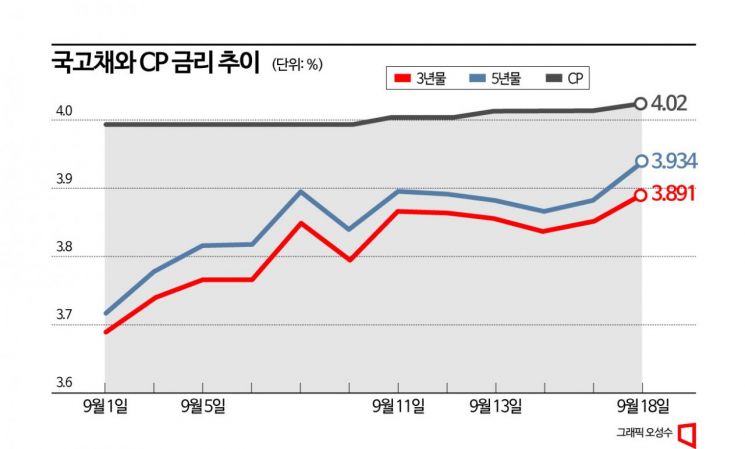

Ahead of the September Federal Open Market Committee (FOMC) meeting, volatility in the bond market has increased, intensifying upward pressure on interest rates. Reflecting the rise in international oil prices, concerns over sustained high interest rates, and the impact of government tax revenue revisions, government bond yields have reached their highest levels of the year. Notably, short-term funding rates have shown a marked increase.

According to the Korea Financial Investment Association on the 18th, the 3-year government bond yield closed at 3.891%, up 0.041 percentage points from the previous day. The 5-year government bond yield ended at 3.934%, rising 0.053 percentage points from the previous day.

The reason for the rise in government bond yields is the growing upward pressure ahead of the September FOMC. August retail sales are a representative example. U.S. retail sales in August surged by 0.6% month-on-month, exceeding expectations (+0.1%). The sharp increase in gasoline prices influenced the rise in retail sales. In fact, the West Texas Intermediate (WTI) crude oil futures price rose from $69.79 per barrel on July 3 to $81.37 on August 1. It continued to climb steadily, reaching a yearly high of $90.77 on September 15. Researcher Jinah Kim of Eugene Investment & Securities analyzed, "Oil prices are sufficient to trigger inflation fears," adding, "However, the rise in oil prices is more likely to delay the timing of interest rate cuts or dampen market expectations for cuts rather than provide grounds for further rate hikes."

Alongside the synchronization of interest rates with the U.S., the government's announcement of tax revenue revisions also impacted the domestic bond market. Researcher Kijung Kwon of IBK Investment & Securities explained, "The government has officially stated that this year's national tax revenue will fall short by about 59 trillion won compared to expectations," adding, "Although the government views the possibility of bond issuance as low, the market seems to have raised yields more than in the U.S. due to concerns over bond issuance stemming from the fiscal deficit."

At the same time, short-term funding market rates are also rising. The corporate paper (CP) rate, which is the short-term borrowing rate for companies, rose by 0.01 percentage points from the previous day to 4.02%. This is the highest level since February 10. The negotiable certificate of deposit (CD) rate, the short-term borrowing rate for banks, also increased by 0.01 percentage points to 3.79%, marking the highest level since January 13 this year.

Researcher Yeosam Yoon of Meritz Securities pointed out, "Ahead of Chuseok and the quarter-end, voices are growing that the short-term funding market is somewhat tight due to fragile supply and demand conditions," adding, "Just a year ago around this time, there was an event like Legoland, and currently, credit conditions related to real estate project financing (PF) remain highly sensitive."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)