LG Energy Solution and EcoPro BM Fall 7-30% in Past Month

"Concerns Over Electric Vehicle Demand Decline vs Industry Rebound from Q4"

Battery-related stocks, which led the domestic stock market in the first half of this year, have recently shown sluggish performance, leading to mixed forecasts from the securities industry.

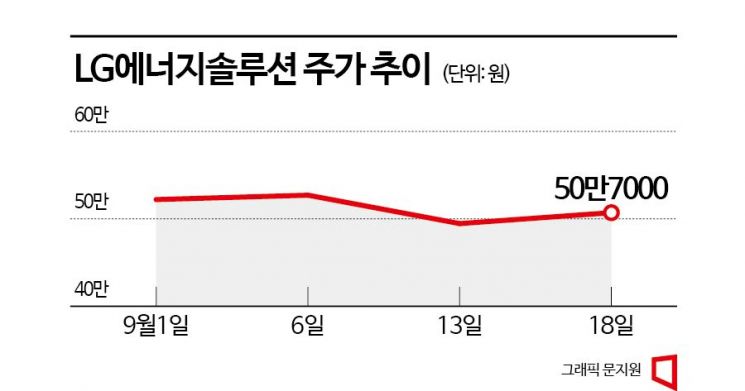

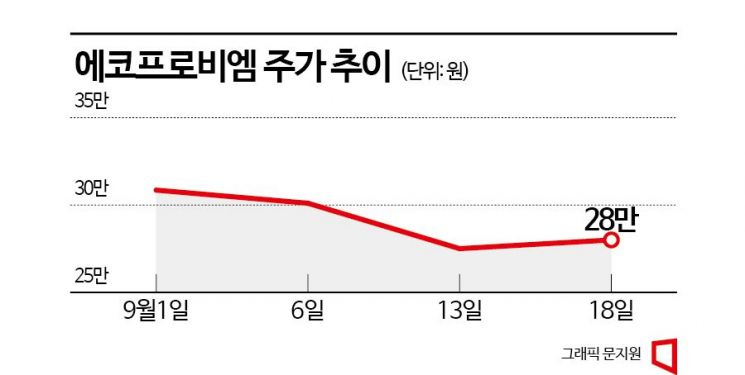

According to the Korea Exchange on the 19th, LG Energy Solution and Samsung SDI have recorded a decline of about 7% since the beginning of this month up to the previous day. EcoPro BM and EcoPro, the leading stocks on the KOSDAQ, also saw drops of approximately 13% and 29%, respectively, during the same period.

The main reason for the recent decline in battery-related stocks is analyzed to be concerns over reduced demand for electric vehicles. According to the Korea Mineral Information Service (KOMIS), as of the 15th, the price of lithium carbonate closed at 166.5 yuan per kilogram (kg), down 6 yuan (3.48%) from the previous day. It has fallen about 65% since the beginning of this year. Lithium carbonate is an essential raw material for batteries and is considered a leading indicator of growth in the electric vehicle market.

Volkswagen, which holds the top spot in Europe with a 20% share of electric vehicle sales, has lowered its growth expectations. According to industry sources, Volkswagen has been reducing production at its Emden electric vehicle plant in Germany since June and is preparing to cut staff at its largest plant in Zwickau. Byung-Hwa Han, a researcher at Eugene Investment & Securities, analyzed, “The reduction in electric vehicle subsidies in Germany, decreased consumer purchasing power due to interest rate hikes, and intensified price competition from Tesla and Chinese companies are slowing Volkswagen’s electric vehicle growth rate.”

There is also an opinion that the strike by the U.S. auto workers’ union could affect electric vehicle prices and demand. Recently, the United Auto Workers union began striking at some plants, citing job insecurity for existing internal combustion engine vehicle workers. Electric vehicles require about 30% fewer workers compared to internal combustion engine vehicles. The union is demanding that automakers slow the transition to electric vehicles, allow battery companies to unionize, and increase wages. Researcher Byung-Hwa Han stated, “While the mid- to long-term investment appeal of electric vehicle-related stocks remains high, domestic anode material companies, which are receiving excessively high valuations, are an exception,” adding, “These companies have expansion plans that exceed global electric vehicle sales forecasts.”

On the other hand, there are forecasts that the battery sector will hit its bottom in the third quarter and rebound from the fourth quarter. This is due to conflicts between the European Union (EU) and China regarding electric vehicles. According to foreign media, on the 13th, the EU announced the start of an anti-subsidy investigation into electric vehicles exported from China to Europe. The EU claims that China is distorting the market by providing massive subsidies to dominate the European market. Chinese brands hold a 10% market share in Europe.

It is analyzed that the domestic battery industry will benefit from this situation. Since Europe is unable to produce batteries on its own, collaboration with domestic companies is the best alternative. Hyundai Motor Securities expects LG Energy Solution to be the biggest beneficiary of this trend. Dong-Jin Kang, a researcher at Hyundai Motor Securities, said, “From the fourth quarter, production of Tesla’s Cybertruck and GM’s Ultium platform flagship models will highlight LG Energy Solution’s external growth,” adding, “As the U.S. share expands, profitability will further improve through benefits such as the Advanced Manufacturing Production Tax Credit (AMPC).” He also added, “Samsung SDI’s stock price has fallen despite solid sales performance, increasing its undervaluation appeal, and POSCO Future M will continue stable volume and high profit growth.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)