As crimes such as fraud and money laundering using virtual currencies have emerged as social issues, prosecutors and financial authorities have directly addressed problems related to virtual currency 'over-the-counter (OTC)' trading and custody services, drawing attention to the background. At the '2023 3rd Prosecutor's Office Criminal Law Academy' held on the 8th at the Supreme Prosecutors' Office under the theme of 'Legal Issues on the Regulation of Virtual Assets,' Deputy Chief Prosecutor Ki Noseong of the recently launched Seoul Southern District Prosecutors' Office Joint Investigation Team on Virtual Asset Crimes and Park Minwoo, Director of the Capital Markets Bureau at the Financial Services Commission, attended and suggested the need for strong regulation of virtual currencies, pointing to OTC and custody services as the epicenters of virtual currency-related crimes.

◆Virtual Currency OTC, Epicenter of 'Money Laundering' and 'Hawala'= At the academy, Deputy Chief Prosecutor Ki, who participated as a discussant in the 'Criminal Law Issues Related to Virtual Assets' session, emphasized the need to regulate OTC operators. He stated, "Illegal virtual currency OTC operators establish corporations overseas and conduct businesses converting illegally obtained virtual currencies into Korean won or foreign currencies," adding, "It is necessary to regulate these operators as unregistered virtual asset trading businesses." The virtual currency OTC referred to by Deputy Chief Prosecutor Ki means trading virtual currencies outside officially certified exchanges such as Upbit and Bithumb. In analogy to regular stocks, it corresponds to over-the-counter trading where unlisted stocks are traded. Both transactions using uncertified virtual currency exchanges and peer-to-peer (P2P) transactions between individuals fall under virtual currency OTC.

OTC is used when investors who want to maintain confidentiality and anonymity trade virtual currencies. It is mainly used by high-net-worth investors and is also called the 'top 1% market.' Domestic virtual currency exchanges fall under the regulation of the Financial Intelligence Unit (FIU) under the Financial Services Commission, where transaction details are monitored, but OTC allows large volumes of virtual currencies to be traded at mutually agreed prices without special oversight. Due to these characteristics, large volumes of unknown virtual currencies are traded. While Upbit, the largest domestic virtual currency exchange, lists 192 types of virtual currencies, one OTC exchange provides trading services for over 700 types of virtual currencies. Since unknown individuals cannot trade virtual currencies arbitrarily, OTC also has platforms similar to exchanges. It functions as a kind of 'black market.' In the peer-to-peer trading section of an exchange, sellers post a certain quantity of virtual currency and price just like listing items on an online shopping mall. If a buyer wants a particular virtual currency, they select the post and pay the seller's virtual currency wallet with a base currency such as Bitcoin. In the OTC market, individuals can trade desired virtual currencies at desired prices without tracking or monitoring.

Consequently, the virtual currency OTC market is used to launder funds and conceal criminal proceeds by making it impossible to trace virtual currencies obtained through crimes such as hacking or ransomware. It is also used for illegal foreign exchange transactions that bypass formal financial markets and for false transactions to manipulate prices. In fact, foreigners and North Korean defectors who conducted illegal foreign exchange transactions using OTC were caught domestically. In February, the International Crime Investigation Division of Incheon District Prosecutors' Office arrested and indicted three people, including a 44-year-old Libyan man A and a 43-year-old North Korean defector B, on charges of violating the Specific Financial Information Act and the Foreign Exchange Transactions Act. They are accused of purchasing virtual currencies worth 94 billion won overseas OTC from October 2021 to October last year on behalf of Libyan clients and transferring them domestically to cash out, conducting illegal foreign exchange transactions.

However, there are currently no regulations in Korea to control OTC itself. Domestic virtual asset service providers are prohibited from trading virtual currencies through OTC operators under Article 10 of the Specific Financial Information Act, but general investors cannot be sanctioned unless their transactions violate foreign exchange laws such as the Foreign Exchange Transactions Act. According to the Korea Customs Service, the scale of illegal foreign exchange transactions through virtual currencies last year was estimated at about 5.6 trillion won. The prosecution's interest in the OTC market is also based on the strong correlation with crimes. A prosecution official said, "Mentioning virtual currency OTC this time was to present a task to discuss and consider types of virtual currency crimes," adding, "We plan to continue researching and deliberating on investigations related to illegal virtual currency OTC." Lawyer Yejaseon of Gwangya Law Firm said, "To launder money through virtual currencies, one must go through illegal virtual currency OTC," and "From the perspective of investigative agencies, an environment that allows active investigation of illegal virtual currency OTC is necessary to accurately track virtual currency flows, which is why a prosecutor from the joint investigation team unusually mentioned OTC."

◆Virtual Currency Custody Services, No Way to Know Even When Investing in High-Risk Assets= Warning messages were also issued regarding virtual currency custody services. Park Minwoo, Director of the Capital Markets Bureau at the Financial Services Commission, announced at the academy the 'Progress and Contents of the Virtual Asset User Protection Act,' stating, "Once the 'Act on the Protection of Virtual Asset Users, etc. (Virtual Asset Act)' is enforced, virtual currency custody services will no longer be allowed domestically." The Virtual Asset Act, enacted to establish a legal framework for supervision, punishment of virtual asset service providers, and user damage relief, passed the National Assembly plenary session on June 30 and is scheduled for official enforcement in July next year. The act includes provisions to establish market order, such as the concept of virtual assets, obligations of virtual asset service providers, prohibition of insider trading, prohibition of price manipulation, and prohibition of fraudulent acts.

The reason a senior official from the Financial Services Commission focused on virtual asset custody services among various contents of the Virtual Asset Act is due to the strong illegal nature such as fraud associated with virtual asset custody services. Virtual currency custody services operate like banks that pay interest when money is deposited; when virtual currencies such as Bitcoin or Ethereum are deposited, they pay interest in virtual currencies at a fixed rate. To pay interest, custody operators generally use asset management methods. They invest customers' deposited funds in virtual currencies to increase virtual currency holdings. Operators promote that they can generate profits and share interest even in a declining market by applying their know-how. However, there are currently no relevant regulations requiring virtual currency custody operators to disclose investment details to customers. Even if they invest in high-yield, high-risk virtual currencies and incur losses or use funds for private unjust gains, customers cannot know unless the operators disclose such facts.

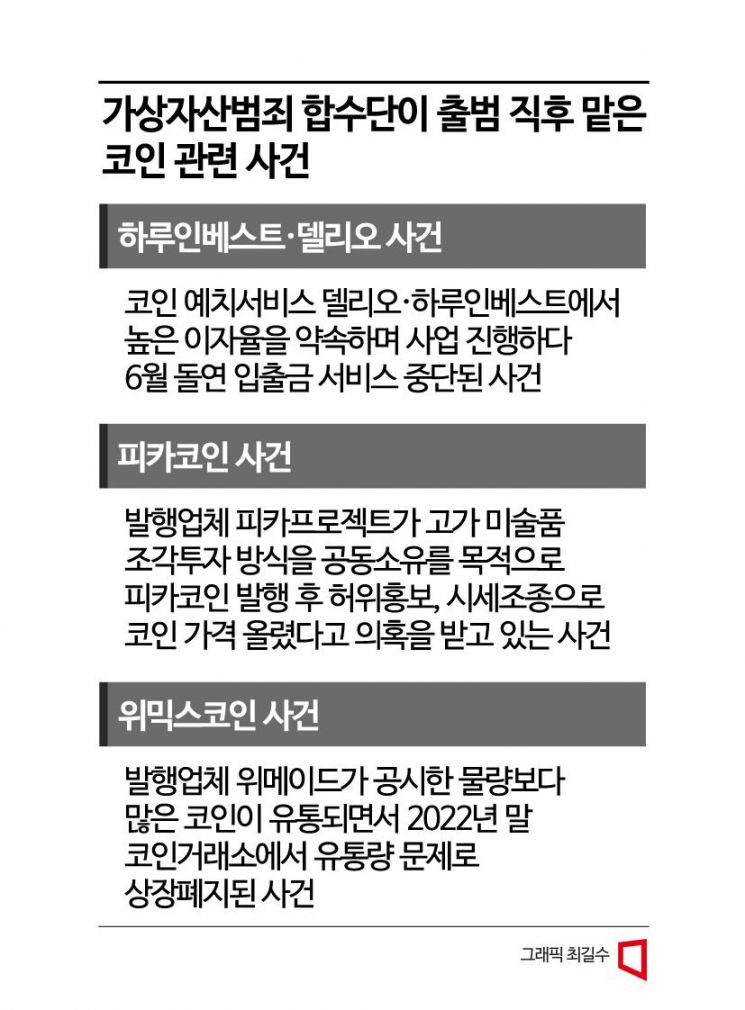

A representative case where problems occurred due to this is the suspension of deposits and withdrawals by Delio and Haru Invest. These companies did not disclose investment destinations to customers and suddenly suspended virtual currency withdrawals in June. Haru Invest blocked withdrawals, citing problems with B&S Holdings, where it had deposited funds. Subsequently, Delio announced that it had invested in Haru Invest and prohibited withdrawals to prevent a bank run. Customers, unaware of this, demanded disclosure of specific investment details and loss amounts, but Delio and Haru Invest did not immediately disclose information. Eventually, customers filed complaints against the management of Delio and Haru Invest for fraud under the Act on the Aggravated Punishment of Specific Economic Crimes at the Seoul Southern District Prosecutors' Office. The case is currently under investigation by the joint investigation team on virtual assets at the Seoul Southern District Prosecutors' Office. On the 1st, the FIU imposed a fine of 1.896 billion won on Delio, recommended dismissal of one executive, and ordered a three-month suspension of business.

Meanwhile, once the Virtual Asset Act is enforced in July next year, virtual asset custody services are expected to virtually disappear. Article 7, Paragraph 2 of the Virtual Asset Act stipulates that virtual asset service providers must substantially hold the same type and quantity of virtual currencies entrusted by users. This means virtual asset custody operators cannot invest or operate virtual currencies deposited by customers elsewhere. Essentially, virtual currency custody services will no longer be possible. Professor Hong Kihoon of Hongik University's Department of Business Administration said, "Investigative and financial authorities are sending strong messages about the virtual currency market one after another, and it seems that some regulatory guidelines have been established," adding, "Stronger sanctions on virtual currency price manipulation and money laundering are expected in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)