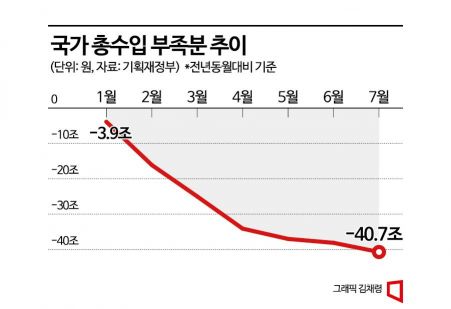

Decreasing National Total Revenue

January -3.9 Trillion → July -40.7 Trillion

Due to Shortage in Corporate Tax and Other National Taxes

Year-End Tax Revenue Shortfall Projected at 60 Trillion

Considering Gongja Fund Card as a Countermeasure

On the 24th of last month, Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho is seen answering questions at a press conference on the 2024 budget proposal.

On the 24th of last month, Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho is seen answering questions at a press conference on the 2024 budget proposal.

The government is running increasingly short of funds. As national taxes are not being collected as expected, total revenue is also on a downward trend. Although the government announced that the managed fiscal balance, which represents the country's finances, has improved, this is due to a larger reduction in total expenditures following the end of COVID-19-related projects. To carry out planned projects without disruption, funds must be sourced from anywhere possible, and the government is considering using reserves from funds that still have some leeway to cover the tax shortfall.

Expenditures Decrease More Than Revenues... Illusory Improvement in National Finances

According to the Monthly Fiscal Trend report released by the Ministry of Economy and Finance on the 14th, total government revenue collected up to July this year was 353.4 trillion won. Compared to 394 trillion won in July last year, this is a decrease of 40.7 trillion won. The shortfall in total revenue is growing over time. In January alone, total revenue was 3.9 trillion won less than the same month last year. However, by the end of the first quarter, the decrease widened to 25 trillion won, and by the end of the second quarter, it surged to 38 trillion won.

The decline in total revenue was led by national taxes. Total revenue is broadly divided into national tax revenue, non-tax revenue, and fund revenue. Among these, national tax revenue was 217.6 trillion won, down 43.4 trillion won compared to the same period last year. In particular, corporate tax decreased by 17.1 trillion won due to worsening corporate performance, income tax fell by 12.7 trillion won due to sluggish real estate transactions, and value-added tax also dropped by 6.1 trillion won.

The government claims that the integrated fiscal balance, which shows the difference between total revenue and total expenditure, and the managed fiscal balance, which reflects the actual national finances, have improved. The integrated fiscal balance recorded a deficit of 37.9 trillion won, an improvement of 18.5 trillion won compared to the same period last year. The managed fiscal balance, which excludes social security fund balances from the integrated fiscal balance, improved by 18.9 trillion won from a deficit of 86.8 trillion won to 67.9 trillion won.

This is due to a significant reduction in COVID-19-related expenditures. Total expenditures shrank by 59.1 trillion won to 391.2 trillion won. Total expenditures consist of budget and fund expenditures. Budget expenditures were recorded at 272.8 trillion won, decreasing by 13.2 trillion won as COVID-19 crisis response projects were scaled back. Fund expenditures also fell to 117.9 trillion won, down 35.3 trillion won, following the termination of loss compensation payments to small business owners initiated during the COVID-19 period. This is an improvement in indicators caused more by a larger reduction in expenditures than by an actual increase in fiscal capacity.

As of the end of July, central government debt was 1,097.8 trillion won, an increase of 64.4 trillion won compared to the end of last year. The balance of government bonds increased by 66.2 trillion won, and the balance of foreign exchange stabilization bonds rose by 2 trillion won.

Year-End Tax Revenue Expected to Decline Further... Considering Use of Public Fund

The decline in total revenue is expected to become more pronounced toward the end of the year. Considering the current pace of national tax collection, the year-end tax shortfall is likely to exceed 50 trillion won. Inside and outside the government, forecasts suggest the total tax shortfall could approach 60 trillion won. If this forecast holds, national tax revenue this year will fall far short of the initially expected 400.5 trillion won, remaining in the 340 trillion won range.

The Ministry of Economy and Finance plans to announce measures to cover the tax shortfall soon. A strong candidate is the use of the Public Fund Management Fund (Gongja Fund). The Foreign Exchange Stabilization Fund would repay the 20 trillion won it borrowed from the Gongja Fund, and the Gongja Fund would then inject this amount into the tax shortfall. The government has already prepared a record-high Gongja Fund budget of 322.8 trillion won for next year, securing ample resources. This was the result of demands to significantly increase deposits and reserves in the Gongja Fund from sources with sufficient fund resources.

Prime Minister Han Duck-soo is responding to a lawmaker's question during the government-wide economic inquiry held at the National Assembly on the 7th. Photo by Kim Hyun-min kimhyun81@

Prime Minister Han Duck-soo is responding to a lawmaker's question during the government-wide economic inquiry held at the National Assembly on the 7th. Photo by Kim Hyun-min kimhyun81@

However, using the Gongja Fund as a tax revenue measure may face criticism for contradicting government policy. The primary purpose of the Gongja Fund is to repay government bonds, and using it to cover tax shortfalls means less debt repayment, hindering debt reduction efforts. Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho, while a member of the National Assembly, also pointed out to former Deputy Prime Minister Hong Nam-ki that the Gongja Fund should not be excessively used.

The opposition party has also begun voicing objections. Hong Seong-guk, the floor spokesperson for the Democratic Party of Korea, recently issued a statement saying, "Is it sound fiscal management to use surplus resources from funds? It’s like removing a stone from the bottom to prop up the top, a futile gesture." During the government questioning session on economic affairs held in the National Assembly on the 7th, Democratic Party lawmaker Jeong Tae-ho criticized Prime Minister Han Duck-soo, saying, "You are trying to launder the Foreign Exchange Stabilization Fund, which is used for foreign exchange management, into the Gongja Fund to use it."

Prime Minister Han responded, "If money is needed for the annual operation of finances, we borrow from the Bank of Korea and repay when taxes come in. It is natural to make inter-fund loans between accounts that have surplus and those that need funds immediately in a situation of tax shortfall," he said.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)