Samjeon, a Key Company in Apple's Supply Chain

Growing Optimism for Semiconductor Market Improvement

"Stock Price Upward Cycle Starting Next Year"

Samsung Electronics' stock price has solidified in the 70,000 won range around the unveiling of Apple's iPhone 15, drawing attention. This is interpreted as a reflection of expectations that the semiconductor sector, which had been in a downturn, could recover thanks to the iPhone launch. Some also believe that Samsung's stock price could rise to the 90,000 won range.

Samsung's stock closed at 70,900 won on the previous day (13th). During the trading session, it even rose to the 71,000 won range. Earlier, on the 12th (local time), Apple held an event at Apple Park in California, USA, to unveil the iPhone 15 series. Despite upgrading performance by one level, the price was frozen at $999 (US standard), the same as the previous model.

There is optimism that the iPhone 15 could have a positive effect on the smartphone market, which had been in a slump. According to market research firm IDC, global smartphone shipments in the first half of this year (January to June) decreased by 3.2% compared to the previous year. The reopening effect in China was also modest.

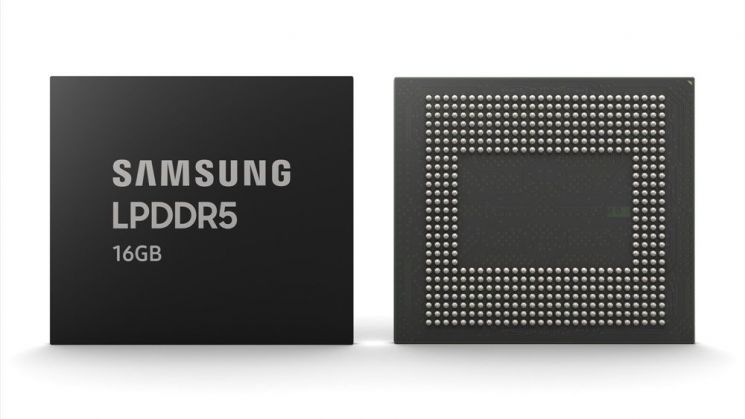

However, if the industry turns around due to the iPhone 15 launch, Samsung, a semiconductor company, will also benefit significantly. Samsung supplies DRAM (RAM) to various smartphones, including the iPhone.

In the case of the iPhone 15, Samsung Display, a Samsung subsidiary, became the only company to secure the supply rights for all four models (standard, Plus, Pro, Pro Max). It gained a windfall as its main rival, China's BOE, failed to receive supply approval due to quality issues.

In fact, the semiconductor sector as a whole rose after the iPhone 15 unveiling. Along with Samsung Electronics, SK Hynix, the other top semiconductor stock in the domestic market, also entered the symbolic 120,000 won range during trading the previous day. Additionally, materials and equipment-related stocks continued to rise.

In the securities industry, there is speculation that Samsung's stock price could enter the 90,000 won range in the fourth quarter. This is because the inventory issues in Samsung's core semiconductor business could be resolved, improving operating profit margins.

Dongwon Kim, a researcher at KB Securities, analyzed, "With the expansion of production capacity for High Bandwidth Memory (HBM) and Double Data Rate (DDR), DRAM supply is expected to shrink, causing a supply-demand imbalance," and added, "NAND will also turn to an upward trend for the first time in two years due to reduced facility investments and a halt in price cuts."

He further predicted, "From the end of the fourth quarter, the supply-demand imbalance caused by supply reduction in the memory semiconductor market will materialize, and from next year, the slope of the stock price rise cycle will steeply develop."

Meanwhile, Samsung's flagship foldable smartphones, the Galaxy Z Flip5 and Fold5, are likely to directly compete with the iPhone 15 this fall. Samsung's foldable phones have already drawn positive responses, setting a record with 1.02 million pre-orders within one week of their domestic release.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)