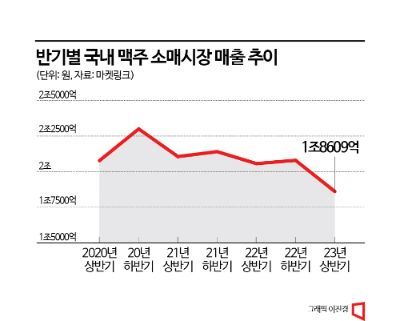

Household Market Sales 1.8 Trillion Won... 9.5% Decrease YoY

'Terra·Kelly' Offensive, but 'Cass' Maintains No.1 Position

Sales revenue in the domestic beer retail market fell below 2 trillion won in the first half of this year. While interest and consumption of competing alcoholic beverages such as whiskey and wine are rapidly increasing, the steady rise in beer prices due to high raw material costs is also cited as a reason for the declining appeal of beer, which is considered a cost-effective alcoholic beverage.

According to market research firm Market Link on the 13th, the sales revenue of domestic beer retail stores in the first half of this year was 1.8609 trillion won, a 9.5% decrease compared to the same period last year (2.0565 trillion won). With first-half sales falling below 2 trillion won, there is a growing possibility that the total sales for this year will also fall below 4 trillion won. Beer retail sales, which were around 4.3771 trillion won in 2020, have been shrinking annually to 4.2462 trillion won in 2021 and 4.1358 trillion won last year.

The recent contraction of the beer market is largely influenced by the rapid growth of alternative markets such as whiskey and wine. Although beer, along with soju, remains a representative alcoholic beverage in the domestic market, the domestic alcohol market is shifting towards consuming a variety of alcoholic beverages, leading to a decline in beer sales. While beer import value decreased from 112.52 million USD in the first half of 2020 to 109.79 million USD this year, whiskey imports increased from 50.47 million USD to 133.29 million USD during the same period.

Additionally, amid the ongoing high inflation, the continuous rise in beer prices at convenience stores, the largest retail distribution channel, is also affecting consumption decline. The price of beer at convenience stores, which was 10,000 won for 4 cans, was adjusted to 11,000 won for 4 cans at the end of 2021 and further increased to 12,000 won for 4 cans in the first half of this year.

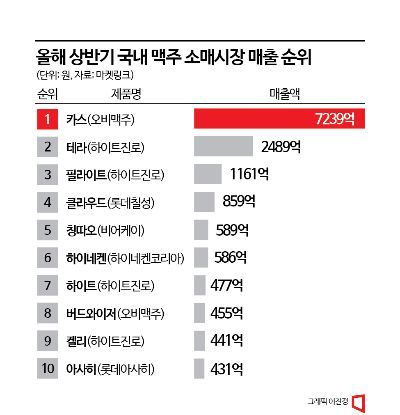

By brand, OB Beer’s ‘Cass’ ranked first with sales revenue of 723.9 billion won. Although Cass’s sales decreased by 5.9% compared to the same period last year (768.8 billion won), it maintained its leading position with a market share of 36.8% as the sales of the second-ranked brand declined more sharply. With Cass firmly holding the top spot, OB Beer also maintained first place in manufacturer market share at 47.3%, followed by Hite Jinro at 28.5%. Heineken Korea (5.2%), Lotte Chilsung (5.0%), and BeerK (3.8%) followed.

Hite Jinro’s ‘Terra’ maintained second place with sales revenue of 248.9 billion won. However, its sales dropped by 20.6% compared to the same period last year, a sharper decline than the overall market. ‘Kelly,’ which Hite Jinro is promoting as a dual brand alongside Terra, ranked ninth with 44.1 billion won in sales. Although its overall sales scale and market share are still relatively low, since it was launched last April and Hite Jinro has announced plans to continue aggressive marketing in the second half of the year following the first half, both sales and market share are expected to rise in the latter half of the year.

Kim Tae-ho, director of the Korea Alcohol Association, commented, “The recent decline in beer consumption is not unique to Korea but a global trend. Amid the global economic downturn, overall consumption is slowing, and as alcohol consumption decreases, non-alcoholic beer consumption is increasing, which together are influencing the market.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)