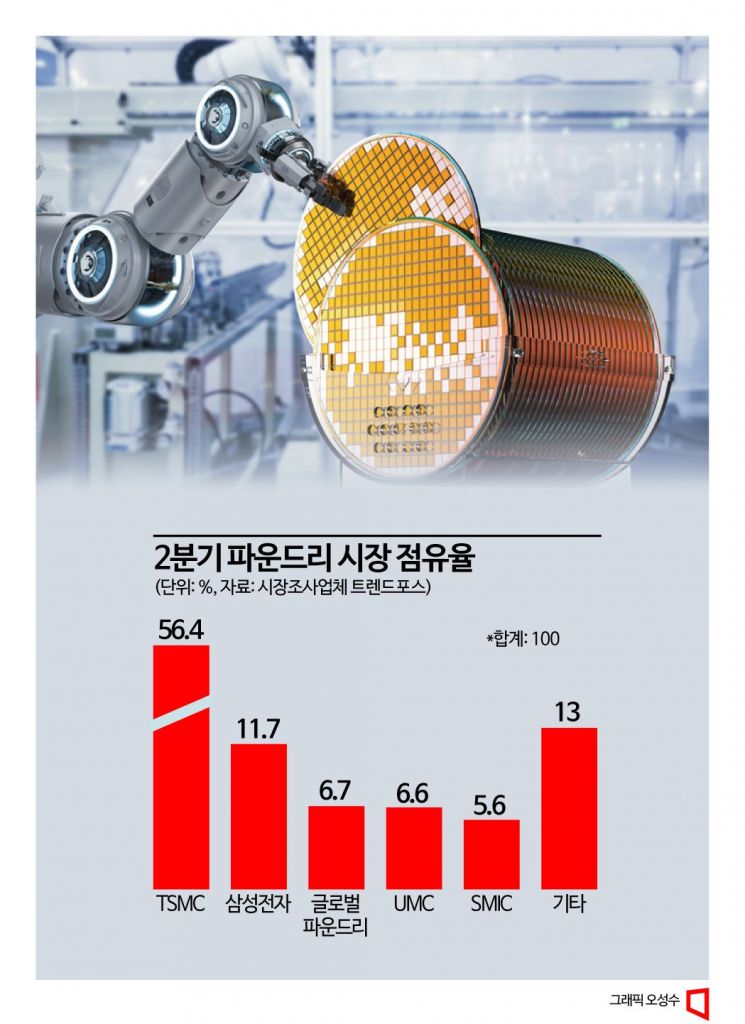

TSMC Market Share Declined in Q2

Samsung Electronics Recovers 10%+ Market Share

Market Expected to Bottom Out and Grow in Q3

Samsung Electronics Strengthens GAA Technology

Samsung Electronics narrowed the market share gap with Taiwan's TSMC in the foundry (semiconductor contract manufacturing) market in the second quarter. There are expectations that the foundry market could gradually recover from the third quarter.

On the 6th, market research firm TrendForce reported that the combined revenue of the world's top 10 foundry companies in the second quarter was $26.249 billion, down 1.1% from the previous quarter. The fortunes of companies diverged. Taiwan's TSMC, ranked first, saw its second-quarter revenue decrease by 6.4% from the previous quarter to $15.656 billion. Its market share in the second quarter also fell by 3.8 percentage points from 60.2% in the previous quarter to 56.4%. On the other hand, Samsung Electronics, ranked second, posted second-quarter revenue of $3.234 billion, up 17.3% from the previous quarter. Its market share also rose by 1.8 percentage points from 9.9% in the previous quarter to 11.7%.

The gap between first and second place narrowed from 50.3 percentage points in the first quarter to 44.7 percentage points in the second quarter. Samsung Electronics saw a significant drop in revenue in the first quarter due to a decline in wafer utilization rates but showed signs of recovery in the second quarter, regaining a double-digit market share. TSMC maintained stable profits in the 7nm and 6nm processes but experienced a decline in revenue from the 5nm and 4nm processes, leading to a decrease in market share.

TrendForce expects the fortunes of the two companies to shift again entering the third quarter. Since TSMC's client Apple is launching new iPhone models, "related component demand could surge," it predicted. For Samsung Electronics, it forecasted that "demand for Android smartphones, PCs, and laptops may decline."

However, the overall outlook for the foundry market is positive. Although demand may still be sluggish compared to previous peak seasons, there is optimism that the market could recover due to the iPhone and artificial intelligence (AI) effects. TrendForce stated, "As orders for AI chips for high-performance computing (HPC) increase, it will add momentum to high value-added manufacturing processes," and predicted that "the revenue of the world's top 10 foundry companies will hit a low point in the third quarter before rebounding and gradually growing."

Samsung Electronics is strengthening its competitiveness in advanced processes to narrow the gap with TSMC. It is improving yield rates (the ratio of good products among manufactured items) in processes below 4nm and preparing for the 2nm era expected to arrive in 2025. Samsung plans to enhance competitiveness with the next-generation transistor technology 'Gate-All-Around (GAA),' which it was the first in the foundry industry to introduce in the 3nm process.

Kyung Kye-hyun, President of Samsung Electronics' Device Solutions (DS) Division, said in a lecture at Seoul National University on the 5th, "Since we are the creators of GAA, you will see us surpass our competitor (TSMC)." Regarding the foundry plant being built in Taylor, Texas, USA, he said, "The factory building is largely constructed," and predicted, "By the end of next year, we will be producing 4nm products there." Samsung Electronics plans to complete the Taylor plant within this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.