Cataracts, Orthotic Treatment, Valve Reconstruction Surgery, and Other Abuses and Frauds Persist

Produced by the General Insurance Association Card News

Complaints related to indemnity health insurance compensation continue to persist in major non-reimbursable items such as cataract surgery and manual therapy. It has been pointed out that consumers need to be more cautious when receiving indemnity insurance compensation.

On the 27th, the General Insurance Association of Korea produced a card news outlining precautions for consumers when claiming indemnity insurance compensation. According to the '2023 First Half Financial Complaint Trends' announced by the Financial Supervisory Service on the 11th, complaints related to non-life insurance accounted for the largest portion at 36.8% of all financial complaints. Among these, the majority (63.0%) were related to compensation.

Accordingly, the General Insurance Association selected major non-reimbursable items where similar types of complaints frequently occur, including ▲cataract surgery ▲manual therapy ▲non-valve reconstruction surgery ▲skin wound dressings ▲prostate ligation surgery, and provided guidance on precautions.

First, cataracts are a representative item with many cases of fraudulent insurance claims. Brokers have been caught collaborating with some hospitals to disguise outpatient treatments as inpatient treatments and issuing false medical certificates. Through this, hospitals receive health insurance benefits, and patients fraudulently claim insurance money from private insurers. The National Tax Service even conducted a comprehensive tax investigation on broker organizations and affiliated hospitals that arranged patients with indemnity insurance to hospitals and clinics and disguised advertising services to evade taxes.

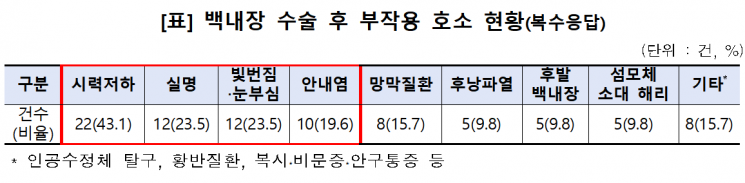

Surgical side effects have also appeared. Among the cataract surgery-related damage relief applications received by the Korea Consumer Agency from 2019 to June 2022, the cases were in order of ▲decreased vision after surgery (43.1%) ▲blindness (23.5%) ▲glare and light scattering (23.5%) ▲endophthalmitis occurrence (19.6%).

Manual therapy has also been abused as a means of insurance fraud. Non-medical personnel such as consultation managers (including brokers) check insurance subscription status and then process costs as manual therapy covered by indemnity insurance, while proposing cosmetic or dermatological procedures.

In addition, non-valve reconstruction surgery, which straightens cartilage for patients with nasal congestion, has often been misused for plastic surgery and cosmetic purposes. There have also been cases where MD creams prescribed by dermatologists for treating atopic dermatitis were sold through secondhand transactions.

This card news can also be viewed on the General Insurance Association’s website and on social network service (SNS) channels such as the Instagram accounts of the General Insurance Association and non-life insurance companies. Jung Ji-won, president of the General Insurance Association, stated, "We produced this card news to enhance consumer understanding of indemnity insurance and to prevent unnecessary disputes," adding, "We will continue to take the lead in consumer protection by discovering useful information for consumers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)