For Self-Employed Individuals Who Took Out Loans During the COVID-19 Recovery Process

Self-employed individuals who took out high-interest credit loans with an annual interest rate of over 7% during the COVID-19 period for business purposes will now be able to switch to low-interest loans with a maximum annual interest rate of 5.5%.

The Financial Services Commission announced on the 27th that starting from the 31st, the 'Low-Interest Refinancing Program' will be expanded to include household credit loans. Since the end of September 2022, the authorities have operated the program targeting business loans to reduce the high-interest burden on small business owners, and now it has been extended to household credit loans as well.

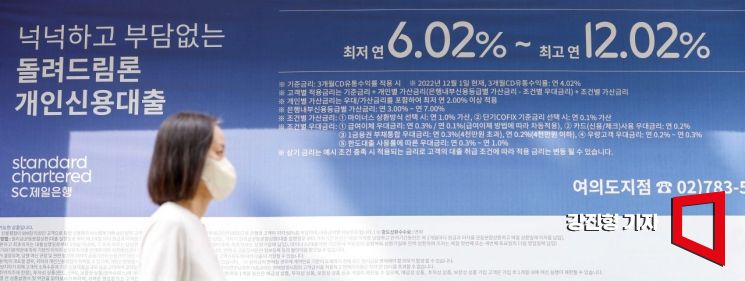

As the average loan interest rate in the banking sector has been rising for two consecutive months, a banner displaying the personal credit loan interest rates is hung on the exterior wall of a commercial bank in Seoul on the 31st. Photo by Jinhyung Kang aymsdream@

As the average loan interest rate in the banking sector has been rising for two consecutive months, a banner displaying the personal credit loan interest rates is hung on the exterior wall of a commercial bank in Seoul on the 31st. Photo by Jinhyung Kang aymsdream@

The household credit loans eligible for the low-interest refinancing program are ▲individual business owners who are operating their businesses normally ▲loans initially taken out during the COVID-19 period from January 1, 2020, to May 31, 2022 ▲loans with an interest rate of 7% or higher at the time of refinancing application ▲including credit loans and long-term card loans (card loans). As before, sectors excluded from small business policy funds such as gambling and entertainment-related industries, nightlife bars, real estate leasing and sales, and finance are excluded from eligibility.

The refinancing limit per borrower for household credit loans is up to 20 million KRW, and the limit is determined by verifying the amount spent for business purposes within one year from the time the individual business owner (self-employed) took out the household credit loan eligible for refinancing. Therefore, even if a borrower applies to refinance 20 million KRW of household credit loans, refinancing is only possible up to the amount spent for business purposes if it is less than that.

Also, the household credit loan limit is included in the borrower-specific limit of 100 million KRW for the low-interest refinancing program for individual business owners. Individual business owners who have already switched business loans to low-interest loans up to 100 million KRW through this program cannot refinance additional household credit loans.

Considering the support purpose of alleviating the repayment burden caused by household credit loans that inevitably occurred during the COVID-19 recovery process and the limitation of the refinancing limit to a maximum of 20 million KRW per borrower, the authorities will ease the burden of proof for business-related expenditures by individual business owners. The amount of business-related expenditures is calculated as the sum of purchase amounts confirmed through the 'VAT report' or 'Business Status Report,' income payment amounts confirmed through the 'Withholding Tax Report,' and rental fees confirmed through the 'Business Lease Contract' or 'Comprehensive Income Tax Return.'

Applications and consultations for this program can be made at branches of 14 banks nationwide starting from the 31st. Applications must be made in person along with the submission of documents that can verify the amount spent for business purposes. Additionally, existing 5-year maturity loans (2 years grace period, 3 years installment repayment) held through the previous program can be renewed to 10-year maturity loans (3 years grace period, 7 years installment repayment) starting from the 31st.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)