Oasis Faces Uncertainty in Quick Commerce via 'V'

Coupang, Emart Also Conduct Pilot Operations in Limited Areas

Profitability Issues Unresolved... Demand Doubts Persist

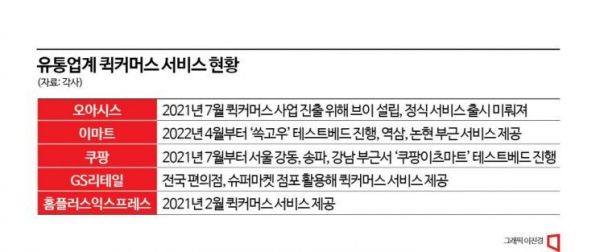

The distribution industry is showing lukewarm responses to the quick commerce business, which delivers products within 30 minutes to an hour after ordering. Until a few years ago, more companies were rapidly entering the quick commerce market, but now they are cautious of each other and slowing down the pace of business expansion.

According to Oasis on the 21st, it has been confirmed that entering the quick commerce business through ‘V’ this year is not easy. The company stated in its business report and quarterly reports this year that it plans to provide services throughout the metropolitan area starting with downtown Seoul in the first half of the year, but the plans have yet to be concretized. In the semi-annual report, the company changed its stance to provide services within this year, but whether the service will be launched within the year remains uncertain. Currently, small-scale logistics centers (MFCs) in Seoul’s Gangdong, Songpa, Gangnam, and Seocho districts are conducting service testbeds, but they are not yet offering pilot services directly related to quick commerce.

A company official said, "Since officially entering the quick commerce business in July 2021, the business has been delayed due to various ups and downs, including difficulties faced by joint venture companies," adding, "We have plans, but other new businesses such as unmanned payment solutions and OnAir Delivery are progressing rapidly, so quick commerce has been deprioritized."

Coupang entered the quick commerce market in July 2021, when Oasis announced its entry, by launching ‘Coupang Eats Mart.’ However, even after two years, it is only operating on a pilot basis in some areas of Seoul, such as Gangnam, Seocho, and Songpa.

Emart also introduced its quick commerce business through ‘SSG Go’ in April last year but has yet to decide on an official launch. Currently, it is only running pilot operations in Nonhyeon and Yeoksam areas.

The reason distribution companies are struggling to enter the quick commerce business is that they have not found answers in terms of profitability. First, to start a quick commerce business, multiple logistics centers (MFCs) must be established in the service areas. However, for distributors without offline stores, additional investments are required to secure base stores, including rent and labor costs. Even for distributors with offline stores, covering all small-scale areas can be challenging.

In fact, even companies like Emart with offline stores face various difficulties in the quick commerce business. Finding delivery personnel can be a problem. Having fixed delivery staff increases fixed costs, which poses a significant economic burden.

On the other hand, doubts about demand continue to be raised. A representative from a distribution company conducting pilot operations of quick commerce said, "Besides profitability issues, it is necessary to verify whether there is sufficient demand for this service," adding, "Since the endemic phase (periodic outbreaks of infectious diseases), the number of quick commerce users has decreased, and demand appears to be limited to certain age groups."

In other words, even if there are many orderers, the market size may not be large enough to officially expand the business. Looking at cases like Lotte Super, they have stopped the ‘immediate delivery’ service and are only offering ‘same-day delivery’ to improve profitability. This can be seen as an example of adjusting management strategies considering market reactions and changes in demand.

The companies actively developing quick commerce businesses in the distribution industry are GS Retail and Homeplus Express, which have offline stores nationwide. GS Retail provides a one-hour immediate delivery service targeting GS The Fresh (supermarkets) and GS25 (convenience stores) through the ‘Our Neighborhood App.’ They utilize over 17,000 convenience stores and supermarkets as MFCs and secure delivery personnel nationwide through their own ‘Woochin Delivery’ platform and partnerships with delivery agencies. Homeplus Express has been operating a ‘one-hour immediate delivery’ business since February 2021, leveraging its nationwide store network and delivery vehicles.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)