Samsung Electronics Small Shareholders Decrease by 350,000 to 6 Million in 8 Months

Retail Investor Sentiment Shifts to Secondary Batteries... POSCO Holdings Tops Net Purchases

Net Buying Returns to Samsung Electronics in August... Focus on Theme Stock Supply in Second Half

In the first half of this year, the every move of the increasingly influential "ant army" in the domestic stock market attracted attention. The landscape of national stocks changed according to their movements. Normally, Samsung Electronics was the top pick for the ants' love calls. This year was different. As Samsung Electronics' stock price stagnated, the ant army decisively flocked to secondary battery stocks. However, it is uncertain whether this trend will continue in the second half of the year. Since August, ants have been concentrating their purchases on Samsung Electronics again.

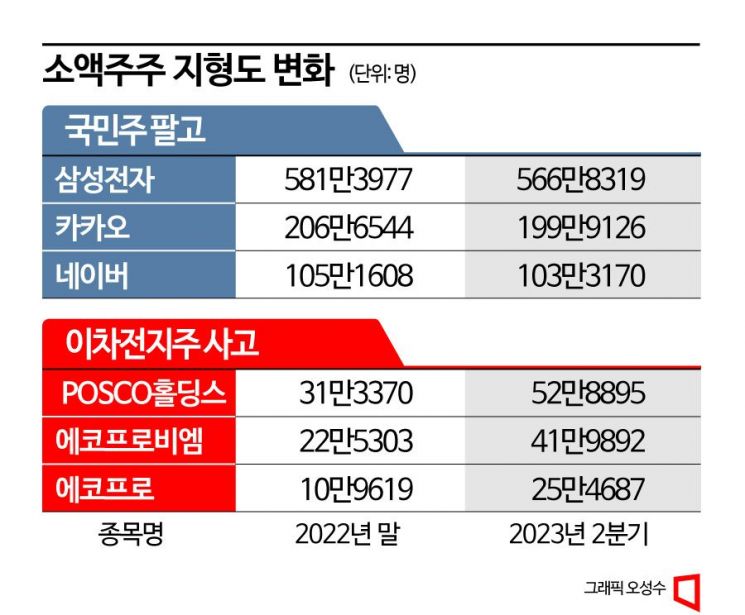

According to the Financial Supervisory Service's electronic disclosure system, as of the second quarter of this year, Samsung Electronics had 5,668,319 small shareholders. This is about 150,000 fewer than the 5,813,977 at the end of last year. The number of small shareholders peaked at 6.02 million in September last year. Since its founding in 1969, Samsung Electronics opened the era of 6 million shareholders for the first time, gaining attention as a national stock, but within eight months, 350,000 shareholders sold their Samsung Electronics shares and left.

There has been a clear change in the national stock landscape this year. The number of small shareholders of Kakao and Naver, which were called national stocks with over 1 million small shareholders, also decreased. Although they were spotlighted as growth stocks after COVID-19, their stock prices fell due to interest rate hikes and poor earnings, causing individuals to turn away. Kakao's small shareholders fell below 2 million to 1,999,126 as of the second quarter. At the end of last year, the number was 2,066,544. Naver's small shareholders also decreased from 1,051,608 at the end of last year to 1,033,170 in the second quarter of this year.

The ant army's footsteps turned toward secondary battery stocks. The small shareholders of Ecopro, the first protagonist of the secondary battery surge, more than doubled from 109,619 at the end of last year to 254,687 in the second quarter of this year. During the same period, Ecopro BM's small shareholders also surged from 225,303 to 419,892. Afterwards, the affection for Ecopro group stocks shifted to POSCO group stocks.

Individual investors sold Samsung Electronics the most and bought POSCO Holdings the most until the end of July this year. The net selling amount of Samsung Electronics was 10.5818 trillion won, and the net buying amount of POSCO Holdings was 9.2833 trillion won. The number of small shareholders of POSCO Holdings also increased from 313,370 at the end of last year to 528,895 in the second quarter of this year.

However, it is uncertain whether this change in the landscape will be maintained in the second half of the year. As the concentration on secondary battery stocks somewhat eases, buying interest is gathering again in the semiconductor sector.

In particular, the mixed investment opinions on POSCO Holdings in the securities industry are also a variable. Securities firms warn of high volatility in secondary battery stocks and advise caution. Jang Jae-hyuk, a researcher at Meritz Securities, said, "One factor that could improve POSCO Holdings' corporate value is the reflection of the lithium business value," adding, "Even considering the production plans specifically shared by POSCO Holdings, the appropriate timing applied in the operating value calculation and lithium prices will be key variables."

Changes are also detected in individual investors' net buying behavior. In August, until the third week, individuals net purchased Samsung Electronics stocks worth 888.3 billion won. This is the top net buying during this period. Until last month, individuals had net sold Samsung Electronics by 549.2 billion won, but the net buying amount has surpassed that.

However, Samsung Electronics' stock price is still stagnant. The stock price, which was above 70,000 won last month, has remained at the "60,000 won level" since August 2. According to financial information provider FnGuide, the average target price for Samsung Electronics by securities firms is 91,364 won. Foreign securities firms' evaluations are also favorable. Morgan Stanley mentioned SK Hynix and Samsung Electronics as suppliers of the next-generation HBM semiconductor, "HBM3," to Nvidia, a leader in artificial intelligence (AI) semiconductors. Currently, Samsung Electronics and SK Hynix are the only companies worldwide capable of producing HBM semiconductors. In particular, Samsung Electronics is expected to become a major supplier of HBM semiconductors through technological development. Morgan Stanley predicted, "Samsung Electronics' efforts to catch up with HBM and DRAM semiconductor technologies used in AI servers will continue." Morgan Stanley recommended "overweight" for Samsung Electronics and SK Hynix, setting target prices at 95,000 won and 170,000 won, respectively. However, if the stock price remains sluggish, individual investors are likely to move to other themes.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)