Global 5th Largest Collaborative Robot Company... "Completing IPO in October"

Expanding Domain with Software... Corporate Valuation Expected at 1.5 to 2 Trillion KRW

Doosan Robotics has passed the preliminary listing review for its initial public offering (IPO), marking the start of the formal listing process. The securities industry expects Doosan Robotics, considered a major IPO in the second half of the year, to have a corporate value of around 1.5 trillion to 2 trillion KRW.

On the 17th, Doosan Robotics passed the preliminary listing review for the KOSPI IPO from the Korea Exchange's Securities Market Headquarters. Doosan Robotics is a deficit company. However, it meets the requirements of 'market capitalization of over 500 billion KRW and equity capital of over 150 billion KRW' and is pursuing listing under the unicorn company special case.

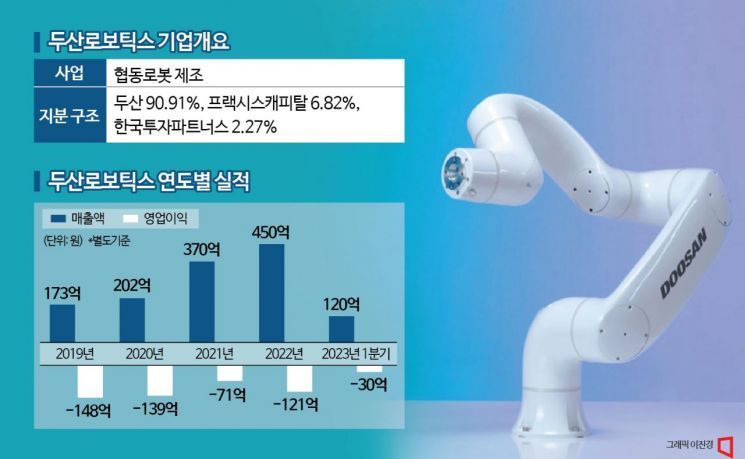

Doosan Robotics was established in 2015. Starting mass production of four types of collaborative robots in 2018, it surpassed cumulative sales of 2,000 units in 2021, entering the global market share top 5. Currently, it produces more than 10 types of robots. Last year, private equity fund (PEF) operator Praxis Capital Partners' private equity fund Cobot Holdings and Korea Investment Partners' private equity fund KIP Robotics invested as financial investors (FI). The current shareholding structure is Doosan (90.91%), Cobot Holdings (6.82%), and KIP Robotics (2.27%).

Doosan Robotics' main products are collaborative robots. Including the E series specialized for the food and beverage (F&B) industry, it has the M series with torque sensors embedded in all six rotational axes, the H series capable of carrying the heaviest load of 25kg among existing collaborative robots, and the A series that achieves fast speeds at a reasonable price. There are a total of 13 models when counting detailed lines by model.

On a separate basis, sales were 20.2 billion KRW with an operating loss of 13.9 billion KRW in 2020, and last year sales reached 45 billion KRW with an operating loss of 12.1 billion KRW. In the first quarter, sales were 12 billion KRW with an operating loss of 3 billion KRW. Although losses continue, the deficit is shrinking each year while recording high sales growth rates. From 2019 to last year, it recorded an average annual sales growth rate of over 37%.

The market views Doosan Robotics' growth potential highly. This is because the industrial collaborative robot and service robot markets are expected to expand due to changes in the economic environment such as labor shortages and corporate cost reductions. Global market research firm MarketsandMarkets projected the global collaborative robot market size to grow from 2.2 trillion KRW in 2022 to 6.45 trillion KRW by 2025.

One advantage is that the overseas proportion is larger compared to domestic sales. Doosan Robotics recorded 13.5 billion KRW (30%) in domestic sales and 31.5 billion KRW (70%) overseas. Eun-ae Cho, a researcher at Ebest Investment & Securities, said, "Sales growth centered on the North American region has continued," adding, "Last year, it seems the market share increased further by surpassing the sales growth rate of Universal Robots, the industry leader."

This year, sales growth in Europe as well as North America is expected to be steeper. In regions like Europe and North America, where high labor costs mean fewer available workers, the use of collaborative robots is expected to increase significantly. A Doosan official explained, "We are continuously monitoring the timing of establishing a European corporation this year," adding, "Although the atmosphere was not favorable last year due to the Russia-Ukraine war, we are strengthening sales activities by building strong relationships with dealers."

Su-hyun Kim, a researcher at DS Securities, also analyzed, "While the global number one company Universal Robots showed negative sales growth in the first and second quarters, and other companies are struggling, Doosan Robotics is estimated to have recorded about 10% year-on-year growth in the second quarter following growth in the first quarter."

Doosan Robotics plans to develop and launch software to expand platform sales in the mid to long term, in addition to robot sales. Currently, Doosan Robotics is conducting beta testing of its software platform 'DartSuite,' which is scheduled to be released in the third quarter of this year. A Doosan official said, "We aim to expand the scope of the robot ecosystem," adding, "In the long term, ecosystem expansion will also benefit the company."

The industry expects Doosan Robotics to complete its IPO by October. The lead underwriters for the listing are Mirae Asset Securities and Korea Investment & Securities. NH Investment & Securities, KB Securities, and foreign firm Credit Suisse (CS) have joined as joint underwriters. The number of shares to be listed is 64,819,980, with 16.2 million shares offered in the public offering. It is a new share issuance without any sale of existing shares. The market values the company at around 1.5 trillion to 2 trillion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.