National Assembly Legislative Research Office 'National Audit Issue Analysis'

Tax Revenue Error Amounting to 114 Trillion Won Over the Past 2 Years

"Review Forecast Models, Recalculate Even in November"

The Ministry of Economy and Finance has been criticized for using unclear forecast figures and insufficient error analysis as fundamental reasons for its failure to accurately predict tax revenues. There are calls to enhance the post-evaluation method to resolve the issue of tax revenue discrepancies.

According to the ‘National Assembly Audit Issue Analysis’ released by the National Assembly Research Service on the 17th, the key topic for the National Assembly’s Strategy and Finance Committee was selected as ‘Securing the Consistency of National Tax Revenue Estimates.’ The National Assembly Research Service analyzes major government policies and their progress every year, then publicly discloses issues likely to become points of contention in the October national audit by committee. For the second consecutive year, the Strategy and Finance Committee’s agenda included matters related to tax revenue discrepancies.

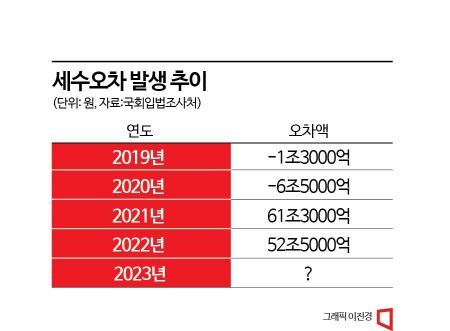

The scale of tax revenue discrepancies has been increasing year by year. When the 2019 budget was drafted, tax revenue was forecasted at 294.8 trillion won, but only 293.5 trillion won was collected, resulting in a discrepancy of just -1.3 trillion won. However, the discrepancy grew to -6.5 trillion won in 2020, and in 2021 and 2022, tax revenues exceeded forecasts by 61.3 trillion won and 52.5 trillion won, respectively. This year’s expected tax revenue is 400.5 trillion won, but only 296.2 trillion won has been collected through the first half of the year, which is 38.1 trillion won less than the same period last year.

Excessive tax revenue discrepancies are problematic because they cause distortions in fiscal management. If revenue is less than expected, expenditures must be cut or covered by borrowing. Repeated occurrences of such situations can destabilize the macroeconomy and increase the risk of inefficient budget execution. Conversely, excessively high tax revenues can lead to oversized expenditures and deterioration of the fiscal balance, negatively affecting economic response measures.

"Review Forecast Models, Re-estimate Even by November"

The Research Service pointed out the use of imprecise forecasting methods as a cause of tax revenue discrepancies. When estimating tax revenues, the government uses explanatory variables forecasted by national research institutes within its own macroeconomic models. The Research Service explained, “The government’s macroeconomic forecasts tend to reflect policy targets positively influenced by government policy effects,” and added, “There have been proposals to strengthen the role of the Tax Revenue Estimation Committee to select neutral figures and use them in estimation models.”

There was also an analysis emphasizing the need to review the capital gains tax forecast model. Despite rapid changes in the real estate market, regression models using past economic indicators have been used to predict asset taxes such as capital gains tax, making accurate forecasts difficult. The government adopted a growth rate method reflecting tax revenue performance up to July starting with this year’s budget, but the Research Service suggested that post-evaluation and review are necessary to improve the model.

To respond swiftly to changes in economic conditions, there were opinions that periodic re-estimation should be conducted. When the government finalizes the next year’s revenue budget, it refers to tax revenue performance and progress rates up to July of that year. The Research Service recommended conducting re-estimation even in November, when the National Assembly’s substantive budget review begins, to apply the changed revenue environment.

In particular, there was a recommendation to advance the evaluation and feedback system. After controversy over tax revenue discrepancies last year, the Ministry of Economy and Finance announced plans to introduce a performance evaluation system and systematize feedback measures as part of improvement plans. Currently, evaluation criteria focus on the overall size of tax revenue discrepancies, but the Research Service assessed that a system should be established to identify error causes by tax category and check progress.

Meanwhile, the Ministry of Economy and Finance is conducting a re-estimation regarding this year’s tax revenue shortfall. The results of the re-estimation are scheduled to be announced early next month. Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho said, “By around August, results for major tax categories such as corporate tax, comprehensive income tax, and value-added tax will be available,” adding, “If possible, the official (tax revenue) re-estimation results will be announced in August, or at the latest, early September.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)