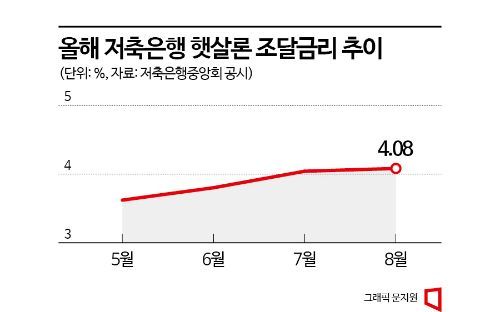

Savings bank 햇살론 funding interest rates have been rising for three consecutive months. Amid a sharp increase in demand with the supply scale of savings bank 햇살론 reaching an all-time high in the first half of this year, the principal and interest repayment burden on vulnerable borrowers is also growing.

0.46 Percentage Points Increase in 3 Months

According to the disclosure by the Korea Federation of Savings Banks on the 16th, the funding interest rate for 햇살론 handled this month was recorded at an annual rate of 4.08%. The 햇살론 funding interest rate, which peaked at 5.82% annually in January this year, steadily declined to 3.62% annually in May but has been rising again to 3.8% in June and 4.04% in July. It increased by 0.46 percentage points in three months.

햇살론 is a financial product for low-income borrowers, guaranteed by the Korea Inclusive Finance Agency, lending to borrowers with credit scores in the bottom 20%, with annual incomes of 45 million KRW or less, or 35 million KRW or less. Savings banks account for about 90% of the total financial sector's handling volume of 햇살론. The upper limit interest rate of 햇살론 is determined by adding a margin to the monthly fluctuating funding interest rate, and as of this month, an annual rate of 11.0% (for Worker 햇살론, 10.02% for self-employed) is applied.

"Impact of Time Deposit Interest Rate Increase"... Burden on Vulnerable Borrowers Rises

The reason why the savings bank 햇살론 funding interest rate is rising again is due to the increase in time deposit interest rates. The 햇살론 funding interest rate of savings banks is calculated based on the weighted average interest rate of new 1-year time deposits taken two months prior. This month reflects the rates from June, during which the savings bank time deposit interest rate, which hovered around 3% from March to May this year, rose to the 4% range. A representative from a major savings bank explained, "The increase in time deposit interest rates is being reflected in the 햇살론 funding interest rate," adding, "The upper limit interest rate, which was in the high 10% range last month, has been raised to 11% annually."

If the trend of rising 햇살론 funding interest rates continues, the repayment burden on vulnerable borrowers will inevitably increase. As high interest rates and economic recession persist, the number of low-credit and low-income vulnerable borrowers seeking 햇살론, which offers relatively low loan rates, is also significantly increasing. According to the Korea Federation of Savings Banks, the supply amount of savings bank 햇살론 in the first half of this year reached 2.0029 trillion KRW, marking a record high for a half-year period. On an annual basis, it has also been increasing: 2.468 trillion KRW in 2019 → 2.9173 trillion KRW in 2020 → 3.1554 trillion KRW in 2021 → 3.4742 trillion KRW in 2022.

The amount of subrogation payments made by the Korea Inclusive Finance Agency on behalf of 햇살론 borrowers who failed to repay their loans is also rapidly increasing. According to data submitted by the Korea Inclusive Finance Agency to the office of Representative Yoon Young-deok of the Democratic Party, the cumulative subrogation amount for major 햇살론 products (Worker 햇살론, 햇살론15, 햇살론 Youth, etc.) was 2.8175 trillion KRW as of the first quarter of this year. It has been on the rise: 1.3773 trillion KRW in 2020 → 1.9228 trillion KRW in 2021 → 2.6076 trillion KRW in 2022. With the interest rate increase, the scale of defaults is expected to grow, especially among vulnerable groups whose repayment ability is deteriorating.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.