K-OTC Market Cap Falls to 17 Trillion Won Range

Average Daily Trading Volume Drops Below 2 Billion Won

Causes Include Lack of Major IPOs and Concentrated Investment in Thematic Stocks

The domestic unlisted stock market is shrinking more and more. This year, both trading volume and trading value have fallen to their lowest levels. Although there is an abundance of funds in the domestic stock market, the extreme concentration phenomenon caused by the theme stock craze is interpreted as further neglect of unlisted stocks. The characteristic of the unlisted stock market, where individual investors trade heavily, has also acted as a 'poison.'

According to the Korea Financial Investment Association, since August, the trading volume and trading value of K-OTC (Korea Over-the-Counter Market), the institutional unlisted stock market, have plummeted to the lowest levels this year. K-OTC is the only institutional over-the-counter market in Korea, established and operated by the Korea Financial Investment Association. It was established under the "Capital Markets and Financial Investment Business Act." Companies must meet requirements such as capital and audit opinions, and unlisted corporations including SMEs use it as a market for entering the KOSPI and KOSDAQ markets.

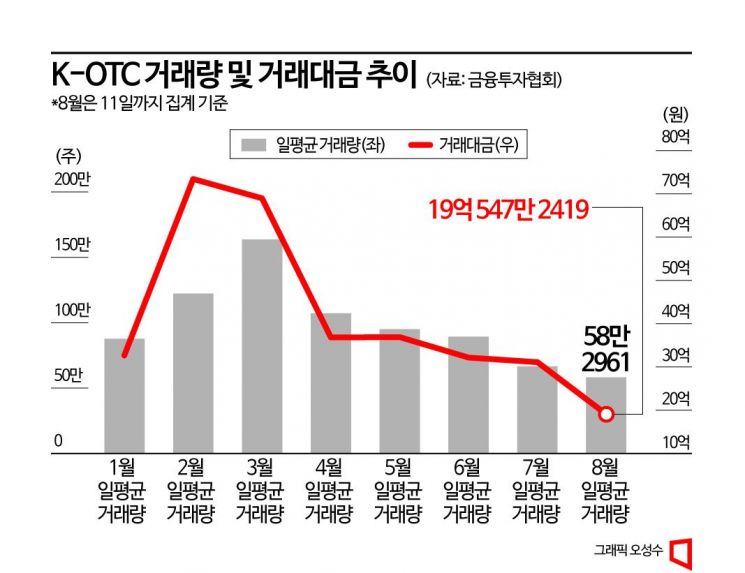

As of the latest available date, August 11, the trading volume was 461,318 shares, and the trading value was 1,685,918,305 KRW. The average daily trading volume in August was 582,961 shares, and the average daily trading value was 1,905,472,419 KRW.

In January this year, the average daily trading volume reached 877,902 shares. It steadily increased, reaching 1,071,979 shares in April. In May, it was 950,416 shares, and in June, 893,394 shares, which were relatively good, but it began to decline from July. Trading funds also experienced a rollercoaster ride. In February, the average daily trading value soared to 7.3 billion KRW and maintained around 3 billion KRW afterward. However, this month, it fell below 2 billion KRW. This is the first time in nine months since November last year (2.41555 billion KRW).

This is the exact opposite trend compared to the abundant investor deposits waiting in the domestic stock market and the soaring trading values in the KOSPI and KOSDAQ markets. In August, investor deposits in the domestic stock market reached 57 trillion KRW, consistently maintaining over 50 trillion KRW. Stock trading values also reached 30 trillion KRW on August 1 and have continuously exceeded 20 trillion KRW.

The dominant analysis is that the theme stock craze, such as in secondary batteries and superconductors, acts as a black hole for funds, causing unlisted stocks to be sidelined. Especially, the market capitalization of K-OTC is also on a downward trend. The market capitalization, which exceeded 46 trillion KRW at the beginning of last year, is currently only about 17 trillion KRW.

The Korea Capital Market Institute sees the limited investment effect of unlisted stocks as a factor for neglect. The uncertainty of IPO timing requires long-term waiting, which acts as a disadvantage. Recently, individual investors are chasing the high volatility of theme stocks that can yield large profits in a short period.

Additionally, although the IPO market is regaining momentum through the performance of small and medium-sized stocks, the absence of large-scale 'big fish' IPOs worth trillions of KRW is accelerating the stagnation of unlisted stocks. Researcher Park Jong-sun of Eugene Investment & Securities said, "There is great interest in the resumption of IPOs of large and mid-sized companies that institutional investors can invest in," but added, "However, for now, they are observing due to concerns about stock market instability and the need to secure ample funds."

An official from the financial investment industry said, "If a large-scale IPO worth trillions of KRW, which has been absent for a while, appears and attracts attention, the atmosphere of the K-OTC market will reverse," but added, "However, since the trend of seeking high returns in a short time is strong, it seems difficult to expect the market to recover as before, and we need to watch whether the theme stock concentration phenomenon will ease first."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)