Voluntary Delisting of Osstem Implant, Organized Trading Until the 11th

No Price Fluctuation Limits... Beware of Short-Term Profit 'Delisting Beam' Attempts

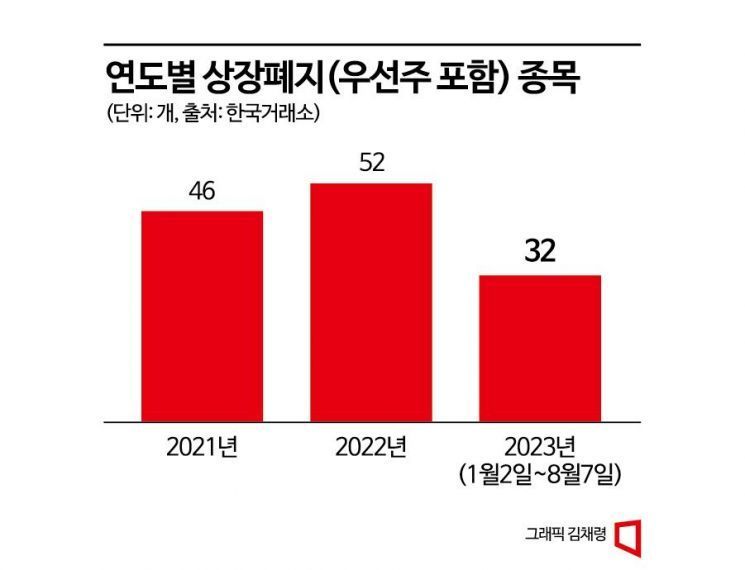

As of the 7th of this year, a total of 32 stocks, including preferred shares, have been delisted. Starting with KOSDAQ-listed MPC Plus, SPACs (Special Purpose Acquisition Companies) that failed to merge have disappeared one after another. Ostem Implant is a case of voluntary delisting.

The reasons for delisting these stocks vary, but they share a common feature: they undergo a liquidation trading period. During this period, speculative trading tends to run rampant, causing large price fluctuations. There are no upper or lower price limits, so many speculators aiming for arbitrage are present. Since these stocks have been decided for delisting, investors who jump in without understanding the situation are likely to incur losses, so caution is required.

According to the Korea Exchange, KOSDAQ-listed Ostem Implant will conduct liquidation trading until the 11th. Ostem Implant applied for voluntary delisting on June 28. At an extraordinary general meeting, a 10-to-1 reverse stock split was approved, reducing the number of shares to one-tenth. The company’s largest shareholder, Dentistry Investment, will purchase minority shareholders’ stocks on the market at 1.9 million KRW per share during the liquidation trading period (the same price as the pre-split tender offer price of 190,000 KRW). After delisting, they plan to buy shares off-market at 1.9 million KRW per share for six months.

From the first day of liquidation trading on the 3rd through the 7th, Ostem Implant’s stock price did not fluctuate significantly. The highest intraday price on the first day was 1,901,000 KRW, and the closing price was 1.9 million KRW. The closing price on the 7th was also 1.9 million KRW. Notably, Dentistry Investment directly purchased half of Ostem Implant’s circulating shares from the 3rd to the 8th. Last year, Mom’s Touch, which voluntarily delisted, also announced plans to tender shares at 62,000 KRW per share during the liquidation trading period and for six months after delisting. During liquidation trading, Mom’s Touch’s stock price ranged from a high of 62,100 KRW to a low of 61,500 KRW.

Generally, stocks undergoing liquidation trading experience large price fluctuations because there are no price limits. Also, unlike regular trading, orders are collected every 30 minutes and traded at a single price, so the stock price can be volatile due to phantom orders.

Companies that decide on voluntary delisting are somewhat different. Typically, their stock prices do not fluctuate much because public tender offers and investor protection measures accompany the voluntary delisting decision. For example, the purchase price is fixed through the tender offer, reducing volatility. Hwang Se-woon, a senior researcher at the Korea Capital Market Institute, explained, "Generally, liquidation trading indicates that the company’s value becomes uncertain, so volatility increases as investors sell or buy shares. In the case of Ostem Implant, the presence of a purchasing entity reduces volatility."

SPACs also tend to have small price fluctuations. For example, DB Financial SPAC No. 8, which was delisted this year, maintained its stock price around 2,050 KRW during liquidation trading. Similarly, Mirae Asset Daewoo SPAC No. 5, delisted last May, traded around 2,015 KRW. This is largely due to the nature of SPACs. SPACs raise funds from multiple investors through public offerings and list in advance. They then merge with unlisted companies to indirectly list those companies. Most of the funds raised during the public offering are placed in safe assets like bank deposits.

These deposits generate a certain amount of interest. If delisting occurs, investors can recover their investment proportionally through the liquidation process. Typically, liquidation after SPAC delisting takes about 3 to 4 months. After this period, investors can collect approximately two and a half years’ worth of bank interest. Although funds are locked up, the interest income over several years makes SPACs a stable investment option.

In contrast, preferred shares that were delisted in bulk this year showed large price fluctuations. Preferred shares such as Heungkuk Fire & Marine Insurance 2nd Preferred B, DB HiTek 1st Preferred, SK Networks Preferred, Samsung Heavy Industries Preferred, and Hyundai BNG Steel Preferred were delisted last month. Among these, Samsung Heavy Industries Preferred fell 73.53% compared to the previous trading day on the first day of liquidation trading but surged 196.55% the next day. SK Networks also rose 65.07% on the second day of liquidation trading, July 7, compared to the previous day, then dropped 38.62% the following day.

However, if investors time their purchases well, they can receive substantial dividends. These stocks were not delisted due to company problems but because the number of listed shares remained below 200,000 for two consecutive half-years. Even after delisting, shares can be traded on over-the-counter markets, so if investors tolerate the inconvenience, they can buy shares at low prices and aim for high dividend yields.

For example, DB HiTek 1st Preferred, delisted on the 14th of last month, closed at 17,500 KRW. Last year, DB HiTek allocated a dividend of 1,350 KRW per preferred share. If an investor buys DB HiTek 1st Preferred at the closing price on the 14th and the dividend remains the same this year, the dividend yield exceeds 7%. A company official from a firm whose preferred shares were delisted this year explained, "Since the shares themselves do not disappear, dividends are paid just like common shares."

However, investing simply to realize short-term gains during liquidation trading, so-called "delisting beam" (meaning the stock shines one last time before delisting), is risky and requires caution. Individual investors can suffer losses by being manipulated by groups seeking quick profits. These groups buy large volumes cheaply on the first day of liquidation trading, then drive up prices by selling at higher prices. When trading volume and prices explode, they offload their holdings. Those who receive these shares often find it difficult to sell them.

Eventually, trading volume decreases over time, and prices fall. Especially on the last day of liquidation trading, prices usually plummet, causing significant losses. For example, MPC Plus, delisted this year, rose 196.84% compared to the previous trading day on the first day of liquidation trading, reaching 2,440 KRW, but the closing price on the last day was 359 KRW. Stocks delisted due to continuous losses or reasons such as breach of trust or embezzlement often become worthless, as relisting is difficult. A financial investment industry official emphasized, "Generally, liquidation trading is like passing the hot potato. Prices can behave like a rollercoaster, and if investors enter at the wrong time, they can suffer large losses, so caution is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)