Food Ingredients Lead Growth in Q2 Catering Business

Increased Catering Demand to Reduce Food Expenses Amid High Inflation

As inflation drives up lunch expenses for office workers, the so-called 'lunchflation (lunch + inflation)' has intensified, boosting the catering businesses of major food ingredient companies such as CJ Freshway, Shinsegae Food, and Hyundai Green Food. With prices soaring, the demand for relatively affordable company cafeterias is expected to continue rising, leading to sustained growth in the performance of food ingredient companies focusing on catering businesses not only in the second quarter but also in the second half of the year.

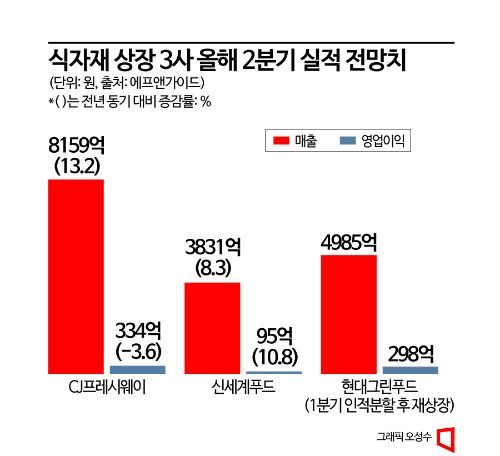

According to financial information firm FnGuide on the 4th, CJ Freshway's second-quarter sales are estimated to reach 815.9 billion KRW, a 13.2% increase compared to the same period last year. However, operating profit is expected to shrink by 3.6% to 33.4 billion KRW. During the same period, Shinsegae Food's sales are projected to increase by 8.3% to 383.1 billion KRW, with operating profit rising 10.8% to 9.5 billion KRW. Hyundai Green Food, newly established after a spin-off in March, is expected to report sales and operating profit of 498.5 billion KRW and 29.8 billion KRW, respectively.

Among the three listed companies, as well as top industry players like Samsung Welstory and Ourhome, the second-quarter results are all expected to be led by the catering business segment. The recent sharp rise in prices has intensified the lunchflation phenomenon, significantly increasing the cost of a single meal. However, from the perspective of catering providers, the growing demand for company cafeterias is actually beneficial. As dining-out prices continue to rise, office workers and university students have turned to group catering, where they can have a meal at an affordable price of around 5,000 to 7,000 KRW, increasing the demand for company cafeterias. This has led not only to more group catering contracts but also to increased meal counts at existing supply locations.

CJ Freshway is expected to see its catering business grow by more than 10% by securing contracts for large corporations and military group catering. On the other hand, while food ingredient distribution sales are expected to continue growing, profitability is likely to decline due to increased infrastructure investments and marketing expenses. However, since the decline in profitability in the second quarter stems from investments, the current expansion of infrastructure and increased digital transformation costs are seen as growing pains that will help secure competitiveness in the future. Nam Seong-hyun, a researcher at IBK Investment & Securities, said, "With the expansion of logistics center utilization rates, the burden of fixed costs is likely to ease, and entering the seasonal peak with increased group catering meal counts, profitability improvement is possible in the second half."

Shinsegae Food is expected to show balanced growth across catering, food ingredient, and dining-out businesses. Profitability is likely to improve as loss-making group catering locations decrease, while food ingredient orders are increasing, centered around Starbucks. Notably, the proportion of sales from E-Mart, which was 19.5% in the first quarter of last year, dropped to 17.3% in the first quarter of this year, indicating a steady decline in group company dependence, which is positive. In the dining-out business, 'No Brand Burger' continues to expand its franchise stores, supporting performance growth.

Lee Kyung-shin, a researcher at Hi Investment & Securities, observed, "No Brand Burger may face some impact from rising raw material costs, but it should be able to offset the burden through price pass-through." Hyundai Green Food, which achieved its highest quarterly performance in the first quarter, is expected to maintain momentum. With increased catering demand amid the economic downturn, it is navigating toward securing meal counts at the level of the boom year 2017, and the sales of its care food specialty brand 'Greeting' are growing through hospitals and senior channels, which is also positive.

Given the ongoing high inflation, the trend of external growth and performance leadership in the group catering sector is expected to continue into the second half of the year. Shim Eun-joo, a researcher at Hana Securities, analyzed, "The catering businesses of food ingredient companies are experiencing significant increases in meal counts due to the reflective benefits of recent lunchflation. Following last year, continuous price hikes have also been implemented, so performance improvement is expected to lead for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)