Last-Minute Negotiations Between Dairy Farmers and Milk Industry Over This Year's Crude Oil Prices

Deadline Until This Day... Possibility of Postponement Due to Differences in Positions

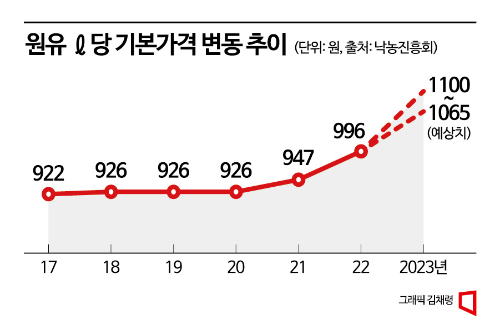

As negotiations between dairy farmers and dairy companies to set the raw milk price for this year reach their final stages, the related industry is closely monitoring the extent of the price increase. This discussion determines the price of raw milk squeezed from dairy cows, and this year it is expected to enter the 1,000 KRW per liter range for the first time. Until now, dairy companies have maintained that the ‘cost-linked system,’ which sets the price increase based on the changes in production costs of dairy farmers amid declining milk consumption, has put them at a disadvantage in price negotiations. Starting this year, a ‘differentiated pricing system by usage’ that considers both production costs and market conditions will be introduced to determine the rate of increase. However, with raw milk prices rising every year and pressure from the government and consumer groups to restrain price hikes on related products, the burden is expected to increase.

Minimum Increase of 69 KRW per Liter... "Lingering Effects of the Cost-Linked System Accumulate"

Price Rise Criticized Despite Consumption Decline

Change to Differentiated Pricing by Usage

According to the industry on the 19th, the Dairy Promotion Committee subcommittee, composed of dairy farmers and dairy industry representatives, is conducting raw milk price negotiations with today as the deadline. They determine the raw milk price annually through negotiations under the Dairy Promotion Act. Discussions have continued for over a month since the first meeting on the 9th of last month, but both sides have yet to narrow their differences over the rate of increase.

This year, the subcommittee plans to set the raw milk price increase within the range of 69 to 104 KRW per liter. Last year, the raw milk price was 996 KRW per liter. If negotiations conclude as expected, the raw milk price will rise to between 1,065 and 1,100 KRW per liter, surpassing 1,000 KRW for the first time. Until last year, the method of determining raw milk prices operated in a way that increased the burden on dairy companies. Based on the previous year’s ‘Livestock Production Cost Survey Results’ announced by Statistics Korea, the increase was set at 90-110% of the change in dairy farmers’ production costs. Accordingly, the raw milk price rose from 922 KRW per liter in 2017 to 926 KRW in 2018, then to 947 KRW in 2021, and 996 KRW this year.

On the other hand, dairy companies supplying products based on raw milk faced increased burdens as they had to absorb the price hikes amid declining milk consumption. According to the Dairy Promotion Committee’s distribution and consumption statistics, per capita domestic consumption of white milk decreased from 26.60 kg in 2017 to 26.20 kg last year. During the same period, consumption of processed milk excluding white milk also declined from 6.20 kg to 5.40 kg. As criticism grew that raw milk prices were continuously raised despite falling milk consumption, the negotiation method was changed to a differentiated pricing system by usage starting in September last year. This system considers not only dairy farmers’ production costs but also market conditions, with the rate of increase set within a 60-90% range. In this case, including the increase in production costs, the standard increase is 69 to 104 KRW per liter.

The Ministry of Agriculture, Food and Rural Affairs predicted that the change in the raw milk pricing system from this year would keep the price increase moderate, but even a minimum increase of 69 KRW per liter is higher than last year’s 49 KRW. A dairy company official noted, "Even though the pricing method has changed, the burden of rising raw milk prices every year due to the long-standing cost-linked system has accumulated."

When Raw Milk Price Exceeds 1,000 KRW per Liter, Consumer Price Expected to Surpass 3,000 KRW

Chain Price Increases for Bread, Coffee, Cheese Inevitable

Dairy Companies Struggle Amid Government and Consumer Group Pressure

If the raw milk price exceeds 1,000 KRW per liter, the consumer price of white milk from dairy companies is likely to enter the 3,000 KRW range. Last year, when the base raw milk price increased by 49 KRW per liter, each dairy company raised white milk product prices by around 10%. The price of 1-liter white milk from Seoul Milk Cooperative rose to the 2,800 KRW range at major supermarkets, and Maeil Dairies’ 900 ml white milk product price increased from 2,610 KRW to 2,860 KRW. Based on this, the price of 1-liter or 900 ml white milk products could rise from the high 2,000 KRW range last year to the 3,000 KRW range. Additionally, price increases for products using milk as a raw material, such as bread, coffee, and cheese, are inevitable, raising the possibility of ‘milkflation’ (milk + inflation).

Meanwhile, the government recently recommended price reductions mainly for products frequently consumed by consumers, such as ramen, snacks, and bread, and reportedly conveyed this stance to dairy companies including Seoul Milk, Namyang Dairy Products, and Maeil Dairies, requesting restraint on excessive price hikes. The Korea Consumer Organization recently issued a statement saying, "The three domestic dairy companies raised product prices by 10.2-16.3% from last year to the first quarter of this year, more than double the increase in raw milk prices," and pressured them by stating, "They should not seek company profits by using raw milk price hikes as an excuse." On the other hand, dairy companies argue that if they do not raise product prices despite rising raw milk prices, they will have to bear losses entirely.

Given the significant differences between the two sides, there is a possibility that this year’s raw milk price negotiations may not conclude as scheduled. A dairy company official said, "For now, we need to review the negotiation results on the rate of increase and then finalize our position," adding, "Since there was a precedent of exceeding the negotiation deadline last year, we cannot rule out the possibility of delays this year as well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)