High Proportion of Other Shareholders in Celltrion and Celltrion Healthcare Causes Concern

If Stock Purchase Request Price Is High, Financial Structure May Suffer...If Low, Minority Shareholders Face Litigation Risk

Merger Benefits May Not Be Significant for Major Shareholders Including Chairman Seo Jung-jin

As Celltrion, Celltrion Healthcare, and Celltrion Pharm?the three Celltrion companies?are actively pursuing a merger, opinions vary regarding the specific merger targets, timing, methods, and forms. Above all, the scale of the stock purchase rights may vary depending on the merger targets, ratios, and timing. With significant uncertainty and stock prices rising first, if the scale of stock purchase rights exceeds the range anticipated by Celltrion’s management, there is a possibility that the merger could be canceled.

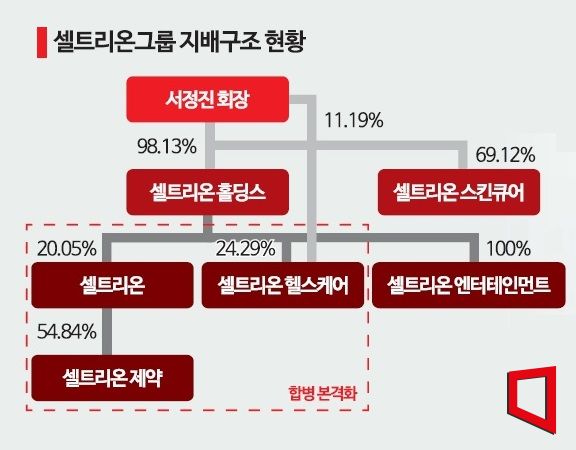

Market experts expect that if Celltrion succeeds in the merger, controversies over internal transactions and accounting irregularities caused by the unique division of labor structure will be resolved. The Celltrion Group has a division of labor structure where Celltrion develops and manufactures biopharmaceuticals, Celltrion Healthcare handles overseas distribution, and Celltrion Pharm manages domestic distribution. Considering this division of labor and shareholding distribution, the merger of the three companies is likely to proceed first with Celltrion absorbing its subsidiary Celltrion Pharm, followed by a merger between Celltrion and Celltrion Healthcare.

According to the Financial Supervisory Service’s electronic disclosure system, Celltrion has selected a lead merger advisor and is reviewing the merger between the business companies. Celltrion Healthcare and Celltrion Pharm also stated in their disclosure responses that "currently, a review of the merger between business companies is underway." However, they added that no specific details regarding the merger targets, timing, methods, or forms have been finalized.

As listed companies, Celltrion, Celltrion Healthcare, and Celltrion Pharm must have their merger proposals approved at shareholders’ meetings to proceed with the merger. Each company requires approval from at least one-third of the total issued shares and two-thirds of the voting rights of attending shareholders at their respective shareholders’ meetings.

Before holding the shareholders’ meetings, processes such as drafting the merger agreement and board resolutions take place. The merger ratio is calculated by weighted averaging the stock prices one day, one week, and one month before the board’s merger resolution. The stock purchase right prices for each company are determined based on the arithmetic average of the two-month weighted average closing price, one-month weighted average closing price, and one-week weighted average closing price.

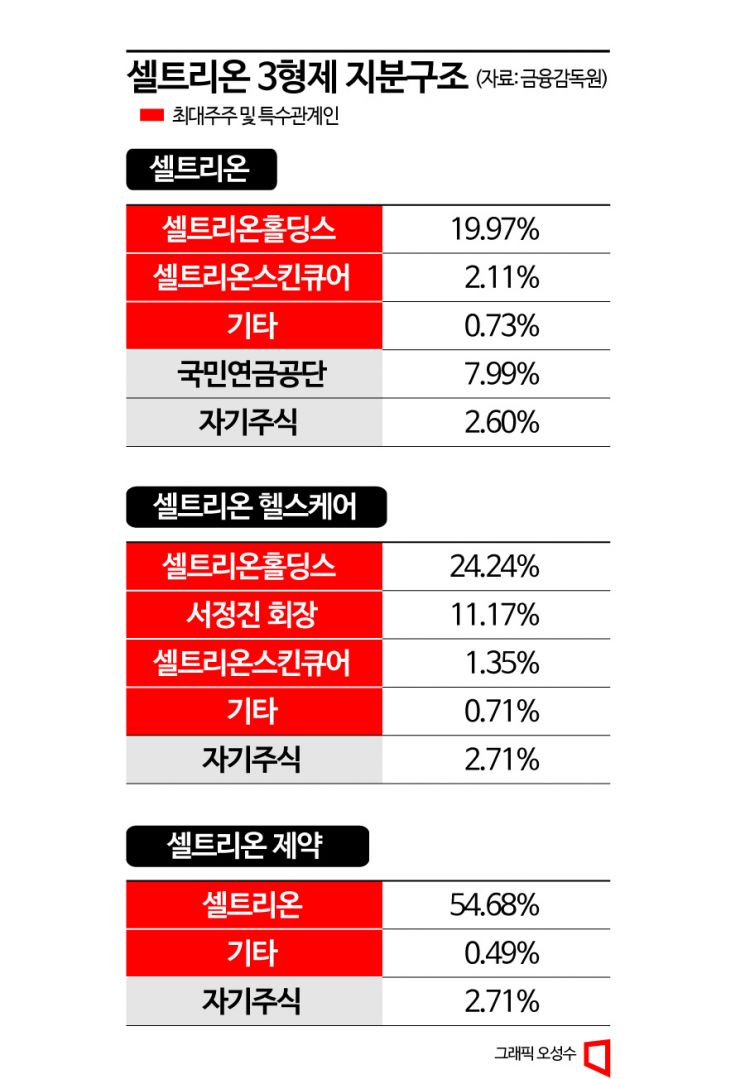

Jaekyung Park, a researcher at Hana Securities, explained, "The amount of stock purchase rights and the corresponding fund procurement are key to the merger’s success," adding, "The proportion of minority shareholders in Celltrion and Celltrion Healthcare is relatively high, which could make stock purchase rights a burden."

Celltrion and Celltrion Healthcare are expected to respond to stock purchase requests from dissenting shareholders using cash assets and treasury stocks they hold. Celltrion’s management inevitably has to consider ways to minimize the scale of stock purchase rights. An industry insider said, "Celltrion’s management will create justifications for the merger and future visions to gain shareholder approval," but added, "The burden has increased as stock prices have risen on merger expectations."

Over the past three days, the stock prices of Celltrion and Celltrion Healthcare have risen by 7.9% and 12.7%, respectively. If the merger is decided while stock prices are high, the stock purchase right prices are likely to increase as well.

There have been cases in the past where mergers were postponed or canceled when stock purchase rights exceeded a certain scale. This is because excessive cash outflows can destabilize the merged company’s financial structure. Celltrion Group Chairman Seo Jung-jin also stated at a management comeback press conference in March, "If we cannot accept stock purchase rights, the merger will be canceled."

In 2019, the bio company Genexine attempted to merge with ToolGen, but the merger was canceled as the stock purchase right exercise amount exceeded a certain scale. At the time of the merger push, Genexine and ToolGen planned to buy back stocks worth approximately 130 billion KRW and 50 billion KRW, respectively. However, the combined stock purchase right amount for both companies was estimated to exceed 450 billion KRW.

Samsung Group attempted to merge Samsung Heavy Industries and Samsung Engineering in 2014, but the merger contract was terminated as the stock purchase right exercise scale exceeded the limit. At that time, shareholders opposing the merger demanded stock repurchases amounting to 923.5 billion KRW for Samsung Heavy Industries and 706.3 billion KRW for Samsung Engineering. Samsung Group prepared to buy back stocks worth 1.36 trillion KRW, but demands for stock purchase rights totaling 1.6298 trillion KRW continued.

Under the Commercial Act, the stock purchase price for dissenting shareholders in a merger is determined through negotiation between shareholders and the company. Shareholders opposing the company’s proposed price can protect their rights through merger invalidation lawsuits and claims for stock purchase price determination.

Recently, there has been an increase in minority shareholders filing lawsuits to raise stock purchase prices. Some minority shareholders filed lawsuits claiming that the stock purchase price for Dongwon Industries, which completed its merger registration with Dongwon Enterprises last year, was too low. The court judged that the market price just before the merger announcement sufficiently reflected Dongwon Industries’ market value before the merger. The minority shareholders who filed the lawsuit sold their shares at 253,034 KRW, higher than the 238,186 KRW paid by Dongwon Industries.

For the merger of the three Celltrion companies to succeed, the will of Chairman Seo Jung-jin and Celltrion Group’s management is crucial. It is necessary to persuade shareholders based on plans to secure funds to respond to stock purchase rights and to continue growth after the merger. However, it should also be considered that the practical benefits gained by Chairman Seo from pushing the merger aggressively may not be significant.

The financial investment industry expects that if Celltrion merges with Celltrion Healthcare, the controversy over internal transactions will be resolved. Researcher Juyoung Jung of Shin Young Securities explained, "The somewhat complex governance structure, internal transactions, and related accounting among the three companies can act as governance weaknesses," adding, "This could negatively affect overseas operations." He further noted, "Enhancing transparency through the merger will be a plus when entering the U.S. market, which values ESG (Environmental, Social, and Governance)."

However, some opinions suggest that using cash assets for merger costs to resolve internal transaction controversies is not necessarily better than investing those funds in mergers and acquisitions (M&A) of other corporations. Competition in the biosimilar market has intensified, making it difficult to secure high profitability. There is a strong call for investment to secure new pipelines in addition to in-house development.

While Chairman Seo’s control could be strengthened depending on the merger ratio, the effect is expected to be limited based on the current market capitalization of the three companies. Although the value of Chairman Seo’s holdings has increased due to rising stock prices on merger expectations, it is difficult to be optimistic about stock price trends after the merger. After the merger event concludes, investors are likely to focus on the intrinsic value of the company, such as approvals and sales of biosimilars under development. Researcher Weijoo Hae of Korea Investment & Securities analyzed, "New product development is proceeding as planned," and noted, "In the second quarter, applications for product approval for three biosimilars were submitted." He expects product approvals to be possible by the first half of next year.

Although a lead advisor has been selected for the merger, uncertainties remain high. Chairman Seo added a caveat at the January 2020 JP Morgan Healthcare Conference (JPMHC), stating, "If shareholders want it." If there are many opposing opinions and the scale of stock purchase rights grows, the merger could be delayed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)