Asahi Officially Launches Draft Beer Cans... Leading Role in Recovering Korean Market

Strengthens Marketing with TV Ads and Pop-ups Resuming After 4 Years

Recovery Seen, but Beer Market Slump Makes Returning to Previous Levels Difficult

Japanese beer companies are putting all their efforts into marketing through TV commercials and pop-up stores (temporary shops) to re-enter the Korean market. As consumption of Japanese products is rapidly recovering, they seem to have judged that this summer peak season is the right time to drive market recovery.

According to the liquor industry on the 15th, Lotte Asahi Liquor officially launched the ‘Asahi Super Dry Draft Beer Can’ in Korea on the 11th. Along with the new product launch, they resumed TV advertising for the first time in about four years since the ‘No Japan’ (boycott of Japanese products) movement intensified in 2019, and are also operating a pop-up store at Hyundai Department Store in Sinchon, Seodaemun-gu, Seoul, for the first time in four years until the 17th.

The Asahi Super Dry Draft Beer Can, first launched by Japan’s Asahi Beer in April 2021, is characterized by soft foam naturally rising when the can is opened. Thanks to its unique product form, it received great response locally and became a must-buy item for travelers visiting Japan. In Korea, a limited sale of some imported Japanese products in May caused a sold-out frenzy after gaining attention on social media (SNS).

Japanese beer companies see this summer’s beer peak season as the optimal timing to make up for the lost four years and return their business in the Korean market to a normal track. Considering that the boycott of Japanese products has practically subsided and interest in various alcoholic beverages has increased recently, they believe that strengthening marketing focused on fun and rarity will be successful.

Yoon Seon-yong, Secretary General of the Korea Liquor Importers Association, analyzed, “Korea is a very important export market for Japanese beer companies, to the extent that they once considered domestic production here. Recently, the boycott has eased, and especially the Asahi draft beer can has gained tremendous popularity in Japan and is a competitively rare product in Korea, so they may have judged that strengthening marketing centered on this product could yield some results.”

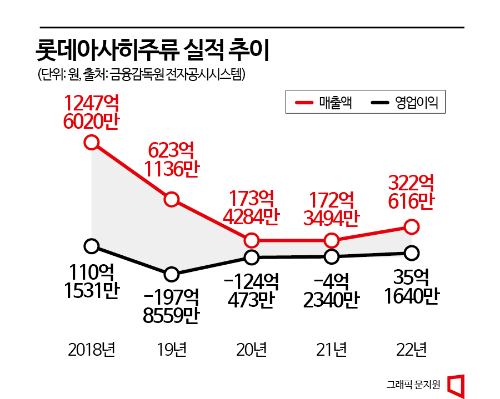

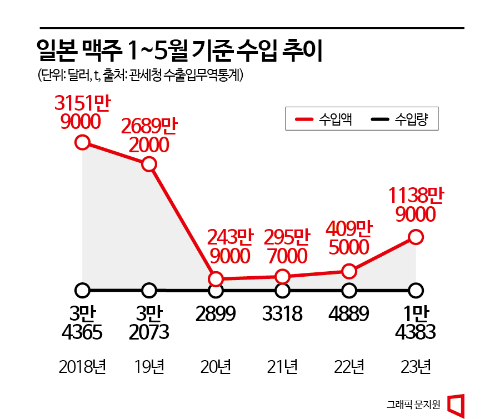

In fact, Japanese beer companies have shown signs of recovery since last year. Lotte Asahi Liquor’s sales last year were 32.206 billion KRW, an 86.9% increase compared to the previous year (17.23494 billion KRW), and operating profit turned positive after four years at about 3.5 billion KRW. This year, the situation is improving further. According to the Korea Customs Service, as of May this year, imports of Japanese beer amounted to 11.389 million USD (about 14.5 billion KRW), a 178.1% increase compared to the same period last year (4.095 million USD). Imports, which dropped to one-tenth the year after the boycott movement intensified in 2019 (26.892 million USD), have recovered to about half. Actual sales recovery is also clear. According to convenience store GS25, as of June this year, sales growth of Japanese beer compared to the same period last year reached 304.3%.

With related indicators rapidly improving, besides Asahi Beer, Sapporo opened a pop-up store near Hongdae Entrance in Seoul on the 24th of last month, and Suntory started operating a pop-up store near Samgakji, Yongsan, Seoul from the 7th of this month, accelerating their re-entry into the Korean market. Lotte Asahi Liquor also expanded the sales channels of the Super Dry Draft Beer Can, which had been limited to convenience stores and large supermarkets, to restaurants, hotels, and golf courses since May.

However, despite the recent recovery, it is expected to be difficult for Japanese beer to regain the glory of its past heyday. This is because the imported beer market is generally shrinking due to the rise of competing alcoholic beverages such as wine and whiskey. Last year, the import value of imported beer in Korea was 195.1 million USD (about 248.3 billion KRW), down 37.0% compared to 2018, when beer imports peaked at 309.68 million USD (about 394.1 billion KRW).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)