ARM, a UK semiconductor design (fabless) company and a subsidiary of Japan's SoftBank, has begun negotiations to attract Nvidia as an anchor investor ahead of its initial public offering (IPO) scheduled for September.

On the 11th (local time), major foreign media outlets reported, citing multiple sources, that ARM is in discussions to secure American semiconductor company Nvidia and others as anchor investors (investors who purchase large stakes to drive IPO success).

Foreign media evaluated that SoftBank is actively seeking Nvidia's investment participation to promote artificial intelligence (AI) as a key factor for ARM's IPO success. Nvidia, listed on the US Nasdaq market, has seen its stock price surge over 190% this year alone thanks to the AI boom, becoming the first semiconductor company to surpass a market capitalization of $1 trillion.

An insider familiar with the discussions said, "With Nvidia's investment participation alone, ARM can be grouped as an AI-related stock." Nvidia recently unveiled the next-generation AI superchip 'Grace Hopper,' based on ARM's design.

However, sources pointed out that the talks could ultimately fail due to a significant gap in valuation expectations between the two parties. Nvidia values ARM at around $35 billion to $40 billion, while ARM is aiming for $80 billion, roughly twice that amount.

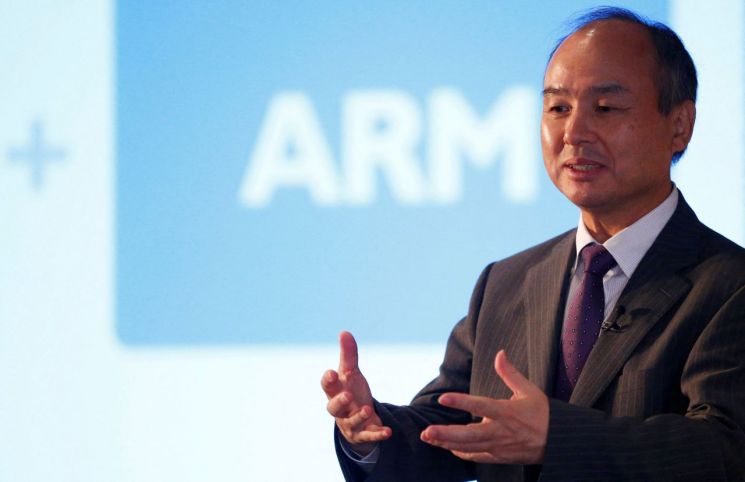

It is known that SoftBank Chairman Masayoshi Son is personally involved in securing Nvidia as ARM's anchor investor. Ahead of ARM's listing, Chairman Son has focused on expanding sales to increase the company's valuation.

The timing of ARM's Nasdaq listing, initially targeted for within the year, has been narrowed down to September. Earlier, in April, Chairman Son officially agreed with the US Nasdaq Stock Market on ARM's Nasdaq listing.

ARM originally planned a dual listing on both the US and UK stock exchanges but shifted to a US-only listing, judging that the US market has a stronger investor base and is more favorable for higher company valuation.

If ARM succeeds in listing on the US Nasdaq, it is expected to be the largest IPO since the US electric vehicle company Rivian, which went public at the end of 2021 with a market capitalization of $70 billion.

SoftBank initially attempted to sell ARM to Nvidia for up to $40 billion in 2020, but the deal fell through due to opposition from regulatory authorities in various countries. Instead of selling, SoftBank shifted its strategy to recover funds through a US stock market listing.

Headquartered in Cambridge, UK, ARM holds core technologies in semiconductor design that serve as the 'brain' of IT devices such as PC central processing units (CPUs) and smartphone application processors (APs). SoftBank acquired ARM in 2016 for $32 billion.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)