Government to Inspect 'Interest Cartel' Ahead of Onple Act

Platform Companies "Busy Moving Forward... Already Worried About National Assembly Audit"

Naver and Kakao have lowered their profiles significantly. This comes as the government warns it will inspect the 'interest cartel' ahead of the announcement of the Online Platform Regulation Act (Onple Act). Under all-around regulatory pressure, there is a mood of either discontinuing services under testing or postponing their launch. Although there is an urgent need to block foreign platform offensives and boost stock prices, they are unable to speed up.

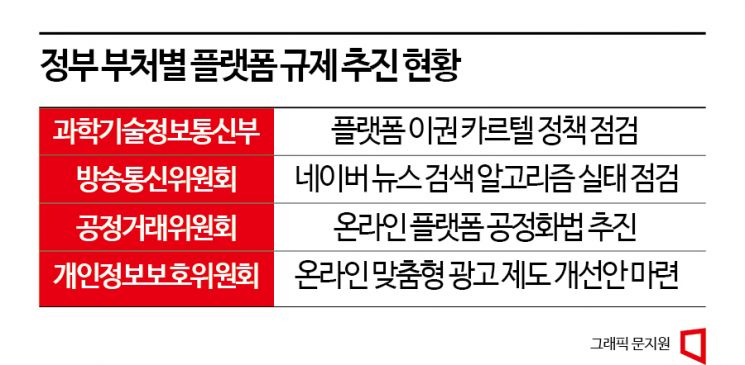

Recent regulatory moves targeting platform companies are numerous. The Ministry of Science and ICT has launched an emergency inspection regarding major platforms such as Naver and Kakao to check for any policies that could be seen as cartel-like. This follows an order from the Presidential Office to identify interest cartel policies in various sectors. The Fair Trade Commission is expected to announce the direction of platform regulations, including the Onple Act, within this month. A plan to designate regulated companies centered on major platforms and impose obligations is being strongly discussed. There is also a possibility of stringent regulations similar to the European Union’s Digital Markets Act (DMA), which imposes fines of up to 10% of revenue for illegal acts such as preferential treatment of own services. Additionally, the Korea Communications Commission has launched an investigation into suspicions of interference in Naver’s news search algorithm.

Platform companies appear to be shrinking back. They are withdrawing services or delaying their launch. Naver has decided to discontinue the 'Trend Topic' service, which had been under testing since September last year. Trend Topic is a service where generative artificial intelligence (AI) extracts keywords from content that users have recently viewed a lot and displays them. The service, which took nearly a year of testing, is being discontinued amid criticism from the political sphere calling for the revival of real-time search rankings. Most new service launches, including the introduction of HomePD and mobile app revamps, have been postponed to the fourth quarter. Only the release of ultra-large AI models such as Naver’s 'HyperCLOVA X' and Kakao’s 'KoGPT 2.0', where competition for dominance is fierce, is scheduled for the third quarter, with no other concrete schedules set. An industry insider said, "It already feels like a prelude to the national audit, so the atmosphere is to postpone (services) until after that," adding, "Big tech companies like Google are gradually encroaching on the domestic market, but movements are limited under the regulatory ceiling."

Meanwhile, foreign platforms are expanding their presence. Google has extended its reach from search, video, and music services to shopping and gaming. YouTube recently opened a separate shopping channel in Korea and introduced a product sales function through live broadcasts. It is also reportedly conducting internal tests to launch gaming services. There is a strong sense of crisis as the domestic platforms have already lost ground in music and search sectors. In the search market, Naver and Daum (Kakao) currently hold market shares of 56.6% and 4.4%, respectively. Naver’s share has been steadily declining from 63.8% at the end of last year, while Daum’s remains stagnant. In contrast, Google’s share has risen from 26.3% to 33.9%, narrowing the gap with Naver. For YouTube, the monthly active users (MAU) have nearly caught up with KakaoTalk, which ranks first. The MAU gap between the two platforms narrowed from 2.98 million in 2020 to 500,000 in May this year. YouTube Music users have already surpassed the domestic platform Melon.

Stock price trends are also diverging. As of the 6th, Naver and Kakao closed at 195,500 won and 50,900 won, respectively. Their market capitalization has fallen out of the top 10, dropping about 30-40% from their peak prices. This contrasts with the rise of U.S. tech stocks fueled by the AI boom. There is criticism that their image as 'growth stocks' is fading as they fall behind in the fiercely competitive technology market, including AI.

Professor Hong Dae-sik of Sogang University Law School pointed out, "Platform operators should play a role in demonstrating creativity and discovering new businesses, but if sanctions are imposed in line with government regulatory trends, it is questionable whether innovative businesses can emerge." Professor Seo Jong-hee of Yonsei University Law School also expressed concern, saying, "Considering the domestic environment where overseas platform use cannot be blocked, regulations result in harsh consequences only for domestic operators," adding, "This could lead to problems that cause consumer harm."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)