Bitcoin Price Fluctuates Following BlackRock's Bitcoin ETF Listing Application

Minimal Impact on Related Companies' Stock Prices as Cryptocurrency Prices Do Not Rise Overall

The world's largest asset management firm, BlackRock, has reapplied for the listing of a Bitcoin exchange-traded fund (ETF), amid which Bitcoin prices are showing strength. However, cryptocurrency-related stocks have not gained momentum.

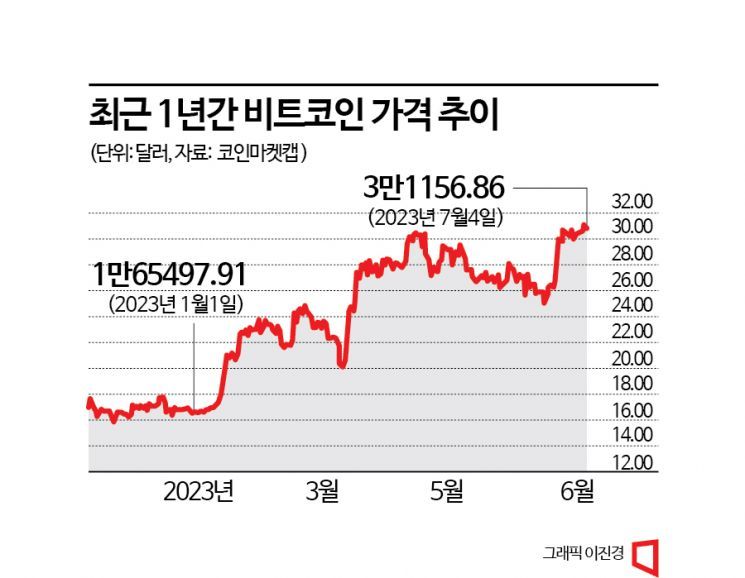

According to Coinbase Global as of 2 p.m. local time on the 4th, the price of Bitcoin was $30,846.45, down 0.74% compared to 24 hours earlier, but up 1.27% compared to seven days ago. On the previous day, the 3rd, Bitcoin surpassed $31,000 intraday, marking its highest price in a year. Bitcoin prices have risen more than 80% since the beginning of this year.

BlackRock's Bitcoin ETF listing application is considered one of the reasons behind the surge in Bitcoin prices. Last month, BlackRock applied to the U.S. Securities and Exchange Commission (SEC) for the listing of a Bitcoin spot ETF but was notified of rejection due to insufficient information. Then, on the 3rd, it submitted reapplication documents. Following BlackRock's entry into the cryptocurrency market, several companies including Fidelity have applied for similar products, continuing the asset management industry's push into cryptocurrency ETFs.

However, cryptocurrency-related stocks are showing mixed trends. Despite BlackRock's Bitcoin ETF announcement, domestic cryptocurrency-related stocks have shown little movement. Overseas cryptocurrency-related stocks have only seen some individual stocks stir. Domestic cryptocurrency-related stocks include Kolon Industries (0.97% as of closing price on the 5th), Wooree Technology Investment (-3.16%), Atinum Investment (-0.60%), and Hanwha Investment & Securities (-1.48%). Most recorded slight declines.

Among overseas related stocks, Coinbase Global rose as much as 12% intraday on the 3rd. It has increased about 22% over the past week. Other overseas cryptocurrency-related stocks that have risen in the past week include Hive Blockchain Technologies (20%) and Marathon Digital Holdings (14%). However, all these companies are considered Bitcoin mining firms. In contrast, companies holding digital assets such as Tesla and Block have not been significantly affected.

The mixed trends among related stocks despite BlackRock's Bitcoin ETF reapplication are attributed to the nature of the ETF product. For Bitcoin-related stocks to rise, Bitcoin demand must increase, leading to a rise in Bitcoin prices. However, ETFs are fund products that track Bitcoin prices and do not have a direct relationship with Bitcoin demand. Especially for Bitcoin, which investors can buy and sell as much as they want, there is little necessity to create an ETF, which is also seen as a limitation.

Nevertheless, BlackRock's Bitcoin ETF listing is attracting attention in the cryptocurrency market due to its 'symbolism.' Asset management firms entering the cryptocurrency ETF market, including BlackRock, signify the creation of a new market where they can earn management fees. For investors and companies holding cryptocurrencies, the impact is minimal since the cryptocurrency prices themselves do not rise.

Professor Hong Ki-hoon of Hongik University's Department of Business Administration said, "The Bitcoin spot ETF itself carries symbolism, so the expectation causes cryptocurrency prices to rise," adding, "The ironic point is that for Bitcoin prices to rise, there must be increased demand flowing into Bitcoin, but Bitcoin ETFs are merely fund products that track Bitcoin prices, so if Bitcoin ETFs are actually launched, Bitcoin prices are likely to fall."

Researcher Hong Sung-hoon of NH Investment & Securities also explained, "With continued expectations regarding BlackRock's Bitcoin spot ETF, Bitcoin prices are supported around the $30,000 level," but "altcoin prices are falling."

Although Bitcoin prices are rising on expectations, cautious forecasts are also being raised. It is uncertain how long it will take for approval of the Bitcoin spot ETF launch, and depending on the approval decision, short-term volatility in Bitcoin prices could increase. Recently, the Wall Street Journal (WSJ) reported that the SEC has expressed the view that Bitcoin spot ETF listing applications are inappropriate.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)