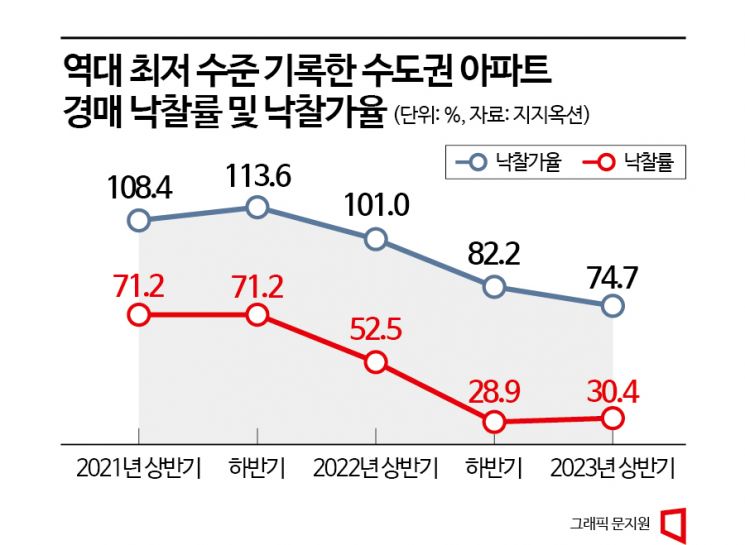

The winning bid rate and winning bid price ratio for apartment court auctions in the Seoul metropolitan area in the first half of this year reached historically low levels. This is interpreted as a result of ongoing negative outlooks on the real estate market since the second half of last year, coupled with increased burden on buyers due to appraisal prices. There are also forecasts that the auction market in the metropolitan area, excluding the Gangnam area, will continue to stagnate in the second half of the year.

Exterior view of the signboard in front of the Incheon District Court bidding courtroom

Exterior view of the signboard in front of the Incheon District Court bidding courtroom [Photo by Yonhap News]

"Only 3 out of 10 units sold"... Accumulating apartment auction listings in the Seoul metropolitan area

According to court auction specialist company Gigi Auction on the 29th, the winning bid rate for apartments auctioned in the Seoul metropolitan area in the first half of this year was tentatively calculated at 30.4% as of the 26th. This is the second-lowest figure since the company began analyzing related statistics in 2001. The winning bid rate refers to the proportion of auctioned properties that were successfully sold, so a rate of 30.4% means that only 3 out of 10 auctioned units found new owners. On a half-year basis, the winning bid rate was lowest in the second half of last year at 28.9%.

The auction market is most frozen in Incheon within the metropolitan area. The average winning bid price ratio was 25.8%, down 1.7 percentage points from 27.5% in the second half of last year. Compared to the real estate boom period in the second half of 2021 (73.7%), this is only about one-third. In particular, in April, the winning bid rate hit a record low of 20.4%, meaning only 2 out of 10 units were sold.

Seoul and Gyeonggi-do, also in the metropolitan area, recorded average winning bid rates of 30.7% and 34.9%, respectively, showing signs of stagnation. Seoul's winning bid rate fell to a record low of 14.2% in November last year but rebounded to 44.0% in January. It maintained the 30% range until March but eventually dropped to the 10-20% range as buyers withdrew. In Gyeonggi-do, the winning bid rate rose to 77.9% in September 2021, indicating that almost all auctioned properties were sold due to high demand, but it fell to 25% in December last year, marking a record low, and has since stayed in the 20-30% range.

Winning bid price ratio also lowest in 10 years... 'Last place' is Incheon

The winning bid price ratio for apartment auctions is also declining. The winning bid price ratio for apartments in the Seoul metropolitan area in the first half of this year was tentatively calculated at 74.7% as of the 26th. This is the lowest figure in 10 years since the second half of 2012 (74.0%). The winning bid price ratio is the ratio of the winning bid price to the appraisal price, meaning an apartment appraised at 1 billion KRW was sold for 747 million KRW.

Incheon also showed the weakest performance in the winning bid price ratio. The average winning bid price ratio was 70.8%, down 6.4 percentage points from 77.2% in the second half of last year. Incheon’s apartment winning bid price ratio soared to 117.3% in the second half of 2021, setting a nationwide record high. Until the first half of last year, it was sold above appraisal price at 103.0%, but then plummeted to the 70% range.

Seoul recorded the highest winning bid price ratio in the metropolitan area at 79.4% in the first half of this year, down 8.7 percentage points from 88.1% in the second half of last year. Gyeonggi-do was recorded at 74.0%, down 7.4 percentage points from 81.4% in the second half of last year.

Red light for auctions amid stagnant sales market... Only 'half-price apartments' auctioned after more than two failed bids are sold

The sluggish apartment auction market in the first half of this year is interpreted as a consequence of the stagnant sales market. Due to consecutive base interest rate hikes last year and other factors, the entire real estate market has stagnated with growing downward forecasts, causing investment demand that had been turning to auctions to become cautious.

There is also a perception that appraisal prices are set higher than buyers expect, which is behind the increase in failed auctions. Appraisals for apartments auctioned are usually conducted 6 months to 1.5 years before the auction starts. Most of the properties currently being auctioned were appraised during 2021 and 2022, when concerns about peak housing prices were raised. However, as housing prices have continued to decline recently, the appraisal prices set at that time are now considered high.

In fact, properties that failed auctions more than twice were relatively popular because their prices were significantly reduced through repeated failures. The winning bid rate for Seoul apartments surged to 44.0% in January as buyers flocked to failed auction properties. When no one bids on an auctioned property and it fails, the minimum price is lowered by 20-30% for the next auction.

The market expects the number of apartment auction listings to gradually increase until the end of the year. As the winning bid rate falls, failed auction properties accumulate, and cases of unsold properties from the sales market entering auctions increase. The number of apartment auctions conducted in the metropolitan area in the first half of this year was 3,728, approaching last year's total of 4,212.

Senior researcher Joo Hyun Lee of Gigi Auction said, "Because the market is not circulating, auction listings are increasing. Except for the Gangnam area, where buying demand has recently revived, other regions are expected to continue similar trends in the second half of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.