Earlier this year, the real estate market, which had shown a slight recovery, has returned to a stagnant state. According to the Korea Housing Industry Institute, the nationwide Housing Business Sentiment Index for June fell by 3.9 points compared to the previous month. The nationwide Housing Business Sentiment Index had been on the rise since January this year and reached its highest level since April last year last month, but it has now entered a downward trend again.

This unstable trend in the real estate market is also bringing changes to real estate investment. Traditional real estate investment involved purchasing properties through loans and earning profits from capital gains. However, as risk factors such as rising loan interest rates and falling house prices increase, stable fractional investment, which allows investment with a reasonable budget, is gaining attention as a new alternative.

The government announced a full allowance policy for STO (Security Token Offering) in February. The STO market is expected to rapidly grow to a scale of 34 trillion won next year. Considering that financial authorities have only recently permitted STO, interest in the real estate fractional investment market is expected to increase further in the future.

Sejong Telecom (CEO Kim Hyung-jin, Lee Byung-guk) conducted a survey in April this year with Macromill Embrain, a market research specialist company, reflecting this trend.

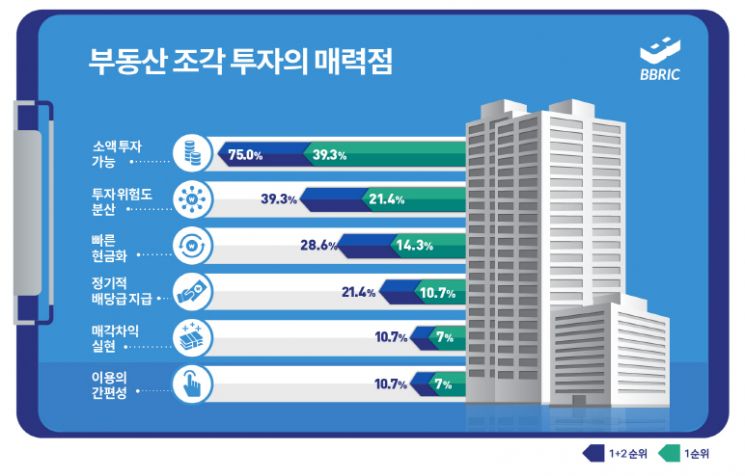

According to the survey of 300 adult men and women who have invested in real estate within the last three years, four out of five respondents said they continue to invest in real estate even during the market downturn and expressed interest in fractional real estate investment. They cited advantages of fractional investment such as the ability to invest small amounts (75%), risk distribution (39.3%), and quick liquidity (28.6%).

The reasons for preferring real estate investment, including fractional investment, were value appreciation (81.3%), safe investment target (58.3%), and securing regular income (53%). The actual investment properties were mostly apartments (85.7%) that could yield capital gains, and apartments (85.0%) were also the preferred investment type. Additionally, investment experience and preference for commercial buildings and officetels, which provide regular income such as rent, were also high. When investing, respondents said they consider the location of the building (83.3%) and growth potential (69.3%).

Furthermore, the average age of investors owning three or more real estate properties was 49.1 years, and the age group most actively investing in real estate averaged 42 years old. They reported that information obtained online is usually verified offline, and they gather information through membership cafes (72%) and model house visits (50.3%) during weekday breaks (24%), weekend leisure time (23%), and commuting time (20%).

Park Hyo-jin, Vice President of Sejong Telecom’s Blockchain Business Division, said, "Vbrick carefully selects commercial real estate assets with high investment value from asset management companies and treats them as public offering fund products. All records, including subscriptions and peer-to-peer transactions, are transparently recorded on the blockchain and strictly managed. Although we faced some difficulties selecting additional properties due to the real estate market downturn after launching our first property last year, we plan to introduce more properties in line with the rising interest in real estate investment. We ask those considering real estate investment to pay attention and watch closely."

Meanwhile, Vbrick is a blockchain regulatory sandbox project supported by the Ministry of SMEs and Startups and promoted by Busan City. It allows anyone to invest small amounts in high-priced commercial real estate by dividing them into profit securities that can be bought and sold. As the first STO-type service attempted in Korea, it guarantees both investment reliability and transparency by simultaneously recording related details on the blockchain distributed ledger and the Korea Securities Depository.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.