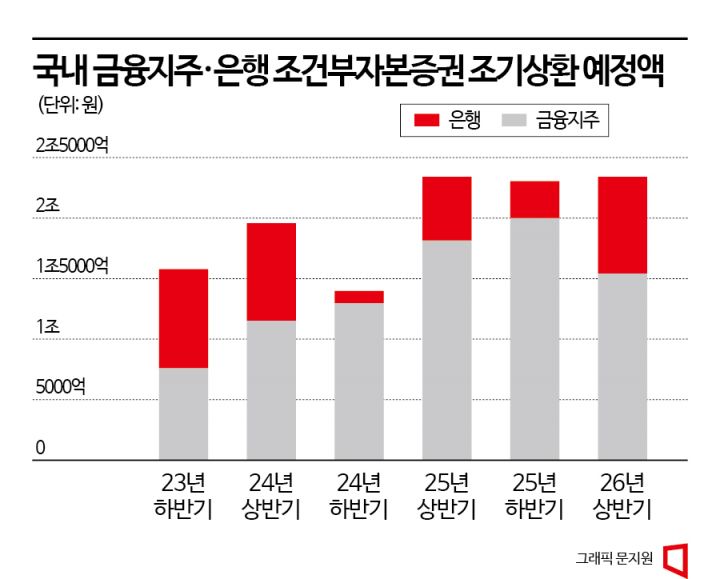

1.5 Trillion Early Repayment in Second Half... Coco Bond Issuance Expected at 2 Trillion

Rapid Increase in Risk Assets Calls for Proactive Capital Expansion

Coco Bond Interest Rates High at 5-6%, Attracting Investors

Financial holding companies and banks are consecutively issuing contingent convertible bonds (CoCo bonds). This is interpreted as a move to proactively secure capital buffers in preparation for the early redemption dates of CoCo bonds issued five years ago and to brace for economic downturns. The issuance amount of CoCo bonds by financial companies in the second half of this year is expected to exceed 2 trillion won significantly since June.

According to the investment banking (IB) industry, NongHyup Bank is planning to issue CoCo bonds worth several hundred billion won. It is known that they recently selected underwriters and are about to start the issuance procedures such as submitting the securities registration statement. Earlier, its affiliate holding company, NongHyup Financial Group, issued 400 billion won worth of CoCo bonds in May. DGB Financial Group also issued 150 billion won worth of CoCo bonds this month.

CoCo bonds are bonds with maturities of over 30 years. Although they are bonds, they have the characteristics of capital and are recognized as capital (supplementary capital) for financial companies. Their structure is similar to that of hybrid capital securities (perpetual bonds) in that they have perpetual maturity and are recognized as capital. However, unlike perpetual bonds, CoCo bonds are either written off or converted into common stock if certain predetermined conditions are not met. In Korea, if the financial supervisory authority designates a financial institution as insolvent, the CoCo bonds issued by that institution are automatically written off.

The market sentiment for CoCo bond issuance is favorable. NongHyup Financial Group initially hoped to issue 270 billion won worth of CoCo bonds last month, but due to strong demand from institutional investors during the book-building process, the final issuance amount was increased to 400 billion won. DGB Financial Group, which issued CoCo bonds this month, also saw investment demand exceed the planned issuance amount of 105 billion won, raising the final issuance to 150 billion won. Recently, CoCo bonds issued by financial holding companies offer interest rates of 5-6%, attracting investors.

An IB industry official said, "With the banking crises in the U.S. and Europe settling down and bond market interest rates stabilizing, and the low probability of domestic financial holding companies or banks being designated as insolvent, demand for relatively high-interest CoCo bonds has surged. Depending on market conditions, interest rate volatility may increase, so if financial companies time their issuance well, they can secure sufficient investment demand at relatively low interest rates."

Following NongHyup Bank, JB Financial Group, Shinhan Financial Group, and Hana Financial Group are expected to sequentially pursue CoCo bond issuance. The issuance of CoCo bonds began domestically in 2018, and the early redemption dates for these financial companies' CoCo bonds will come one after another starting in the second half of this year, five years later. Most financial companies that issued CoCo bonds can exercise a call option to redeem the bonds early five years after issuance.

Financial companies are likely to issue CoCo bonds in amounts exceeding the early redemption amounts. This is because the possibility of insolvency is increasing due to economic downturns, such as rising loan delinquency rates among affiliates under financial holding companies. There is a growing need to additionally raise capital to prepare for a decline in capital ratios (BIS ratios) caused by losses.

The BIS ratio is the ratio of capital to total risk-weighted assets (RWA) and indicates how much loss-absorbing capacity financial holding companies and banks have secured. RWA is the sum of assets weighted by risk weights assigned to market risk assets such as interest rate fluctuations, credit risk assets, and operational risk assets. CoCo bonds can be recognized as buffer capital in addition to common equity capital (Tier 1 capital).

According to NH Investment & Securities, in the first quarter of this year, the RWA growth rate of some financial holding companies exceeded their capital growth rate, causing a slight decline in BIS ratios. The total amount of CoCo bonds reaching early redemption dates after June is 1.576 trillion won. If these financial holding companies and banks issue CoCo bonds exceeding the early redemption amounts to replenish capital, it is estimated that more than 2 trillion won worth of CoCo bonds could be issued in the second half of the year alone.

Choi Sung-jong, a researcher at NH Investment & Securities, said, "The capital ratios of domestic financial holding companies and banks are being maintained at sufficiently stable levels," but added, "The rapid increase in risk assets and the financial authorities' encouragement for financial holding companies and banks to enhance additional loss-absorbing capacity may lead to a significant increase in CoCo bond issuance."

The allowance of CoCo bond issuance by insurance companies is also expected to contribute to the increase in issuance volume. The amendment to the Insurance Business Act, passed by the National Assembly plenary session in December last year, will take effect in July. The amendment allows insurance companies to issue CoCo bonds as a means of capital expansion following the introduction of the new international accounting standard (IFRS17). Previously, insurance companies had expanded their capital ratios (RBC ratios) through hybrid capital securities and subordinated bonds.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)