Only 29% of KOSPI Stocks Outperformed KOSPI Growth Rate in First Half of Year

Only 26.26% of KOSDAQ Stocks Exceeded KOSDAQ Average Growth Rate

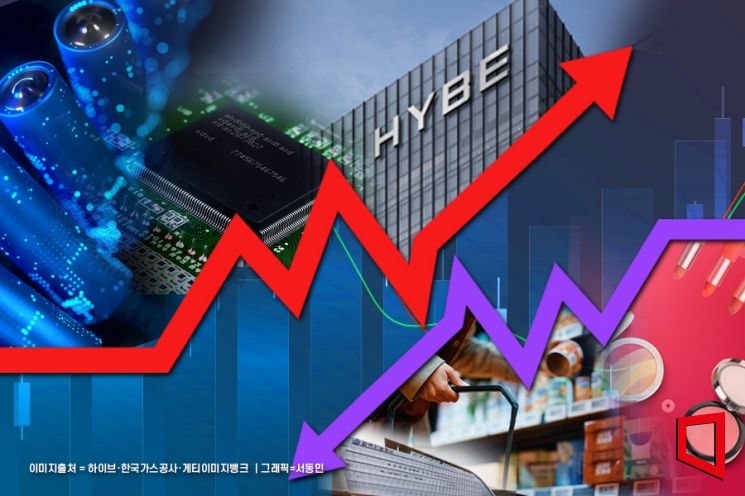

Semiconductors, Secondary Batteries, Entertainment, Aerospace Sectors Stand Out

In the first half of this year, the Korean stock market recorded a relatively strong upward trend, contrary to the initial 'lower start, higher finish' forecast. However, the rally was concentrated in certain sectors such as secondary batteries, semiconductors, and entertainment stocks, and the positive momentum did not spread broadly across the market. Approximately 70% of the stocks, which make up the bulk of the market, failed to join the rally and underperformed the average market gains. In particular, sectors like cosmetics, food and beverages, and electricity and gas not only lagged behind the average market gains but actually recorded losses.

KOSPI up 15.9%, KOSDAQ up 29.01% in the first half of the year

According to an analysis by Asia Economy on the 26th, among the 953 stocks listed on the KOSPI from January 2 to June 22, only 277 stocks outperformed the KOSPI average gain of 15.98%. This accounts for 29.06% of the total, meaning the remaining approximately 71% of stocks underperformed the KOSPI returns.

The top-performing stocks by market capitalization on the KOSPI in the first half were mainly in the aerospace, semiconductor, secondary battery, and entertainment sectors. Posco Future M, a secondary battery-related stock, stood out with a 109.44% increase. Additionally, SK IE Technology and POSCO Holdings recorded gains of 72.64% and 43.22%, respectively. Hanwha Aerospace, an aerospace stock, rose 87.09% during the same period. In the entertainment sector, HYBE gained 76.95%, and in semiconductors, SK Hynix stood out with a 52% increase.

Among the 1,645 stocks listed on the KOSDAQ, 432 stocks (26.26%) outperformed the KOSDAQ average gain of 29.01%. The remaining 74%, or 1,213 stocks, all underperformed the KOSDAQ average gain for the first half. This clearly shows that the strong rally in the KOSDAQ this year was limited to certain sectors such as secondary batteries.

In the KOSDAQ, the strength of secondary battery and entertainment stocks was particularly notable. Ecopro BM, the largest market capitalization stock on the KOSDAQ in the first half, surged by an impressive 187.73%. At the end of last year (December 29, 2022), Ecopro BM ranked second with a market capitalization of 9.0075 trillion KRW, but with a nearly 190% increase, it solidified its position as the largest market cap stock on the KOSDAQ. Other secondary battery stocks like L&F also significantly outperformed the KOSDAQ average with a 44.09% gain. Alongside secondary batteries, entertainment stocks led the KOSDAQ gains. JYP Ent. rose 97.64%, and YG Entertainment increased by 80.84% this year. Cube Entertainment (53.09%) and SM Entertainment (48.89%) also outperformed the KOSDAQ average during the same period.

In contrast, stocks related to electricity and gas, cosmetics, and food and beverages experienced significant declines. Indices representing these sectors, such as KRX Utility (-45.19%), KRX 300 Consumer Staples (-14.35%), and KRX Consumer Staples (-13.77%), not only failed to outperform the average index gains but actually retreated. Representative underperformers included Korea Electric Power Corporation (-15.09%), Korea Gas Corporation (-30.52%), LG Household & Health Care (-31.02%), KT&G (-9.18%), Amorepacific (-25.45%), E-Mart (-18.57%), Hite Jinro (-15.07%), Kolmar Korea (2.00%), and CJ CheilJedang (-26.28%).

Secondary battery and entertainment stocks remain strong among top market cap rankings

The concentration of gains in certain stocks during the first half led to changes in the market capitalization rankings on both the KOSPI and KOSDAQ. On the KOSPI, NAVER, which ranked 9th in market capitalization at the end of last year, fell out of the top 10. POSCO Holdings, which saw strong buying momentum from individual investors amid the secondary battery sector's strength this year, entered the top 10.

The KOSDAQ, where sector concentration was particularly pronounced, also saw significant shifts within the top 10 market cap rankings. Celltrion Healthcare, which held the top spot at the end of last year, saw its market capitalization shrink by about 2 trillion KRW, dropping to 3rd place. As of the closing price on the 22nd of this month, the 1st, 2nd, and 4th largest market caps on the KOSDAQ were all secondary battery stocks: Ecopro BM (25.9174 trillion KRW), Ecopro (20.2903 trillion KRW), and L&F (9.0599 trillion KRW). Alongside secondary batteries, entertainment stocks also recorded strong gains. JYP Ent. jumped from 10th place at the end of last year to 5th place in the first half. During the same period, JYP Ent.'s market capitalization nearly doubled from 2.4067 trillion KRW to 4.7567 trillion KRW. Studio Dragon, which ranked 8th at the end of last year, fell out of the top 10.

It is expected to take some time for the underperforming sectors in the first half to recover. Hanuri, a researcher at Meritz Securities, stated, “We maintain a 'neutral' investment opinion on consumer staples such as cosmetics for the second half. The persistent unpredictable diplomatic risks, along with weakening demand for Korean cosmetics, have led to a decline in Korea's market share within the Chinese cosmetics market.”

The strong performance of stocks that led the rally in the first half is expected to continue into the second half. Park Seung-young, a researcher at Hanwha Investment & Securities, explained, “NVIDIA raised its guidance for the second quarter, igniting the semiconductor sector. NVIDIA, which has never missed its guidance historically, reported numbers that met expectations in its Q2 earnings announcement.” He added, “Semiconductor stocks, including those related to the AI theme, are expected to lead the stock market in the second half as well.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.