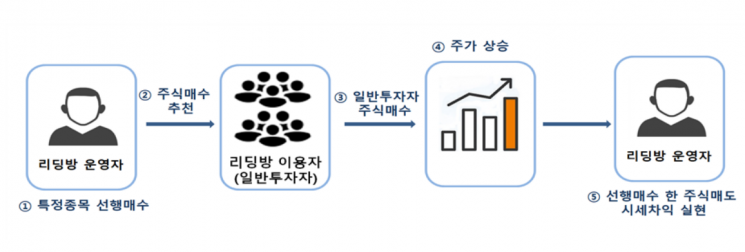

Methods of Gaining Unfair Profits through 'Seonhaeng Maemae'

Cases of Operating Investment Advisory without Reporting

Over 3,000 Cases of Illegal Leading Damage... Caution Needed

The prosecution has brought to trial six stock leading operators who earned illegal profits through stock leading on SNS and YouTube. As complaints about illegal stock leading continue to rise, exceeding 3,000 cases annually, investors need to exercise caution regarding stock leading crimes.

On the 22nd, the Financial Investigation Division 1 of the Seoul Southern District Prosecutors' Office (Chief Prosecutor Chae Hee-man) announced that from December last year until this day, two illegal stock leading operators, Yang (30) and Kim (28), were arrested and indicted on charges of violating the Capital Markets Act, and four others including Song (37) were indicted without detention. Song, who promised principal guarantees to attract investors, was also charged with violating the Act on the Regulation of Conducting Fund-Raising Business Without Permission. The prosecution obtained seizure and preservation orders for the illegal gains of five of the indicted individuals except Song, and also requested seizure and preservation orders for Song simultaneously with the indictment.

Using Investors as 'Mulryangbadi' through Stock Leading

The mechanism of obtaining unfair profits through 'illegal stock leading'/Data=Seoul Southern District Prosecutors' Office

The mechanism of obtaining unfair profits through 'illegal stock leading'/Data=Seoul Southern District Prosecutors' Office

According to the prosecution, these individuals operated stock leading chat rooms and YouTube stock broadcasts, using investors who were members of the leading rooms or viewers of the stock broadcasts as so-called 'mulryangbadi' (victims of front-running) or organized them into groups to use as tools for stock price manipulation crimes. Front-running refers to the act of a person or a stock manipulation group buying certain stocks first, then actively recommending investors to buy those stocks to drive up the price, and finally selling them to gain illegal profits.

In this process, some operated unauthorized investment advisory businesses and engaged in unauthorized fund-raising activities. According to the Capital Markets Act, investment advisors or similar investment advisory businesses are prohibited from holding or depositing money or securities from investors. To operate investment advisory or similar investment advisory businesses, registration with the Financial Services Commission and notification to the Financial Supervisory Service are required, respectively.

Yang, Ahn (30), and Shin (28) are accused of recommending 28 stocks in free KakaoTalk stock leading rooms from March to October last year and earning about 364 million KRW in illegal profits through front-running. They operated 10 to 20 leading rooms, each used by 60 to 200 people. Yang, who also appeared on economic TV broadcasts, achieved the highest return rate in a practical stock investment competition hosted by a domestic securities company using this method, but his award was revoked after the crime was discovered.

Kim (28), an employee of a similar investment advisory company, is accused of leading investors to buy and hold stocks of Company A from December 2020 to May of the following year by claiming that a manipulation group was involved in the transfer of the largest shareholder's stake and management rights of Company A to raise the stock price, thereby earning an unspecified amount of illegal profits. He is also accused of receiving about 200 million KRW in performance bonuses for recruiting members. About 300 paid leading room members who traded stocks based on Kim's recommendations suffered losses of 15 billion KRW.

By purchasing and holding 25-30% of the freely tradable shares of Company A (locking the volume) through Kim's leading, stock price manipulation became possible with a small amount of money. The prosecution stated that they are continuing to investigate the stock manipulation group that requested 'locking the volume' from Kim and used Kim's actions to raise stock prices and earn illegal profits.

Song operated a paid KakaoTalk leading room without registration from November 2020 to April of the following year and appeared on stock specialty broadcasts recommending 63 stocks with front-running until August last year. From January 2018 to July last year, he is also accused of attracting about 13.3 billion KRW by promising principal guarantees to investors without authorization and investing in stocks. Song earned about 122 million KRW in illegal profits through this.

Kim (54), who has about 550,000 subscribers, is accused of recommending five stocks on his YouTube stock broadcast from June 2021 to June last year and earning about 5.8 billion KRW in illegal profits through front-running. While strictly applying standards to other employees' conflict-of-interest stock trading, Kim used Contracts for Difference (CFD) accounts, which are easier to conceal trading facts, to conduct front-running. Kim is known as a so-called 'Super Gaemi' operating a YouTube broadcast ranked 13th in economic YouTube subscribers and 4th in stock broadcast subscribers.

A prosecution official said, "Ordinary retail investors often fall victim to false and exaggerated advertisements such as 'loss recovery,' 'guaranteed short-term high returns,' and 'refund guarantee,' and suffer significant losses after subscribing to the service." He added, "We have focused investigations on unfair trading acts such as front-running through stock leading and strictly punished major participants, revealing that users used as 'mulryangbadi' inevitably suffer losses."

Over 3,000 Cases of Illegal Stock Leading Damage... Caution Needed

Damage related to illegal stock leading is increasing. Complaints related to illegal stock leading received by the Financial Supervisory Service have exceeded 3,000 cases since 2021. They recorded 905 cases in 2018, 1,744 in 2020, 3,442 in 2021, and 3,070 last year.

The prosecution emphasized that 'free stock leading' is likely a bait to induce paid membership since one of the revenue sources of stock leading rooms and stock broadcasts is paid membership fees. They also warned that trading according to free recommendations could unknowingly make one a victim of front-running crimes.

They also said that if a paid leading operator checks the investable amount or guarantees profits on specific stocks while demanding profit sharing, there is a high possibility of fraud. Moreover, paid leading companies often do not respond to cancellation or refund requests, so careful subscription is necessary. They also cautioned that the career, profitability, user reviews, and bulletin board comments of stock experts may be false or exaggerated.

Furthermore, users of stock leading rooms need to be especially cautious as they can also be involved in crimes. Providing undisclosed internal company information or information about stock manipulation groups to general investors during stock leading can result in imprisonment for more than one year.

A prosecution official said, "Stock leading-related crimes are often conducted secretly using Telegram, WhatsApp, etc., and criminal proceeds are concealed through nominee accounts." He added, "We ask for active reports and cooperation in investigations from users."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.