Strengthening Foundry Independence and Expanding Revenue Structure

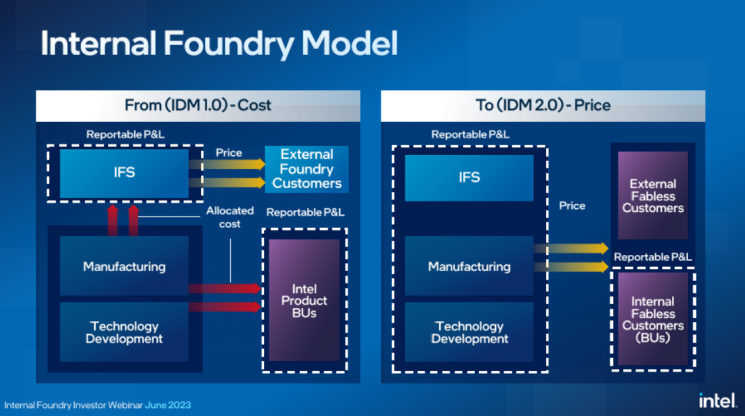

Intel is restructuring its detailed business structure to strengthen its competitiveness in foundry (semiconductor contract manufacturing). By separating the product division and the manufacturing division (including foundry), Intel aims to enhance the independence of its foundry and receive orders from the product division in the same way as external fabless (semiconductor design) companies. This means that not only orders from external fabless companies but also internal semiconductor production will be included in foundry sales.

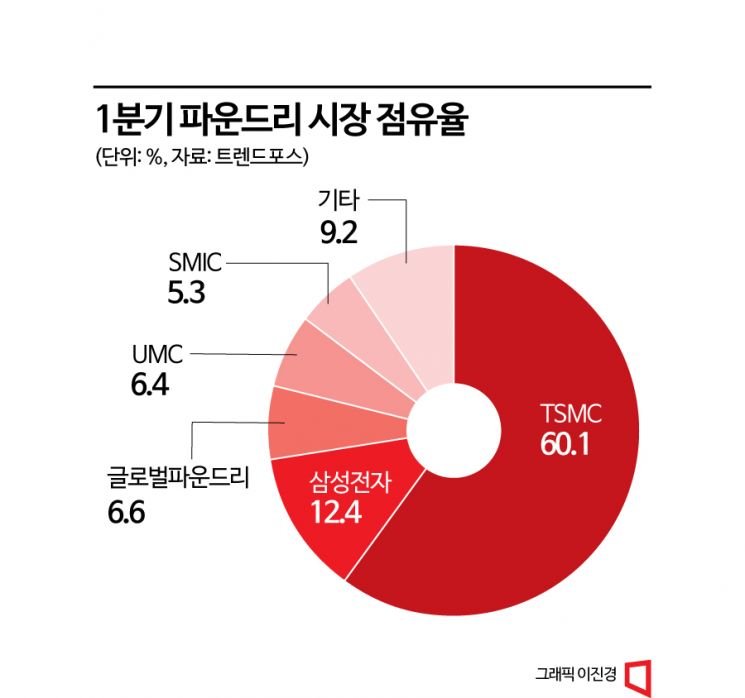

Intel will begin implementing this from the first quarter of next year. In this case, foundry sales could exceed $20 billion in the next year alone. This scale is enough for Intel to surpass Samsung Electronics and take second place in the global foundry market.

"Treating internal production like external fabless orders"…Intel moves to reduce costs

On the 21st (local time), the American semiconductor company Intel held a webinar for analysts and investors to specifically introduce its 'Internal Foundry Model.' During the approximately one-hour event, Intel explained that it would actively introduce the internal foundry model to optimize costs incurred during the semiconductor business process.

The internal foundry model is Intel's innovative strategy to introduce a fabless-foundry business structure within its semiconductor business. Just as a foundry receives orders from external fabless customers and manufactures products, within Intel, the product division will place orders for specific semiconductor production, which will be processed as contract manufacturing by an independent manufacturing division.

To this end, starting from the first quarter of next year, Intel will include three areas in the product division: ▲Client Computing ▲Data Center and Artificial Intelligence (AI) ▲Network and Edge. The manufacturing division will include ▲Manufacturing ▲Technology Development ▲Foundry (IFS) and other fields. The two divisions will be clearly separated in accounting to enhance their independence.

Image of foundry sales structure before and after internal foundry model introduction / [Image source=Intel webinar capture]

Image of foundry sales structure before and after internal foundry model introduction / [Image source=Intel webinar capture]

Intel expects that this will help reduce costs in the semiconductor business by $3 billion in 2023 and by $8 to $10 billion by 2025. It will also reduce cases of delayed product launches compared to original plans, such as the Sapphire Rapids server CPU introduced this year.

For example, in Intel's case, when launching a specific product, multiple rounds of test chip production are required, resulting in longer product development times compared to competitors. Costs inevitably increase as well. If the product division were to place orders at market prices like external fabless companies, unnecessary test chip production could be reduced, saving both testing time and costs, according to the company.

"Aiming to become the second-largest operator with external volume by 2030"

The internal foundry model is expected to strengthen competitiveness in the foundry business. Intel is an integrated device manufacturer (IDM) that operates both fabless and foundry businesses. Fabless customers seeking Intel foundry services may worry that Intel's technology could flow into its design business. Enhancing foundry independence this time will help improve market trust.

With increased sales, Intel could leap to a top-tier operator in the foundry market. Intel's foundry sales last year were $768 million, not ranking within the top 10 globally. Intel expects that by applying the internal foundry model from the first quarter of next year, foundry sales generated internally could exceed $20 billion that year alone. Including external fabless production, Intel could surpass Samsung Electronics' foundry sales (based on TrendForce, $21.9 billion last year), the second-largest in the foundry market.

David Zinsner, Intel's Chief Financial Officer (CFO), said during the webinar presentation, "In 2024, we expect to record manufacturing sales exceeding $20 billion based on internal volume, becoming the second-largest foundry operator." He also stated, "Our goal to become the second-largest operator based on external volume by 2030 remains unchanged."

The internal foundry model is the second phase of Intel IDM 2.0 execution. Pat Gelsinger, Intel's Chief Executive Officer (CEO), announced the IDM 2.0 strategy, including re-entering the foundry business, in March 2021. While the first phase of IDM 2.0 focused on expanding manufacturing capabilities such as increased use of external foundries and building foundry services, this time Intel is undertaking the biggest business transformation in its 55-year history by applying the internal foundry model. Intel is developing more than five products based on 18-angstrom (?, 1?=0.1 nanometers) technology, aiming for release in 2025.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)