Surging Demand from Institutional Forecasts to Public IPO Subscription

IPO Market Interest Rises with Expanded Price Limits on First Listing Day

From the 26th, the price limit on the listing day for newly listed companies will be expanded to 60-400% of the public offering price. Funds are pouring into demand forecasting and subscription for IPO stocks of companies preparing for listing. The first-day return on investment in IPO stocks can increase from the current 160% to up to 300%. If the public offering price was 10,000 KRW and the stock achieved 'Ttah-sang' (forming the opening price at twice the public offering price and then hitting the upper limit), the price would rise to 26,000 KRW. Going forward, it could rise to 40,000 KRW, which is seen as an opportunity for IPO investors. Aluminum automotive parts manufacturer Almek confirmed its public offering price at 50,000 KRW, exceeding the proposed price range. This is a result of the heated enthusiasm for IPO stocks combined with the fact that it is an electric vehicle parts company attracting significant interest in the domestic stock market.

According to NH Investment & Securities on the 22nd, the subscription for Almek IPO stocks for general investors was conducted over two days starting from the 20th, attracting deposits of 8.4725 trillion KRW. The subscription competition rate recorded was 1,355.6 to 1.

In the demand forecasting conducted for institutional investors from the 14th to the 15th, a competition rate of 1,697 to 1 was recorded, proving interest in Almek. Among participating institutions, 98.7% expressed willingness to subscribe at prices above the public offering price range of 40,000 to 45,000 KRW.

The public offering price was finalized at 50,000 KRW, 11.1% higher than the upper limit of the price range. This is about 10% lower than the per-share valuation of 54,790 KRW calculated by the lead manager NH Investment & Securities. Generally, a discount rate is applied to the appropriate corporate value when determining the public offering price, but Almek’s discount rate is relatively small. When estimating the appropriate corporate value, Almek was projected to achieve a net profit of 35.2 billion KRW next year, more than six times last year’s net profit of 5.5 billion KRW.

Looking at the earnings estimates, sales are expected to increase from 156.8 billion KRW last year to 372.8 billion KRW this year and 487.1 billion KRW next year. Operating profit is expected to rise to 11.3 billion KRW, 34.6 billion KRW, and 58.2 billion KRW respectively. Despite optimistic growth prospects, institutions participating in demand forecasting offered subscription prices exceeding the upper limit of the public offering price range. There is an expectation that sales and profits will increase as Almek, which produces electric vehicle parts, invests the funds raised through the IPO to expand production capacity.

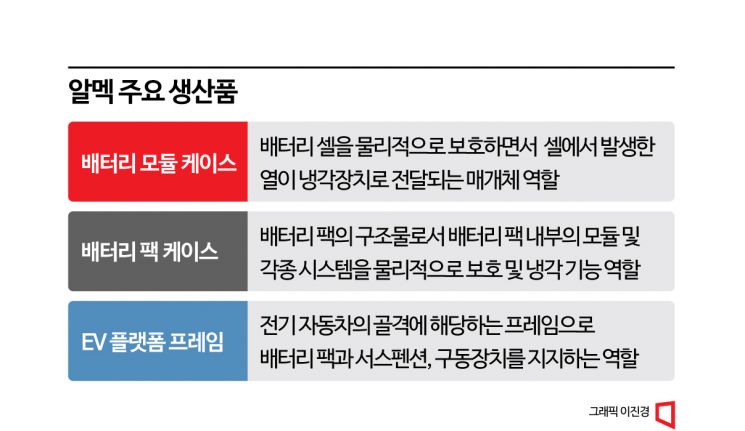

Almek produces secondary battery module cases, battery pack frames, and electric vehicle platform frames. Its aluminum extrusion module cases, which protect batteries from external shocks, hold the number one market share domestically. Major clients include LG Energy Solution, SK On, GM, Rivian, and Lucid.

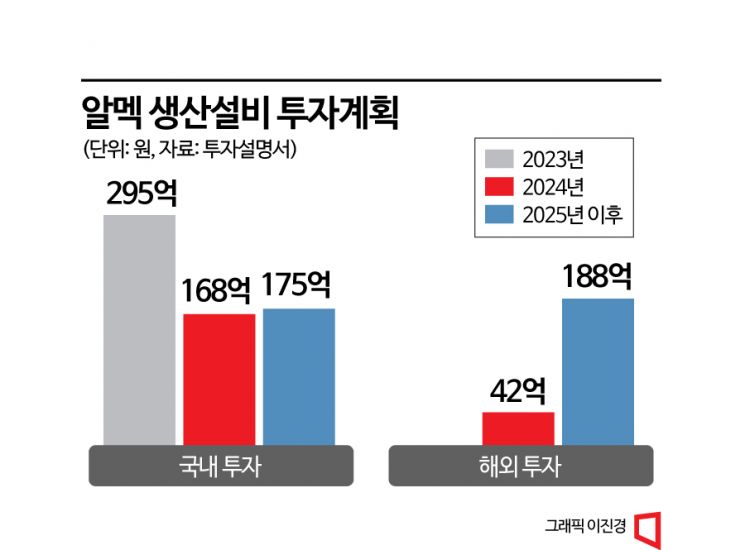

Almek stated, "We plan to raise 50 billion KRW through the public offering to be used for facility funds and improving financial structure." It is expanding production facilities not only domestically but also in the United States. The company is pursuing the purchase of land for establishing overseas subsidiaries and production facilities in Montgomery, Alabama. It plans to invest a total of 86.8 billion KRW for expansion, funded by existing cash and funds raised through the IPO. The order backlog secured until 2030 exceeds 1.5 trillion KRW, and it is judged that sales and profits will increase once the expansion is completed.

Researcher Park Jong-sun of Eugene Investment & Securities explained, "As the global electric vehicle market grows, the supply of electric vehicle parts is increasing," adding, "They are securing large-scale projects related to electric vehicles themselves and platforms." However, he added, "The tradable shares after listing account for 31.5% of the total issued shares," noting that "this is somewhat burdensome."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)