BlackRock Files for Bitcoin Spot ETF Listing with SEC

Experts Say "Different from Ark Investment's Application"

The global largest asset management firm BlackRock's move to launch a Bitcoin spot exchange-traded fund (ETF) has stirred the cryptocurrency market. Bitcoin prices surged by more than $2,000 in just one day.

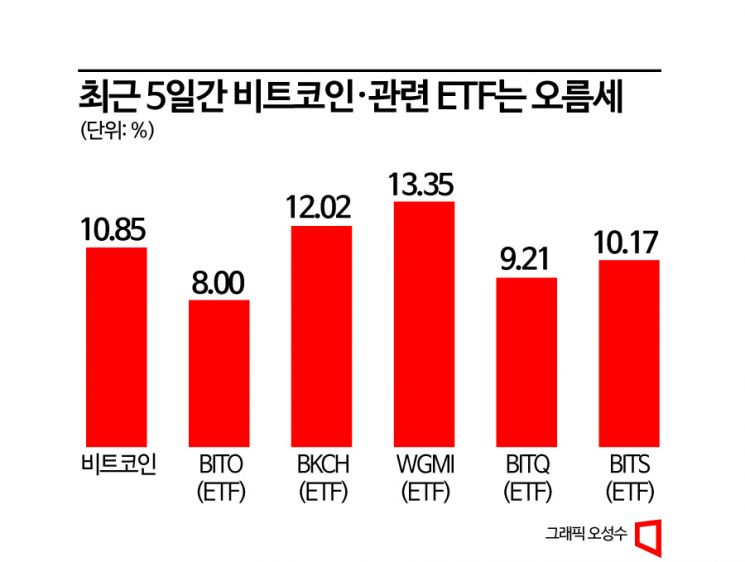

According to CoinMarketCap, a global cryptocurrency market tracking site, as of 3:26 PM on the 21st, Bitcoin was priced at $28,783 (approximately 37.19 million KRW), up 7.32% from the previous day. Over the past five days, the price has risen by 10.85%. Since the 16th of this month, Bitcoin had been on a slight upward trend, recording around $26,600 until the day before, but the price sharply increased within a day.

The sharp rise in Bitcoin prices is attributed to expectations surrounding BlackRock's application to list a Bitcoin spot ETF. On the 15th, BlackRock filed an application with the U.S. Securities and Exchange Commission (SEC) to list the iShares Bitcoin Trust, a Bitcoin spot ETF.

Until now, the SEC has not allowed the launch of Bitcoin spot ETFs. Ark Investment, led by Cathie Wood, known as the "Money Tree Sister," also applied for approval of a Bitcoin spot ETF in partnership with 21Shares but was repeatedly rejected. However, the market senses that BlackRock's application this time is different. Earlier, Bloomberg Intelligence stated in a report, "BlackRock's Bitcoin ETF application gives hope for approval due to the company's size, status, and reputation." Additionally, there is growing expectation that the market atmosphere, which had been tightening regulations by the SEC against the global cryptocurrency exchange Binance and claiming securities status for 19 types of cryptocurrencies, could change if approval is granted.

This positive development is also driving the rise of cryptocurrency-related ETFs. The ProShares Bitcoin Strategy ETF (BITO), a Bitcoin futures ETF, rose 8.00% over the past five days. The Global X Blockchain ETF (BKCH), which invests in cryptocurrency-related companies, and the Valkyrie Bitcoin Mining ETF (WGMI), which invests in Bitcoin mining companies, surged 12.02% and 13.35%, respectively. The Bitwise Crypto Industry Innovators ETF (BITQ), which invests in companies holding significant cryptocurrency assets, and the Global X Blockchain & Bitcoin Strategy ETF (BITS), which invests in Bitcoin futures, also rose 9.21% and 10.17% during the same period.

Meanwhile, cryptocurrency investor sentiment has reached a level of "greed." According to Alternative, a cryptocurrency data provider, the Fear & Greed Index, which measures investor sentiment, rose 10 points from the previous day to 59 points (greed) on this day. Compared to a week ago, it increased by 13 points. Alternative's Fear & Greed Index ranges from 0, indicating extreme fear and pessimism about investing, to 100, indicating strong optimism.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)