Mortgage loans are trending with interest rates in the 4% range annually, while unsecured loans are mostly in the 5% range.

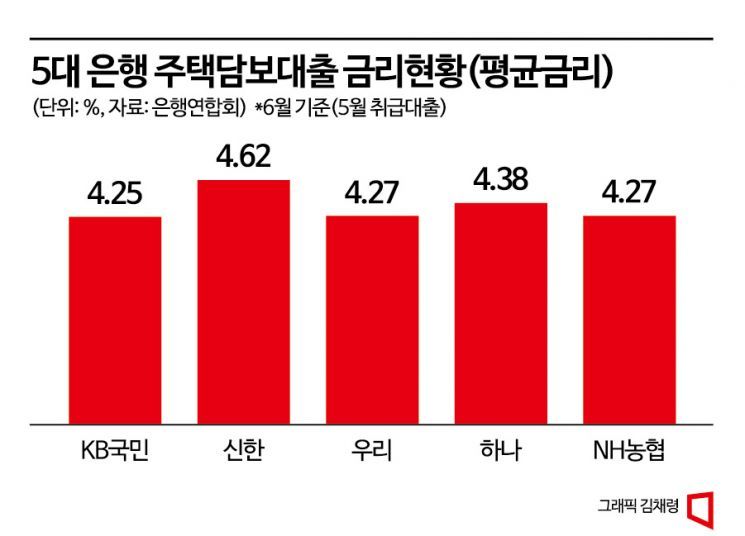

According to the Bankers Association on the 21st, the average mortgage loan interest rates of KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup banks were all in the 4% range as of June (based on loans issued in May). KB Kookmin Bank had the lowest rate at 4.25%, followed by Woori Bank and NH Nonghyup Bank at 4.27%, Hana Bank at 4.38%, and Shinhan Bank at 4.62%. Compared to the average interest rates in December last year, which were in the 5% range, this marks a decrease of about 1 percentage point in half a year.

More than 90% of mortgage loans at all five major banks were subject to interest rates in the 4% range. Looking at the proportion of mortgage loans by interest rate bracket (based on loan amount) at each bank, KB Kookmin Bank had the highest at 97.9%, followed by Woori Bank at 96.5%. Shinhan Bank and Hana Bank were at 94.1% and 94%, respectively. At KB Kookmin, Woori, Hana, and NH Nonghyup banks, some loans were granted with interest rates in the 3% range. Among customers who took mortgage loans from Kookmin Bank, none were subject to interest rates of 5.5% or higher, and at Hana Bank, there were no mortgage loans with high interest rates of 6% or more.

Unlike commercial banks, internet-only banks, which can reduce branch operating costs, showed a higher proportion of mortgage loans with interest rates in the 3% range. KakaoBank’s average interest rate for installment mortgage loans issued in May was 3.88%. Based on loan amounts, 75.8% of loans were subject to interest rates in the 3% range. K Bank’s average interest rate was 4.08%, with 68.6% of loans in the 3% range.

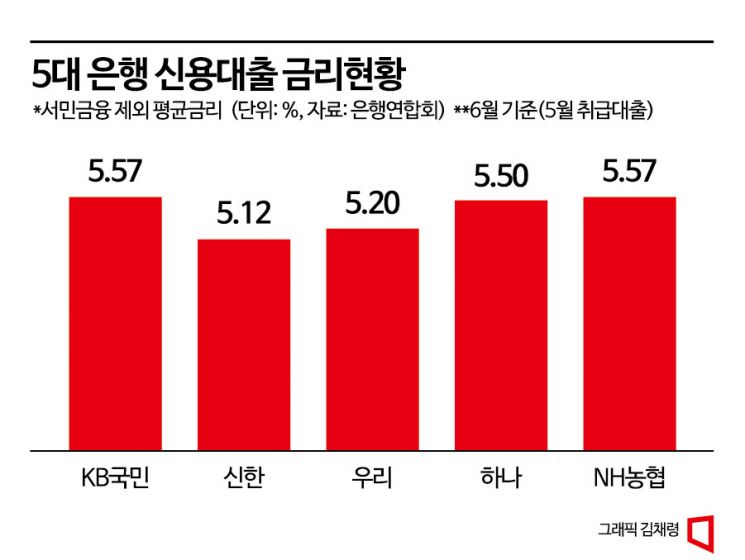

For general unsecured loans, the 5% range was most common. The average interest rates excluding microfinance for the five major banks were KB Kookmin Bank and NH Nonghyup Bank at 5.57%, Hana Bank at 5.5%, Woori Bank at 5.2%, and Shinhan Bank at 5.12%. Looking at the proportion of loans by interest rate bracket, 88.3% of Woori Bank’s loans were in the 4-5% range, followed by Shinhan Bank at 71.2%, Hana Bank at 69.3%, NH Nonghyup Bank at 63.7%, and KB Kookmin Bank at 63.3%. The average interest rate for credit limit loans (overdraft loans), which was approaching 7% at the end of last year, also recorded a mid-5% range.

As the upward trend in loan interest rates has slowed, household loan balances at the five major banks increased last month for the first time in 17 months. The household loan balance at the five major banks as of the end of last month was 677.6122 trillion KRW, up 143.1 billion KRW from the previous month. This reversed a 16-month consecutive decline that had been ongoing since January last year. However, on the 15th, the COFIX (Cost of Funds Index), the benchmark rate for banks’ variable-rate mortgage loans, rose by 0.12 percentage points from the previous month, causing mortgage loan interest rates at banks to start rising again. The variable-rate mortgage loan interest rates at the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?are now between 4.23% and 6.98%, with the lower bound, which had once fallen to the 3% range, adjusted upward to the low to mid-4% range.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)