Fuel Price Drop and Won-Dollar Exchange Rate Decline Reduce Costs

Surge in Japan-Bound Travelers Due to Yen Weakness... Growing Optimism Ahead of Summer Peak Season

Despite the transition of COVID-19 to an endemic phase, airline stocks, which had been sluggish, soared simultaneously due to low oil prices, low exchange rates, and a weak yen. Although the second quarter is traditionally an off-season, the unprecedented increase in demand and anticipation ahead of the peak summer vacation season in the third quarter are expected to lead airlines to record their highest-ever performance in Q2.

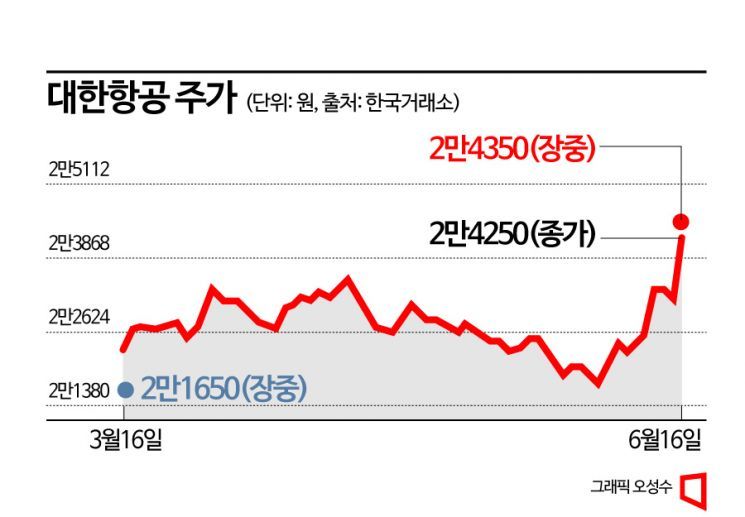

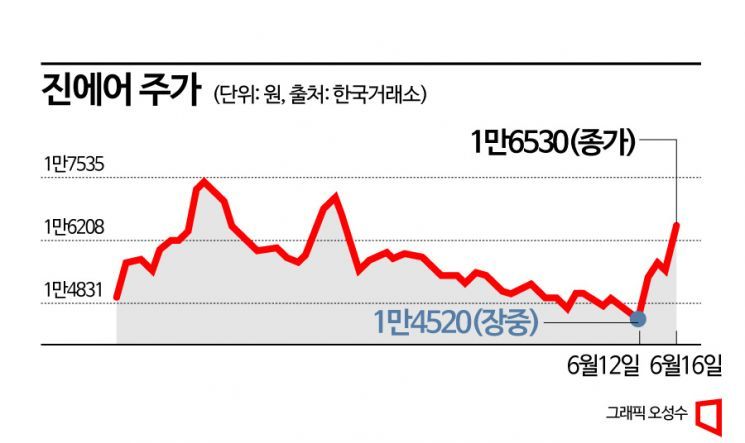

According to the Korea Exchange, on the 16th, Korean Air closed at 24,250 KRW, up 4.75% from the previous trading day. During the session, Korean Air even rose to a high of 24,350 KRW (5.18%). Low-cost carriers (LCCs) also showed strong performance that day, including Jin Air (6.03%), Jeju Air (6.48%), T'way Air (4.59%), and Air Busan (7.78%).

Although airline stocks had been recognized as representative reopening beneficiaries, they had maintained a sluggish trend. This was due to a sharp decline in cargo demand, which had surged during the pandemic, and the anticipation of Q1 earnings being priced in since Q4 of last year.

The simultaneous strength of airline stocks on the 16th is analyzed to have been influenced by the "three lows." The decline in the KRW-USD exchange rate increased airlines' foreign exchange gains. Since airline fuel imports, aircraft purchases, and leases are mainly settled in dollars, a lower exchange rate reduces costs. According to Korean Air's semi-annual report, every 10 KRW drop in the exchange rate generates approximately 35 billion KRW in foreign currency valuation gains. On the 16th, the KRW-USD exchange rate closed at 1,271.9 KRW, down 8.6 KRW from the previous day's closing price, according to the Seoul foreign exchange market. This is about 70 KRW lower than the peak of 1,344 KRW reached in May, roughly a month ago.

Low oil prices also reduced fuel cost burdens. According to Daishin Securities, the jet fuel price in Q2 was 93 USD per barrel, below the expected 105 USD, resulting in an estimated fuel cost reduction of about 100 billion KRW. Yang Ji-hwan, a researcher at Daishin Securities, analyzed, "As passenger demand continues to recover, external factors such as oil prices and exchange rates are falling, reducing cost burdens."

The historic low yen also positively impacted the boom in flights to Japan, the main route for LCCs. As of the 16th, the KRW-JPY exchange rate was 903.82 KRW per 100 yen, nearing the 900 KRW mark. Until the end of April, it hovered around 1,000 KRW per 100 yen but dropped nearly 100 KRW in two months. If this trend continues, it is expected to enter the 800 KRW range for the first time since June 2015. In fact, Japan was the top destination for LCC flights in Q1 this year, with 660,545 passengers departing.

Passenger demand is steadily increasing. Although Q2 is traditionally an off-season for the airline industry, passenger demand has significantly increased. According to Incheon Airport transportation statistics, the number of round-trip flights at Incheon Airport last month was 28,154, about 11.6% higher than April's 25,218 flights. Passenger numbers also rose by approximately 8.6%, from 4,048,187 to 4,394,892. Additionally, anticipation is growing ahead of the peak season, such as the summer vacation period.

Securities firms have unanimously raised target prices for airline stocks. Daishin Securities raised Korean Air's target price by 10% from 30,000 KRW to 33,000 KRW. Heungkuk Securities raised Jin Air's target price from 15,500 KRW to 19,000 KRW, and Eugene Investment & Securities also raised Jin Air's target price by 44% to 23,000 KRW. Park Soo-young, a researcher at Hanwha Investment & Securities, said, "Q2 earnings will be better than expected due to demand exceeding expectations and cost burdens falling short of expectations. Starting from late June, with the beginning of the summer peak season, if the current trend continues, it will surpass the existing market capitalization estimates for airlines."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)