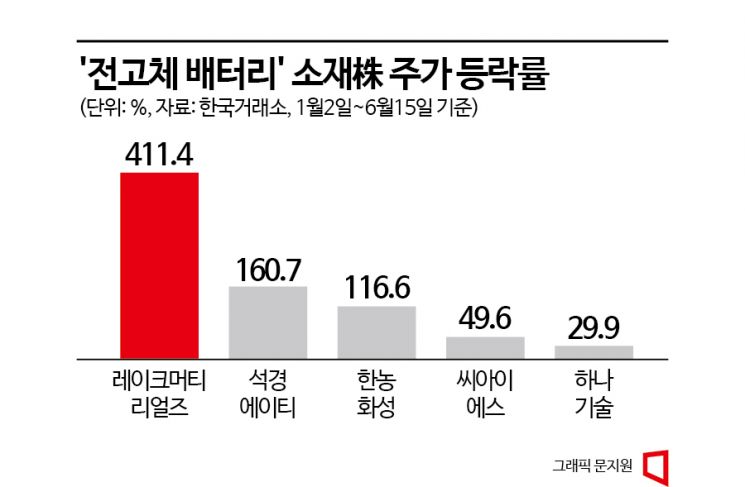

Material Companies' Stocks Surge Ahead of Next-Generation Battery Market Shift

Lake Materials, Hana Technology, Seokgyeong AT, and Others Soar Since Early Year

Japanese automaker Toyota has announced the "commercialization of all-solid-state batteries by 2027." In recent years, the secondary battery industry, which has been a key theme in the stock market, has mainly focused on lithium-ion batteries. Amid this, Toyota has opened the door to the all-solid-state battery market, which is considered a technological advancement. In the securities industry, related material companies' stock prices are already fluctuating ahead of the transition to the next-generation battery market.

According to the Korea Exchange on the 16th, Lake Materials, a materials company listed on KOSDAQ, closed at 22,350 KRW the previous day, marking more than a fivefold increase from the mid-4,000 KRW range at the beginning of the year. Lake Materials originally supplied materials used in manufacturing processes such as semiconductors, solar cells, and LEDs, but the recent stock price surge is attributed to 'all-solid-state batteries' rather than its existing business. The stock price skyrocketed from mid-March after news spread that Lake Technology, a subsidiary in which Lake Materials holds about 70% of shares, would enter the all-solid-state material business. Yoonji Byun, a researcher at Hana Securities, stated, "Lake Technology, a subsidiary of Lake Materials, is smoothly progressing with the development of technology and processes related to lithium sulfide (Li2S), a key raw material for all-solid-state battery electrolytes, and plans to complete mass production facilities by the end of this year."

All-solid-state batteries replace the liquid electrolyte in conventional lithium-ion batteries with a solid electrolyte. Compared to liquid electrolyte batteries, which pose risks of fire and explosion due to external shocks or battery damage, all-solid-state batteries are considered safer. Because the electrolyte is solid, the structure is rigid and can maintain its form even if damaged.

Above all, the key reason all-solid-state batteries are attracting attention as next-generation technology is their capacity. The capacity of batteries installed in electric vehicles is directly linked to driving range, making it a very important factor. All-solid-state batteries do not require a separator that blocks the liquid electrolyte, and the reduced number of components allows for materials that increase battery capacity, resulting in relatively higher energy density.

Not only battery manufacturers such as Samsung SDI and LG Energy Solution but also automakers have rushed to develop all-solid-state batteries. Although still in the preliminary research stage due to cost and other issues, Toyota's specific announcement of the mass production timeline is expected to accelerate development among competing companies. Accordingly, investor interest in related material companies is also expected to grow.

In addition to Lake Materials, companies such as Hana Technology, Hannong Chemical, CIS, and Seokgyeong AT have seen their stock prices rise sharply this year as all-solid-state battery-related material issues have come to the forefront. Hana Technology, a secondary battery equipment company, recently announced its intention to enter the new material business to diversify sales. The inclusion of all-solid-state battery materials attracted investor attention. Sung-hwan Kim, a researcher at Bukuk Securities, said, "Attention should be paid to all-solid-state battery materials (sulfide-based). We plan to execute a 20 billion KRW capital expenditure (CAPEX) to establish a lithium sulfide ton-scale production system in the first half of next year." He added, "From 2025, related material sales are expected to become full-scale, leading to significant external growth and maximized profitability improvement effects due to margin mix."

Seokgyeong AT, whose stock price has nearly tripled this year, secured core technology for boron-based lithium-ion all-solid-state electrolytes early on since 2017 and is currently applying for patents. Jae-ho Choi, a researcher at Hana Securities, said, "Boron-based all-solid-state electrolytes do not produce harmful compounds compared to sulfide-based ones, do not require large-scale facility investments, and have low raw material costs. We are currently discussing tests with customers, and we expect to enter a full-scale growth phase with sales for all-solid-state batteries possibly starting in the second half of 2024."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)