Ministry of Economy and Finance Monthly Fiscal Trends Published

Managed Fiscal Balance Deficit 54 Trillion → 45 Trillion

Usually Total Revenue ↑ Total Expenditure ↓ in April

Key to Managing Fiscal Deficit is 'Sangjeohago'

The national budget deficit, which reached 54 trillion won in the first quarter, improved to 45.4 trillion won. This was due to seasonal effects where total revenue increases and total expenditure decreases in April. The government’s projected fiscal deficit for this year is 58 trillion won, and successful management is expected to depend on a "high-low" pattern and the supplementary budget.

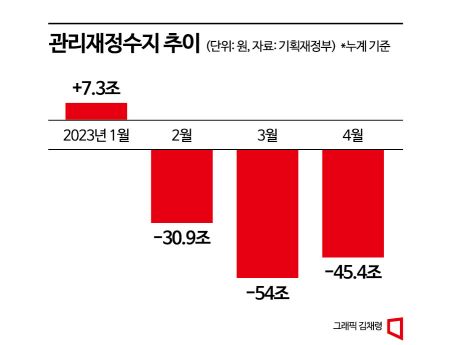

According to the Monthly Fiscal Trend report published by the Ministry of Economy and Finance on the 15th, the managed fiscal balance for April was recorded as a deficit of 45.4 trillion won. The managed fiscal balance is the figure obtained by subtracting social security funds from the integrated fiscal balance, serving as an indicator of the overall national budget. The deficit improved by 8.6 trillion won from the previous month’s 54 trillion won. The managed fiscal balance started the year with a surplus of 7.3 trillion won in January but recorded a deficit of 30.9 trillion won in February, showing a trend of increasing deficit.

The slight improvement in the managed fiscal balance is attributed to seasonal factors. Typically, April often records a surplus in the managed fiscal balance. This is because value-added tax revenue comes in April, increasing total revenue, and total expenditure decreases due to expenditure reviews conducted at the end of the quarter. A Ministry of Economy and Finance official explained, “April tends to show an increase in total revenue and a decrease in total expenditure,” adding, “Last April also saw a surplus exceeding 7 trillion won.”

This year’s overall managed fiscal balance is expected to depend on the economic situation in the second half of the year. The government’s projected fiscal deficit is 58.2 trillion won. Historically, the managed fiscal balance fluctuates until June, increasing, but tends not to rise significantly from the second half onward. If the economy rebounds in the second half, realizing the so-called "high-low" pattern, revenue conditions will improve, increasing the likelihood of stabilization and improvement in the managed fiscal balance. Conversely, if the economy falls in the second half as some fear, showing a "high-low-low" trend, tax revenue shortages will worsen, potentially expanding the fiscal deficit.

The problem is that the economic outlook is not optimistic. Initially, the government and domestic and international experts predicted that the Korean economy would face difficulties in the first half but recover in the second half. However, due to continued external challenges such as sluggish exports and the Russia-Ukraine war, growth forecasts for this year have been lowered. The Hyundai Research Institute revised its growth forecast from 1.8% to 1.2%, the Bank of Korea from 1.6% to 1.4%, and Standard & Poor’s (S&P) issued a forecast of 1.1%.

The supplementary budget is also a key variable. The fiscal deficit could roughly double compared to the first quarter if a supplementary budget is implemented in the second half, depending on its scale. Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho maintains the position that there will be no supplementary budget. At a Kwanhun Forum on the 8th, Deputy Prime Minister Choo stated, “We are not considering a supplementary budget at all,” and emphasized, “We must refrain from habitual supplementary budgets.” On the other hand, opposition parties such as the Democratic Party argue that a supplementary budget is necessary to overcome the economic slowdown due to difficulties faced by the public.

Meanwhile, total revenue was 211.8 trillion won, down 34.1 trillion won compared to the same period last year. This decline is attributed to a decrease in national tax revenue to 134 trillion won, down 33.9 trillion won. The reduction in national tax revenue was particularly notable in income tax (-8.9 trillion won), corporate tax (-15.8 trillion won), and value-added tax (-3.8 trillion won). Non-tax revenue also shrank by 3.8 trillion won to 10.4 trillion won.

Total expenditure was 240.8 trillion won, down 26.5 trillion won compared to the same period last year. Budget expenditure decreased by 7.1 trillion won due to the reduction of COVID-19 crisis response projects, and fund expenditure dropped by 8.6 trillion won due to the end of loss compensation for small business owners.

However, central government debt increased by 19.1 trillion won from the previous month to 1,072.7 trillion won. Compared to the end of last year, the balance of government bonds increased by 38.1 trillion won, resulting in a total increase of 39.2 trillion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)