Grain Prices Decline... Possibility of Rising Soft Commodity Prices Like Raw Sugar and Coffee

Selective Investment in Agricultural Products... Caution Needed for Stocks Facing Increased Raw Material Costs in Raw Sugar and Coffee

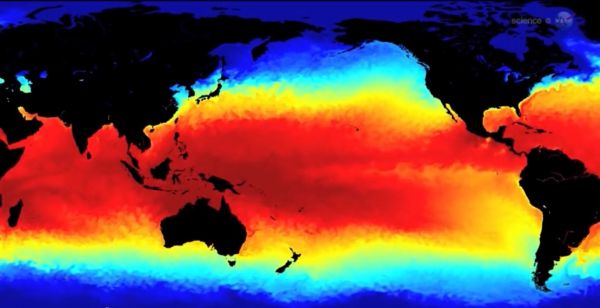

▲El Ni?o occurs when sea surface temperatures in the tropical Pacific Ocean rise abnormally. [Photo by NASA]

▲El Ni?o occurs when sea surface temperatures in the tropical Pacific Ocean rise abnormally. [Photo by NASA]

This summer, as forecasts predict a ‘Super El Ni?o’ will strike worldwide, interest in agricultural commodity investments is growing. This is based on the expectation that adverse weather conditions could lead to poor crop yields, resulting in rising agricultural product prices.

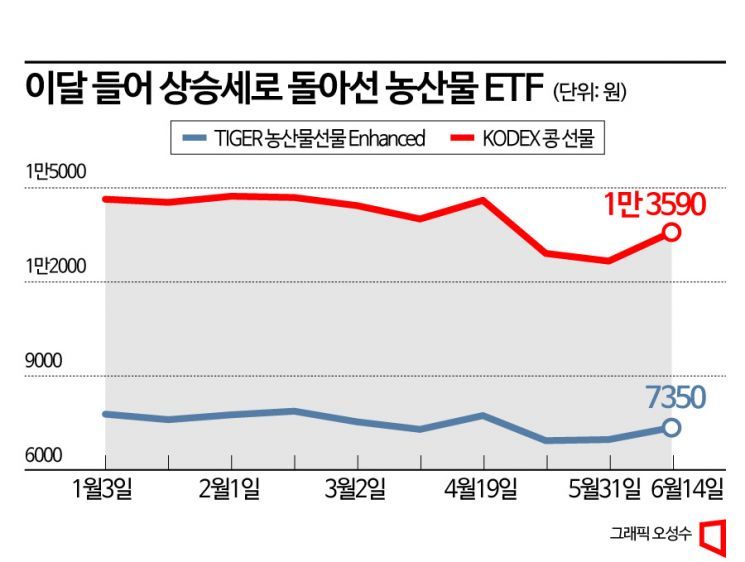

According to the Korea Exchange, the 'KODEX 3 Major Agricultural Products ETF' (exchange-traded fund) has risen more than 3.8%, from 11,200 KRW to 11,630 KRW, so far this month. This ETF tracks the price fluctuations of corn futures, soybean futures, and wheat futures listed on the Chicago Board of Trade. The ETF surged to around 17,000 KRW during the food inflation triggered by Russia’s invasion of Ukraine last year but fell back to the 10,000 KRW range this year due to Russia’s resumption of grain supplies and reduced energy costs. However, with the probability of a Super El Ni?o exceeding 80%, reflecting concerns over grain crop yields, prices have turned upward. During the same period, the 'KODEX Soybean Futures ETF' rose over 4%, the ‘TIGER Agricultural Futures Enhanced (H) ETF’ increased by 2.7%, and the ‘Meritz Representative Agricultural Futures ETN’ rose 3.4%.

El Ni?o refers to a situation where the Pacific Ocean sea surface temperature remains at least 0.5 degrees Celsius above the average for five months or more. It is the opposite of La Ni?a, which is characterized by sea surface temperatures 0.5 degrees below average. A Super El Ni?o is defined as a condition where sea surface temperatures are more than 2 degrees above average for at least three months. The U.S. National Oceanic and Atmospheric Administration (NOAA) predicts a Super El Ni?o will occur this summer.

Generally, when El Ni?o begins, northern parts of the U.S., Australia, India, and southern Africa experience dry conditions, while the southern U.S., Mexico, and Central Asia see increased rainfall. The rise in sea surface temperature causes abnormal weather patterns, with regions along the Pacific coast such as Australia, Southeast Asia, and South America being particularly vulnerable. India, China, and Southeast Asia have already experienced droughts earlier this year, and drought concerns are also rising in Brazil and Australia. Hwang Byung-jin, a researcher at NH Investment & Securities, explained, “The increased probability of El Ni?o occurrence raises the possibility of grain prices rising again. Last month, drought conditions in the U.S. Midwest have resulted in a low proportion of high-grade corn and soybean crops.”

Experts analyze that El Ni?o may stimulate short-term volatility in agricultural product prices but do not expect it to make harvesting all crops difficult in the long term. Agricultural products expected to see further price increases include soft commodities such as raw sugar, coffee, and cocoa. For grains, long-term crop yields are expected to improve. Choi Jin-young, a researcher at eBest Investment & Securities, said, “With La Ni?a retreating, rainfall is expected in drought-stricken Argentina and the U.S. Midwest, normalizing the supply of wheat, corn, and soybeans. Additionally, as the weakening of severe cold in the Northern Hemisphere reduces heating demand, energy prices such as coal may fall, potentially leading to further grain price declines.”

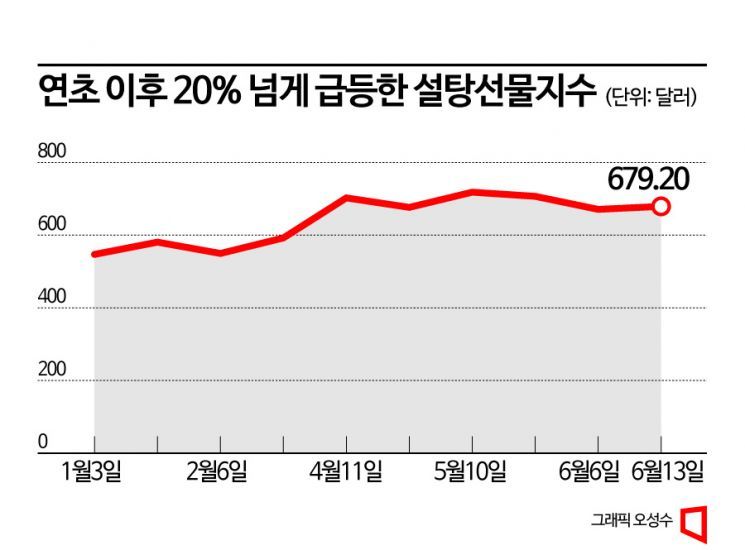

India and Brazil, which are within the El Ni?o influence zone, are major production areas for raw sugar and coffee. Brazil, the world’s largest producer of coffee and raw sugar, is expected to experience poor crop yields due to the intense heat caused by El Ni?o during the sowing period from September to December. India, the world’s second-largest raw sugar producer and exporter, is expected to face severe drought in August and September, the sowing months. Consequently, the raw sugar supply outlook for November, when harvesting begins, is expected to decline further. Researcher Choi Jin-young noted, “Coffee production is highest in Brazil, Vietnam, Colombia, and Indonesia, all of which are regions likely to face supply disruptions due to El Ni?o. It is important to note that during past transitions from La Ni?a to El Ni?o, soft commodities outperformed grains such as corn, soybeans, and wheat.” Australia is also affected by drought, which may reduce wheat supply, but it is estimated not to impact total production significantly. Reflecting these concerns, sugar prices, which are based on raw sugar, have already been rising. According to the London Futures Exchange, sugar prices stand at $679 per ton, a 22% surge since the beginning of the year.

For those considering investments, it is important to check which products and what proportions are included in ETFs or exchange-traded notes (ETNs). Most domestically listed ETNs and ETFs heavily invest in corn, soybeans, and beans. The ‘TIGER Agricultural Futures Enhanced (H) ETF’ invests evenly across wheat, corn, soybeans, and sugar but may not fully benefit from rising raw sugar prices. Among overseas ETFs, there is the ‘Teucrium Sugar Fund (CANE)’ that invests in sugar price increases. For coffee investment products, the ‘iPath Series B Bloomberg Coffee ETN’ is notable.

Securities experts also caution investors to be mindful of stocks that may face increased raw material costs due to rising raw sugar and coffee prices. Ha Hee-ji, a researcher at Hyundai Motor Securities, explained, “Although the easing of La Ni?a will reduce the burden of grain input costs, the sugar price burden is becoming apparent for processed food and dining companies with a high proportion of sugar raw materials, which may increase raw material cost pressures for food and beverage companies.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)