Companies Strengthen Shareholder Return Policies...As of the 13th, 26 Stocks Decide Interim Dividends

Dividend Investment Weakens Due to Concentration in Semiconductor and AI Firms...Krevers and Leadcorp Show High Dividend Yields

As more companies announce interim dividends, interest is growing in stocks that offer a "summer bonus." Investors can receive interim dividends by purchasing the relevant stocks by the 28th, two days before the interim dividend record date (the 30th of this month).

According to the Korea Securities Depository, a total of 26 stocks?22 from the KOSPI (including preferred shares) and 4 from the KOSDAQ?have decided to pay interim dividends at the end of June. An interim dividend refers to a dividend paid during the fiscal year. For companies with a December fiscal year-end, this means paying dividends once more on June 30 in addition to the year-end dividend in December. To receive the interim dividend, shareholders must be registered in the shareholder registry by the dividend record date. Therefore, stocks must be purchased by the 28th. Dividends will be paid in July and August.

Companies deciding on interim dividends for the first time this year include E1 and Isang Networks. Earlier, E1 amended its articles of incorporation at the regular shareholders' meeting held in March to allow interim dividends in addition to the year-end dividends. They also specified their dividend policy by pledging to maintain total dividends at 15% or more of net income based on separate financial statements during the 2023?2025 fiscal years. E1 has maintained a strong performance trend after recording its highest quarterly earnings in Q3 last year. Its operating profit in Q1 this year reached 70 billion KRW, marking an 860% increase compared to the same period last year.

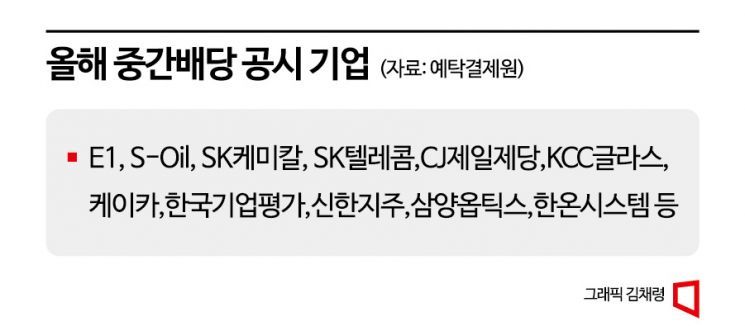

Companies such as SK Chemicals, SK Discovery, and CJ CheilJedang, which initiated interim dividends last year, have decided to continue interim dividends this year. SK Telecom, Shinhan Financial Group, K Car, Ssangyong C&E, CJ CheilJedang, and Hanon Systems will continue with interim dividends in Q2 following their Q1 quarterly dividends.

Although not yet publicly announced, the number of companies paying interim dividends is expected to increase this year. As companies strengthen shareholder return policies, they are increasingly offering interim dividends to meet shareholders' growing interest in dividends.

Except for 2020, when the COVID-19 pandemic occurred (59 companies including REITs), the number of companies paying interim dividends has been on the rise over the past five years. In 2018, 71 companies paid interim dividends; in 2019, 65; in 2021, 100; and in 2022, 102 companies decided on interim dividends. Companies that have consistently paid dividends to shareholders every year over the past five years since 2018 include Samsung Electronics, POSCO Holdings, Hana Financial Group, SK Telecom, SK, Ssangyong C&E, Hanon Systems, KCC, Daekyo, Hansol Paper, Samyang Optics, Jinyang Holdings, Hankook Terminal, KPX Holdings, KPX Chemical, Creverse, Winix, Leadcorp, Samhwa Crown, Daehwa Pharmaceutical, Intops, Miwon Commercial, Shinheung, and Jinyang Industry.

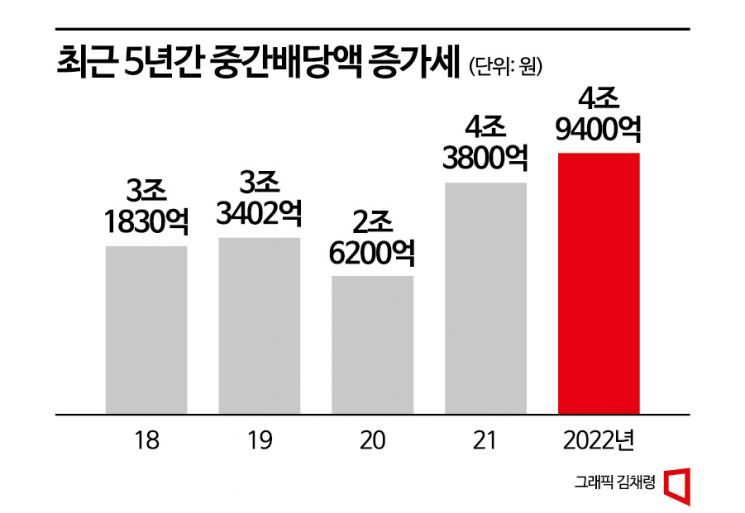

As companies have increased their dividend amounts, the total dividend payout has also grown. It expanded from 3.183 trillion KRW in 2018 to 3.3402 trillion KRW in 2019, 4.38 trillion KRW in 2021, and 4.94 trillion KRW in 2022. Due to the impact of COVID-19, it was only 2.62 trillion KRW in 2020. Samsung Securities estimates that among KOSPI 200 companies, 24 companies, and among KOSDAQ 150 companies, 7 companies will pay interim dividends, indicating an increase in companies deciding on interim dividends compared to last year.

Recently, interest in dividend stocks has waned somewhat due to rising market interest rates and increased bond investments. The stock market has rebounded mainly in technology stocks, overshadowing the appeal of dividend stocks. However, experts still consider dividend stock investment attractive. Especially for interim dividends, it can signal strong corporate financial structure and earnings, which is likely to lead to stock price increases. Also, compared to year-end dividends, the "ex-dividend effect," where stock prices drop after the dividend date, is less pronounced. Kang Song-cheol, a researcher at Eugene Investment & Securities, said, "Interest in dividend investing has declined as attention has focused on a few growth themes or sectors like AI and semiconductors, but buying dividend stocks with low market interest can also be an investment opportunity. It should be kept in mind that companies that increase dividends annually over a long period significantly outperform market returns."

The company with the highest dividend yield from interim dividends last year was the education company Creverse, which showed a dividend yield close to 4%. Creverse is a representative high-dividend company in the KOSDAQ market and has continuously increased its interim dividend amount over the past five years. Starting with a dividend of 300 KRW per share (total dividend 2 billion KRW) in 2018, it paid 1,000 KRW per share (8.3 billion KRW) last year. Following Creverse were Leadcorp (3.65%), S-Oil (2.4%), C&TUS (2.3%), SNT Energy (2.2%), Doosan Bobcat (2.08%), Hana Financial Group (2.03%), and LG Uplus (1.96%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.