Analysis of Top 20 KOSPI Stocks by Buyer Type This Year

Cumulative KOSPI Return About 18% Until June 9

9 Stocks Negative for Individuals, All Positive for Institutions, 3 Stocks Negative for Foreigners

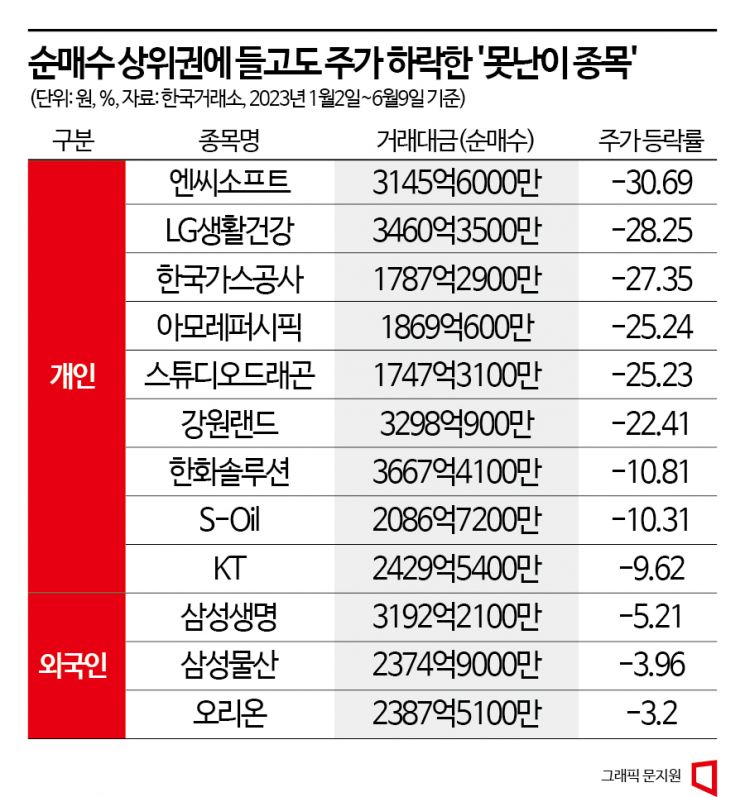

About half of the stocks ranked in the top 20 for net purchases by individual investors this year posted 'negative' returns. Despite the KOSPI rising nearly 18% since the beginning of the year and the rally continuing, the so-called Donghak Ants' bets appear to have failed.

According to the Korea Exchange Information Data System on the 13th, among the top 20 KOSPI stocks by net purchases from individual investors (based on trading volume from January 2 to June 9), nine stocks, including NCSoft (-31%), LG Household & Health Care (-28%), and Korea Gas Corporation (-27%), saw their stock prices decline. Including stocks that underperformed the KOSPI's rise (about 18%) during the same period, the total number of such stocks exceeds half, reaching 11.

The stock with the highest decline rate was NCSoft, whose stock price dropped 31% compared to the beginning of the year. This was due to negative evaluations of newly released and beta-tested games, as well as increased uncertainty about the overall game market's success. Following NCSoft, LG Household & Health Care's stock price fell by 28%. It ranked fifth in net purchases by individual investors amid expectations of China's economic reopening, but the effect was less significant than anticipated, and political uncertainties further contributed to the downward trend.

Hanwha Solutions ranked fourth in net purchases by individual investors this year, but its stock price fell by 10.81%. Hanwha Solutions achieved record-high operating profits of 1 trillion won last year and attracted investor interest as a representative beneficiary of the U.S. Inflation Reduction Act (IRA). However, despite strong earnings, it maintained a 'no dividend' policy for three consecutive years, leading to a sharp stock price drop at the beginning of the year.

Among institutional investors, none of the stocks in the top 20 net purchases group recorded negative returns. The stock with the lowest price change in the institutional investors' top net purchases group was KB Financial, ranked fifth, with a mere 0.52% fluctuation.

Foreign investors showed an overwhelming buying trend only in Samsung Electronics this year, with purchases amounting to 10.6733 trillion won. Samsung Electronics' stock price responded accordingly, rising 28% compared to the beginning of the year. In contrast, three stocks?Samsung Life Insurance (-5.2%), Samsung C&T Corporation (-4%), and Orion (-3.2%)?were among the top 20 net purchases by foreign investors but experienced stock price declines.

Comparing by investor type, institutional investors appear to have achieved stable performance with 'failure-free' investments during the recent stock price rally phase. However, when looking at the average returns of the top 20 net purchase groups by investor type, individual investors led with 64%. Although half of the stocks they accumulated recorded negative returns, some stocks such as EcoPro (565%), YoonSung F&C (332%), and EcoPro BM (192%) soared dramatically. They were followed by foreign investors (48%) and institutions (33%).

On the 12th, the KOSPI index started with a drop of more than 10 points. Employees are working in the dealing room of Hana Bank in Myeongdong, Seoul. Photo by Heo Younghan younghan@

On the 12th, the KOSPI index started with a drop of more than 10 points. Employees are working in the dealing room of Hana Bank in Myeongdong, Seoul. Photo by Heo Younghan younghan@

The securities industry is continuously revising upward the KOSPI's upper range. However, the possibility of a box-range market cannot be ruled out. While there are macro factors supporting the rise, such as price stability and the end of tightening, uncertainties remain due to concerns about an economic recession. Lee Woong-chan, a researcher at Hi Investment & Securities, said, "While expectations for AI-related stocks and a bullish second half may prevail, we maintain the outlook of 'a rise in the first half followed by a box range in the second half.' I believe the Federal Reserve's mission is to manage the economic and financial instability without triggering a new bubble in the new Cold War and post-COVID world."

Park Seok-jung, a research fellow at Shinhan Investment Corp., also noted, "The strong market led by a few tech stocks such as AI-related stocks, Amazon, and Tesla is exposed to valuation pressures. Fundamentally, confidence in a soft landing and corporate earnings turnaround needs to build, but it is still difficult to conclude." He added, "Strong employment and inflation's downward rigidity remain concerns, making it difficult to be certain about the monetary policy path. There is also a possibility of repeated financial market uncertainties and increased concerns about demand contraction." He forecasted that U.S. consumer prices, Federal Open Market Committee (FOMC) results, and Chinese economic indicators will hold significant meaning at the crossroads between economic contraction and stimulus.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)