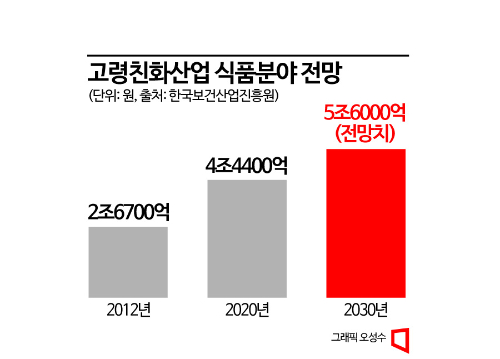

2030 Elderly-Friendly Food Industry Expected to Reach 5.6 Trillion Won

Food Industry Actively Responds by Introducing 'Care Food'

Delivery Care Systems Combined with Care Services Also Emerging

As the aging clock of Korean society accelerates, the senior generation is emerging as a quiet but powerful consumer group. The increase of young seniors, known as the ‘YOLD (Young+Old)’ generation, who exhibit active consumption behaviors and an open attitude toward new trends, is transforming the previously shrinking and marginal consumer segment into a new influential consumer class. As an era approaches where conducting business without including the senior generation is impossible, the food industry is also setting them as a key consumer group and actively trying to attract them.

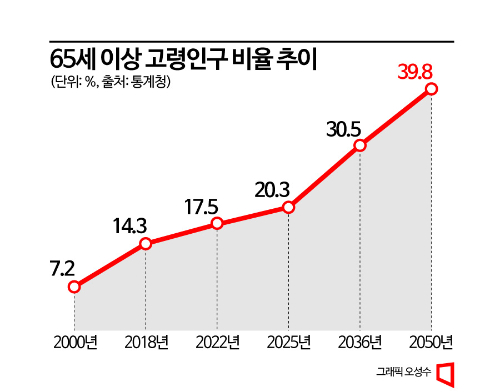

According to the Korea Health Industry Development Institute on the 7th, the domestic senior-friendly food industry, which was valued at approximately 2.67 trillion KRW in 2012, grew to 4.44 trillion KRW in 2020 and is expected to expand to 5.6 trillion KRW by 2030. With the proportion of the population aged 65 and over rising from 17.5% last year to 20.3% in 2025 and 30.5% in 2036, and the baby boomer generation possessing both time and economic resources emerging as a major consumer group, related industries are expected to experience rapid growth.

The increase in food consumption by the senior generation is not merely quantitative. Diversity is also expanding. According to the National Health and Nutrition Examination Survey conducted by the Ministry of Health and Welfare and the Korea Disease Control and Prevention Agency, contrary to the stereotype that seniors would only prefer porridge or traditional Korean food, recent seniors tend to continue enjoying the foods they liked when they were younger, supported by advances in medical technology and consistent self-care. They also wish to enjoy a variety of menus such as steak and pasta. However, due to chewing and swallowing difficulties, there is an increased preference for and consumption of soft foods and plant-based ingredients.

In response to these changes, the food industry is actively adapting. Existing infant and dairy industries are expanding new product launches and branding strategies to overcome profitability declines caused by decreasing infant demand and to secure the senior generation as a new consumer segment. These companies prefer to brand foods manufactured for seniors not as ‘senior-friendly foods’ but as ‘care foods,’ a term that inclusively covers all age groups from children requiring tailored nutrition to adolescents and seniors.

CJ Freshway has launched ‘Healthy Nuri,’ a care food specialty brand, expanding its product lineup with various ambient ready meals such as lotus leaf bean curry rice. Pulmuone is also introducing senior-friendly foods through its specialized brand ‘Pulscare.’ Hyundai Green Food operates the care food brand ‘Greeting,’ offering meal plans inspired by the diets of global longevity villages, Mediterranean diets with calorie control, and subscription-based meal services.

Rather than releasing products targeting a specific generation, these companies brand their offerings as lifecycle-tailored products encompassing entire family generations, thereby reducing seniors’ resistance to being categorized as elderly. This aligns with the recent trend of managing diets proactively in daily life rather than for treatment. Additionally, these companies diversify their main consumer base in response to demographic changes by launching and operating various premium and convenient home meal replacement (HMR) products and subscription services.

Recently, new delivery care systems combining food and caregiving services have also emerged. These systems consider mobility difficulties and cooking convenience by offering diversified senior-friendly home meal replacements (HMR), aligning with the trend of seniors preferring to age in their own homes rather than in elderly care facilities. This represents an evolution from simple delivery to a form integrated with caregiving services.

Representative services include CareDoc’s life care service, which accumulates meal data through cameras, and Doctor Diary, which operates one-on-one coaching services such as blood sugar data management. As the senior generation continues to grow, the application of food tech to senior food business for developing personalized foods considering individual health conditions and preferences, utilizing them in the dining sector, and combining caregiving services is expected to expand further.

Professor Eunhee Lee of Inha University’s Department of Consumer Studies stated, “As the proportion of the elderly population rapidly increases, today’s senior generation is characterized by having economic resources to consume for themselves, unlike in the past. Since this generation has grown to a scale that constitutes a market, I expect the market for customized specialized foods for health and subscription services for healthcare products to continue growing.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)