Aggressive Targeting of Auto Financing and Retail Finance

Two-Track Strategy of Partnerships and Digital Transformation 추진

On the 2nd (local time), Moon Dong-kwon, President of Shinhan Card (left), visited Aster Auto in Almaty, Kazakhstan, and took a commemorative photo with Alexey Bakal, Chairman of the Aster Group. (Photo by Shinhan Card)

On the 2nd (local time), Moon Dong-kwon, President of Shinhan Card (left), visited Aster Auto in Almaty, Kazakhstan, and took a commemorative photo with Alexey Bakal, Chairman of the Aster Group. (Photo by Shinhan Card)

Shinhan Card is accelerating its push into Kazakhstan. The company plans to leap to the top tier of the local retail finance market, including auto financing, through expanded partnerships and digital transformation.

On the 4th, Shinhan Card announced that President Moon Dong-kwon visited its Kazakh subsidiary Shinhan Finance and one of Kazakhstan's top three car dealers, Orbis, on the 2nd (local time).

President Moon expressed his intention to strengthen existing partnerships, support the sustained growth of the local Kazakh corporation, and elevate Shinhan Finance to the top tier of Kazakhstan's retail finance (MFO) market.

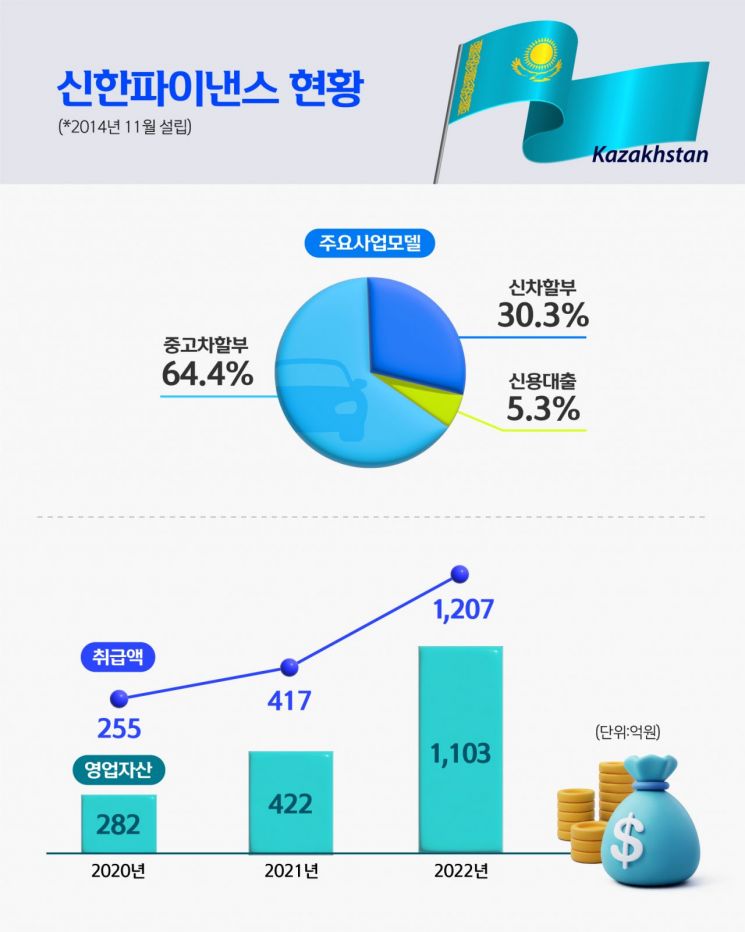

Established in November 2014, Shinhan Finance is Shinhan Card's first overseas subsidiary. It operates mainly in Kazakhstan's three key cities?Almaty, Nur-Sultan, and Shymkent?offering retail loan products such as auto financing and credit loans. As of the first quarter, it handled KRW 26.1 billion in loans and had total assets of KRW 124.3 billion, ranking 5th among over 230 local retail loan finance companies.

Shinhan Finance's average annual growth rate over the past three years has reached 72%. Starting with a partnership agreement in August 2020 with Asia Auto, Kazakhstan's number one vehicle manufacturer and seller, it also partnered in October 2021 with Aster Auto, the leading local used car dealer.

In addition to expanding partnerships, Shinhan Finance is preparing for digital transformation by broadening customer channels such as mobile applications. It plans to enhance accessibility and convenience by establishing a non-face-to-face loan process via mobile apps and internet web, and launching digital loan products exclusively for individual customers. Furthermore, it will build new systems for loan screening, customer management, and debt management to digitally transform internal procedures.

A Shinhan Card official stated, "Based on our financial know-how and digital transformation experience that have maintained our domestic industry leadership, we will lead the spread of K-finance in Kazakhstan," adding, "We aim to grow Shinhan Finance into a retail specialized financial company leading the retail loan market, including credit loans, in Kazakhstan."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)