Statistics Korea, May Consumer Price Trends

Agricultural Products and Petroleum Excluded Index Up 4.3%

Lowest Since 4.1% in May Last Year

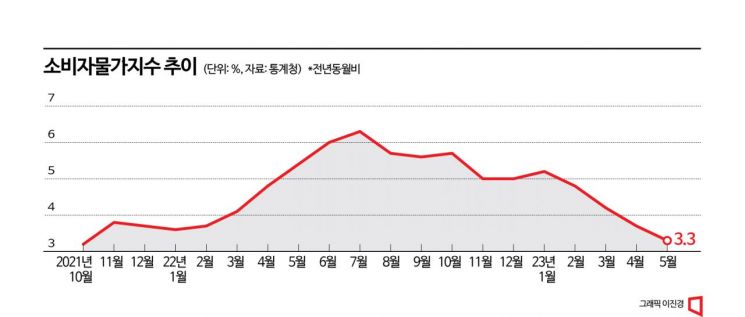

Last month, the consumer price inflation rate recorded its lowest level in 19 months at 3.3%. The core inflation, which had maintained a high level until recently, has also started to show a downward trend. Unless there are unusual factors such as international raw material prices, oil prices, or exchange rates, the downward trend in inflation is expected to continue for the time being.

According to the 'May 2023 Consumer Price Trends' released by Statistics Korea on the 2nd, consumer prices last month rose by 3.3% compared to the same period last year. This is the lowest since September 2021 (3.2%), marking the lowest in 1 year and 7 months. The consumer price inflation rate peaked at 6.3% in July last year and has been on a downward trend since. This year, it has declined for four consecutive months from 5.2% in January.

The core consumer price index is also slowly but steadily decreasing. The index excluding agricultural products and petroleum products rose by 4.3% compared to the same month last year. This rate of increase is the lowest since May last year (4.1%). The core consumer price index has maintained a relatively high level despite the overall downward trend in prices that began this year. Kim Bo-kyung, Economic Trend Statistics Officer at Statistics Korea, explained, “Core inflation had not shown a decline until now, but this month it has started to decrease slightly,” adding, “The recent decline in jeonse (long-term deposit rent) has been reflected in falling rent prices, and the rate of increase in dining-out prices among personal services has slowed.”

Stable Oil Prices and Extension of Fuel Tax Reduction... Transportation Price Inflation Rate -6.9%

The living cost index rose by 3.2% compared to the same month last year. The living cost index is calculated from 144 items out of a total of 458 items, focusing on those with high purchase frequency and expenditure share, making price changes more sensitive. Food prices rose by 5.0%, but non-food items increased by only 2.0%. The living cost index including rent and jeonse rose by 2.8%.

The fresh food index increased by 3.5% compared to the same month last year. Fresh fish and seafood rose by 6.3%, fresh vegetables by 7.0%, but fresh fruits fell by 1.4%.

By expenditure purpose, compared to the same month last year, housing, water, electricity, and fuel (5.9%), food and accommodation (7.0%), food and non-alcoholic beverages (3.9%), clothing and footwear (8.0%), other goods and services (6.4%), household goods and housekeeping services (6.0%), recreation and culture (3.8%), education (2.2%), health (1.6%), communication (0.9%), and alcoholic beverages and tobacco (0.2%) all increased.

Transportation prices are influenced by gasoline, diesel, and petroleum products, with the recent stabilization of international oil prices cited as a major reason for the decline. Additionally, the fuel tax reduction measure, which was scheduled to end at the end of April, was extended until the end of August, further increasing the rate of decline.

Electricity, Gas, and Water Prices Continue High Inflation at 23.2%

However, the inflation rate for electricity, gas, and water prices remained high at 23.2% compared to the same month last year. It also rose by 2.2% compared to the previous month. This is attributed to the increase in electricity rates by 8 won per kWh and gas rates by 1.04 won per MJ on the 15th of last month. Statistics Korea expects the electricity rate increase to be reflected over May and June, forecasting about a 2% rise compared to the previous month next month as well.

By item type, agricultural, livestock, and fishery products fell by 0.3% compared to the same month last year, while industrial products rose by 1.8%. Rent increased by 0.6%, public services by 1.0%, and personal services by 5.6%.

The overall downward trend in prices is expected to continue for the time being. Officer Kim said, “There is a high possibility that the figures will decline for about two to three months due to the base effect,” adding, “Unless there are unusual factors such as international oil prices, exchange rates, or raw material price trends, stability is expected for the time being.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)