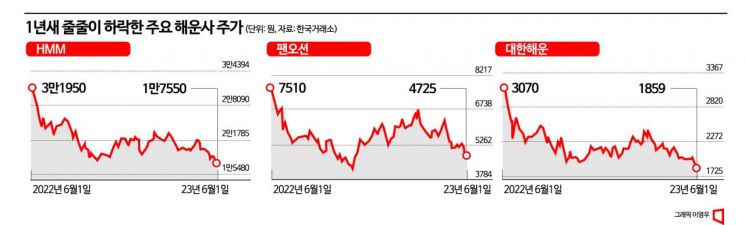

HMM, Korea's Leading Shipping Company, Stock Price Halved in One Year... Pan Ocean and Daehan Shipping Also Plunge

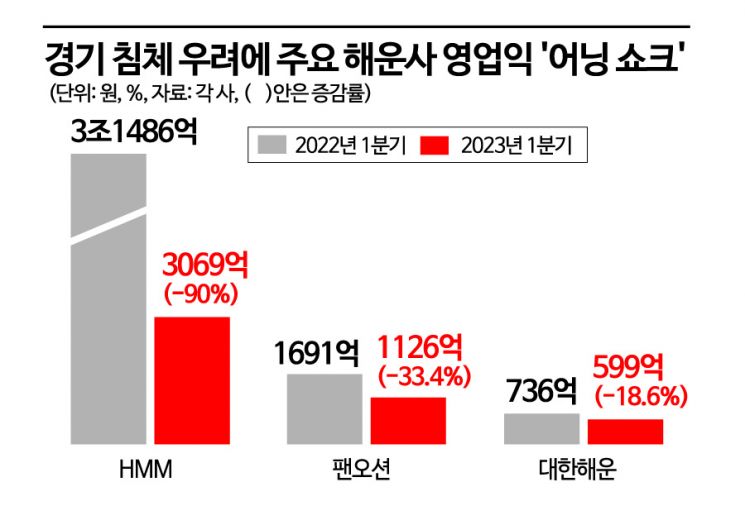

HMM Operating Profit in Q1 This Year Down 90% Compared to Same Period Last Year

China Reopening Effect Falls Short of Expectations... Container Freight Rates Drop, Cargo Volume Declines

Despite the KOSPI's rising rally since the beginning of the year, the stock prices of major domestic listed shipping companies have been declining for several months. There was hope for a rebound following China's economic reopening in the first quarter, but the effect fell short of expectations. With the looming threat of an economic downturn in the second half of the year, the stock outlook remains bleak.

According to the Korea Exchange on the 2nd, the stock price of HMM, a leading domestic shipping company, closed at 17,550 KRW, down 1.13% from the previous day. Compared to June 1 of last year (31,950 KRW), the stock price has nearly halved, resulting in a market capitalization loss of 7.2867 trillion KRW over the past year. Compared to the peak during the supply chain issues right after the COVID-19 outbreak (51,100 KRW on May 28, 2021), it has plummeted by a staggering 65%. Pan Ocean's stock also closed at 4,725 KRW the previous day, down 37% from a year ago, while Daehan Shipping's stock fell 39% over the same period, closing at 1,859 KRW.

Over the past year, the KRX Transportation Index dropped from 1,268.21 to 892.40. With a decline of about 30% in one year, it recorded the second-largest drop among the 28 KRX indices.

The decline in shipping companies' stock prices stems from poor earnings. HMM posted an operating profit of only 306.9 billion KRW in the first quarter of last year. Compared to the 3.1486 trillion KRW operating profit in the first quarter of the previous year, this represents a 90% plunge, an 'earnings shock.' Pan Ocean also showed a poor performance with an operating profit of 112.6 billion KRW, down 33.4% from the previous year’s first quarter, and Daehan Shipping recorded 59.9 billion KRW, down 18.6%.

The container segment accounts for the largest share of shipping companies' revenue, but from the third quarter of last year, container freight rates sharply declined, delivering a shock to the industry. The Shanghai Containerized Freight Index (SCFI), which reflects spot contract rates for 15 major routes in the Shanghai shipping market, maintained levels between 4,000 and 5,000 points in the first half of last year but dropped sharply from July, falling to 1,000 points by the end of the year. Even after five months, it remains at a similar level. Additionally, cargo volume has contracted compared to last year.

Ryu Je-hyun, a researcher at Mirae Asset Securities, said, "Following the shocking drop in peak season freight rates in the third quarter of last year and continued stagnation in the first half of this year, a sharp rebound in freight rates is unlikely, and we are going through the worst phase." He added, "The current three major alliance system formed amid the shipping market's ups and downs could see further restructuring as mergers and splits remain possible." Regarding the outlook for the second half, he said, "There was a historic profit cycle during the supply chain disruptions caused by COVID-19, and the subsequent derating pattern is similar to past trends. After a steep valuation decline, stabilization is underway, but significant improvement is difficult."

The dry bulk market also lacks momentum for a rebound as expectations for China's reopening have turned into great disappointment. The Baltic Dry Index (BDI) fell nearly 30% in May alone, giving back all the gains from March and April, and the seasonal low season is expected to continue along with a stagnant phase. Ko Chae-woon, a researcher at Korea Investment & Securities, expressed concern, saying, "China's steel demand recovery is slow, and grain cargo volume is also below expectations due to drought damage in Argentina. Overall, energy and raw material prices are adjusting, and uncertainty about the global economy is increasing again."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)