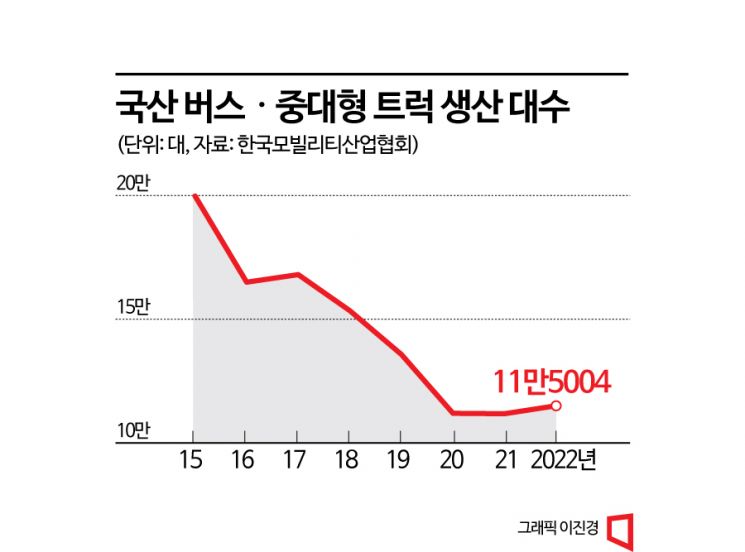

Last Year's Domestic Commercial Vehicle Production Halved Compared to 2015

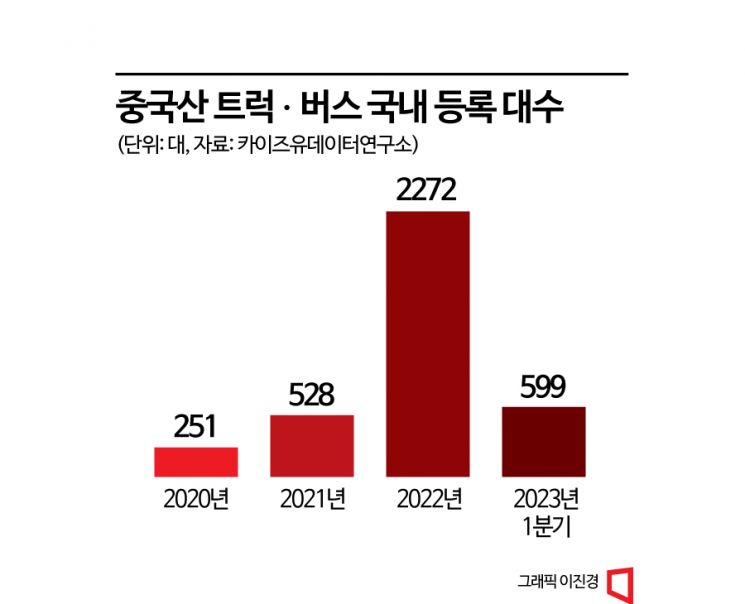

Chinese Electric Trucks and Buses Increased Ninefold in Two Years

Limited Demand in Commercial Vehicle Market, Combined with Chinese Companies' Offensive

Challenges Intensify at Jeonju Plant Producing Medium and Large Trucks and Buses

The Hyundai Motor Company’s Jeonju plant, which produces medium and large buses and trucks, has been running at a loss for several years. Amid an economic downturn and declining demand for commercial vehicles, Chinese companies leveraging price competitiveness have aggressively increased their market share.

According to statistics from the Korea Automobile Mobility Industry Association on the 31st, domestic production of buses and medium-to-large trucks nearly reached 200,000 units in 2015 but dropped to 115,000 units last year, a halving. The commercial vehicle market, closely linked to the transportation and construction industries, is sensitive to economic conditions. As production and demand for commercial vehicles decline due to the economic slump, Hyundai’s Jeonju plant is also facing difficulties. Recently, the plant manager mentioned concerns about factory losses at an official event with the labor union.

The commercial vehicle market, classified as a national key industry, has limited demand compared to passenger cars. In recent years, the COVID-19 pandemic reduced mobility demand, worsening the situation for bus transportation companies. When company profitability declines, new bus purchases inevitably decrease. The medium and large truck market is similar. Medium and large trucks, mainly purchased by self-employed individuals, have longer replacement cycles than buses. While buses must be replaced after 11 years of operation at the latest for passenger safety, large commercial vehicles are not subject to such regulations.

Hyundai Motor’s Jeonju plant, the domestic production base for commercial vehicles, manufactures 7 types of buses, 3 types of trucks, and 7 types of special vehicles. Recently, it has been producing CNG hybrid, hydrogen fuel cell, and electric buses, attempting to transform into the world’s largest eco-friendly commercial vehicle production facility.

However, the eco-friendly commercial vehicle market is also challenging. Chinese-made commercial vehicles, competitive in price and performance, occupy about half of the domestic market share. According to data from the Kaizyu Data Research Institute, 2,272 Chinese-made electric commercial vehicles (buses and trucks) were newly registered domestically last year, a ninefold increase compared to just 250 units two years ago (2020). This year, the first quarter alone saw about 600 units. Chinese companies’ market share in the electric bus market reached 43.5% from January to April this year.

An official from the Korea Mobility Industry Association said, "Since countries are implementing policies to protect their domestic industries, expanding exports of commercial vehicles is not easy," adding, "The commercial vehicle market, purchased by corporations or self-employed individuals, also faces difficulties in rapid electrification transition."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)